Kansas Quitclaim Deed from Husband and Wife to LLC Form

What is the Kansas Quitclaim Deed From Husband And Wife To LLC

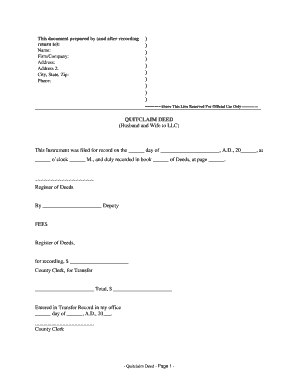

The Kansas Quitclaim Deed from Husband and Wife to LLC is a legal document that allows a married couple to transfer their interest in real property to a limited liability company (LLC). This type of deed is often used when couples wish to simplify ownership structures, protect personal assets, or facilitate business operations. Unlike a warranty deed, a quitclaim deed does not guarantee that the title is free from defects, making it essential for the parties involved to understand the implications of this transfer.

Steps to Complete the Kansas Quitclaim Deed From Husband And Wife To LLC

Completing the Kansas Quitclaim Deed involves several key steps to ensure the document is legally binding and properly executed:

- Gather necessary information, including the legal description of the property, names of the grantors (husband and wife), and the name of the grantee (LLC).

- Fill out the quitclaim deed form accurately, ensuring all details are correct and complete.

- Both spouses must sign the deed in the presence of a notary public to validate the document.

- After notarization, file the deed with the appropriate county clerk's office to officially record the transfer.

Key Elements of the Kansas Quitclaim Deed From Husband And Wife To LLC

Several essential elements must be included in the Kansas Quitclaim Deed to ensure its validity:

- Grantor Information: Full names and addresses of both spouses transferring the property.

- Grantee Information: The name and address of the LLC receiving the property.

- Property Description: A detailed legal description of the property being transferred, including parcel number and location.

- Signatures: Both spouses must sign the deed in front of a notary public.

- Notary Acknowledgment: A notary public must acknowledge the signatures to validate the document.

Legal Use of the Kansas Quitclaim Deed From Husband And Wife To LLC

The Kansas Quitclaim Deed is legally recognized as a valid method for transferring property ownership. However, it is important to note that this deed does not provide any warranties regarding the title. This means that if there are existing liens or claims against the property, the LLC assumes those risks upon acceptance of the deed. Therefore, it is advisable for both parties to conduct thorough due diligence before finalizing the transfer.

How to Obtain the Kansas Quitclaim Deed From Husband And Wife To LLC

Obtaining a Kansas Quitclaim Deed can be done through several methods:

- Download a template from a reputable legal website or obtain one from a local attorney.

- Visit the county clerk's office, where you can often find official forms for property transfers.

- Consult with a real estate attorney to ensure the deed meets all legal requirements and is tailored to your specific situation.

State-Specific Rules for the Kansas Quitclaim Deed From Husband And Wife To LLC

In Kansas, specific rules govern the execution and recording of quitclaim deeds. These include:

- The deed must be signed by both spouses, and signatures must be notarized.

- The legal description of the property must be clear and accurate.

- Filing fees may apply when submitting the deed to the county clerk's office.

- It is recommended to check with local authorities for any additional requirements or regulations that may apply.

Quick guide on how to complete kansas quitclaim deed from husband and wife to llc

Effortlessly Prepare Kansas Quitclaim Deed From Husband And Wife To LLC on Any Device

Digital document management has gained popularity among organizations and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the required form and securely save it online. airSlate SignNow equips you with all the resources necessary to craft, modify, and electronically sign your documents swiftly without interruptions. Manage Kansas Quitclaim Deed From Husband And Wife To LLC on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Kansas Quitclaim Deed From Husband And Wife To LLC effortlessly

- Obtain Kansas Quitclaim Deed From Husband And Wife To LLC and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, either by email, SMS, or via an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Alter and digitally sign Kansas Quitclaim Deed From Husband And Wife To LLC while ensuring excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Kansas Quitclaim Deed From Husband And Wife To LLC?

A Kansas Quitclaim Deed From Husband And Wife To LLC is a legal document that transfers ownership of property from a married couple to a Limited Liability Company. This type of deed is often used for changing property title without any guarantees regarding the ownership or title. It's a fast and straightforward way to formalize property transfers in Kansas.

-

How do I create a Kansas Quitclaim Deed From Husband And Wife To LLC using airSlate SignNow?

Creating a Kansas Quitclaim Deed From Husband And Wife To LLC using airSlate SignNow is simple. You can use our template library to find the appropriate quitclaim deed form and customize it with your property details. After filling out the form, both parties can eSign it easily.

-

What are the benefits of using airSlate SignNow for a Kansas Quitclaim Deed From Husband And Wife To LLC?

Using airSlate SignNow to manage your Kansas Quitclaim Deed From Husband And Wife To LLC offers several benefits, such as speed, convenience, and legal compliance. Our platform provides an easy-to-use interface and secure electronic signatures, ensuring that your documents are legally binding and processed quickly.

-

Is pricing different for a Kansas Quitclaim Deed From Husband And Wife To LLC?

The pricing for creating a Kansas Quitclaim Deed From Husband And Wife To LLC on airSlate SignNow may vary based on subscription plans. We offer flexible pricing options that cater to individuals, businesses, and legal professionals looking to efficiently handle property transactions.

-

Can I integrate airSlate SignNow with other software for a Kansas Quitclaim Deed From Husband And Wife To LLC?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing the process of creating a Kansas Quitclaim Deed From Husband And Wife To LLC. You can connect with tools like Google Drive, Dropbox, and CRM solutions to streamline your document management and signing workflows.

-

What if I make a mistake on my Kansas Quitclaim Deed From Husband And Wife To LLC?

If you make a mistake on your Kansas Quitclaim Deed From Husband And Wife To LLC, you can easily edit the document before finalizing it. airSlate SignNow allows you to make adjustments and send revised versions for eSignature. However, if the deed is already recorded, you may need to draft a new deed for corrections.

-

Do I need witnesses for a Kansas Quitclaim Deed From Husband And Wife To LLC?

In Kansas, a Quitclaim Deed generally does not require witnesses to be valid, but it does need to be signNowd. When using airSlate SignNow, notarization can be included as part of the workflow, making it quick and easy to ensure that your Kansas Quitclaim Deed From Husband And Wife To LLC meets all legal requirements.

Get more for Kansas Quitclaim Deed From Husband And Wife To LLC

- Ar amendment 497296781 form

- Ar financing 497296782 form

- Legal last will and testament form for single person with no children arkansas

- Legal last will and testament form for a single person with minor children arkansas

- Legal last will and testament form for single person with adult and minor children arkansas

- Legal last will and testament form for single person with adult children arkansas

- Legal last will and testament for married person with minor children from prior marriage arkansas form

- Legal last will and testament form for married person with adult children from prior marriage arkansas

Find out other Kansas Quitclaim Deed From Husband And Wife To LLC

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document