Sc1065 Form

What is the Sc1065 Form

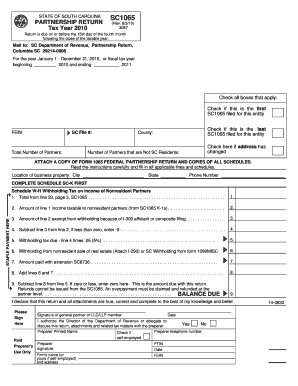

The SC1065 Form is a tax document used by partnerships in the United States to report income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for partnerships that need to disclose their financial activities for a specific tax year. It provides a comprehensive overview of the partnership's earnings and distributions to partners, ensuring compliance with federal tax regulations.

How to use the Sc1065 Form

To use the SC1065 Form, partnerships must accurately fill out the required sections, including details about income, deductions, and partner information. Each partner's share of income, deductions, and credits must be reported on the form. After completing the form, it is submitted to the IRS, typically along with any necessary schedules that provide additional information. Partnerships must ensure that all figures are accurate to avoid penalties.

Steps to complete the Sc1065 Form

Completing the SC1065 Form involves several key steps:

- Gather all financial records related to the partnership's income and expenses.

- Complete the basic information section, including the partnership's name, address, and Employer Identification Number (EIN).

- Report total income, including sales, interest, and any other sources of revenue.

- Detail the deductions the partnership is entitled to claim, such as operational expenses and depreciation.

- Allocate income, deductions, and credits to each partner based on their ownership percentage.

- Review the form for accuracy before submission.

Legal use of the Sc1065 Form

The SC1065 Form is legally binding when filled out correctly and submitted on time. It must comply with IRS guidelines, ensuring that all reported information is truthful and complete. Proper use of this form is crucial for partnerships to avoid legal issues and potential audits. Additionally, partnerships must maintain records supporting the information reported on the form for at least three years.

Filing Deadlines / Important Dates

The SC1065 Form must be filed by the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Partnerships can request a six-month extension, but they must file Form 7004 to do so.

Required Documents

When completing the SC1065 Form, partnerships should have the following documents ready:

- Financial statements, including profit and loss statements.

- Records of all income sources and expenses.

- Information about each partner's contributions and distributions.

- Any prior year tax returns for reference.

Form Submission Methods (Online / Mail / In-Person)

The SC1065 Form can be submitted in several ways. Partnerships can file electronically through the IRS e-file system, which is often faster and more secure. Alternatively, the form can be mailed to the appropriate IRS address based on the partnership's location. In-person submissions are not typically available for this form, as the IRS encourages electronic filing for efficiency.

Quick guide on how to complete sc1065 form

Effortlessly Prepare Sc1065 Form on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Sc1065 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Sc1065 Form with Ease

- Obtain Sc1065 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and hit the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Sc1065 Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc1065 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SC1065 Form?

The SC1065 Form is a South Carolina partnership tax return that businesses must file annually. It reports the income, deductions, gains, and losses of partnerships operating in South Carolina. Proper completion of the SC1065 Form is crucial for compliance with state tax regulations.

-

How can airSlate SignNow help with the SC1065 Form?

AirSlate SignNow streamlines the process of completing and signing the SC1065 Form by allowing you to send documents electronically for convenient eSigning. Our platform ensures that all forms are securely signed and stored, saving you time and effort during tax season. With airSlate SignNow, managing your SC1065 Form gets easier.

-

Is airSlate SignNow cost-effective for filing the SC1065 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing your SC1065 Form and other documents. With our competitive pricing plans, you can easily handle eSignatures and document management without breaking the bank. The value provided by our service far exceeds traditional methods of form filing.

-

What features does airSlate SignNow offer for the SC1065 Form?

AirSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the SC1065 Form. Our user-friendly interface makes it simple to fill out the form and gather signatures from all necessary parties. Additionally, you can integrate with various tools to enhance your workflow.

-

Can I integrate airSlate SignNow with other software for the SC1065 Form?

Absolutely! AirSlate SignNow integrates seamlessly with a variety of popular software solutions, allowing you to enhance your efficiency when handling the SC1065 Form. Whether it's project management tools or CRM systems, our platform can integrate to create a streamlined document management process.

-

How secure is my data when dealing with the SC1065 Form on airSlate SignNow?

Security is a top priority at airSlate SignNow. When you deal with the SC1065 Form, rest assured that your data is protected by advanced encryption and compliance with industry standards. We implement stringent security measures to ensure that your sensitive information remains confidential and secure.

-

Can airSlate SignNow assist in the timely submission of the SC1065 Form?

Yes, airSlate SignNow can assist in the timely submission of the SC1065 Form by providing reminders and allowing for quick electronic signing. Our platform simplifies the process, ensuring that all signatures are collected quickly and that you meet your submission deadlines. This helps prevent late fees and other issues.

Get more for Sc1065 Form

Find out other Sc1065 Form

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free

- Sign Mississippi Child Custody Agreement Template Free

- Sign New Jersey Child Custody Agreement Template Online

- Sign Kansas Affidavit of Heirship Free

- How To Sign Kentucky Affidavit of Heirship

- Can I Sign Louisiana Affidavit of Heirship

- How To Sign New Jersey Affidavit of Heirship

- Sign Oklahoma Affidavit of Heirship Myself

- Sign Washington Affidavit of Death Easy

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament