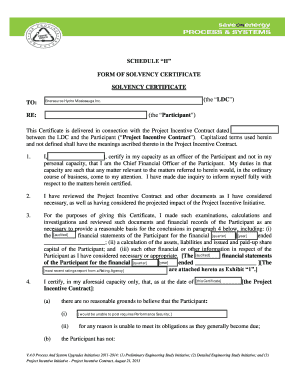

Solvency Certificate Sample Form

What is a solvency certificate?

A solvency certificate is a formal document issued by a financial institution, typically a bank, that confirms an individual's or a company's financial stability and ability to meet its debts. This certificate serves as proof of solvency, indicating that the entity is financially sound and capable of fulfilling its financial obligations. It is often required for various purposes, including loan applications, business transactions, and legal compliance.

Key elements of a solvency certificate

A solvency certificate generally includes several key components that validate its authenticity and purpose. These elements typically consist of:

- Name and address: The full name and address of the individual or business seeking the certificate.

- Financial institution details: The name and address of the bank or financial institution issuing the certificate.

- Statement of solvency: A clear statement affirming that the individual or business is solvent and capable of meeting its financial obligations.

- Date of issuance: The date on which the certificate is issued, which is crucial for determining its validity period.

- Signature and seal: The signature of an authorized representative from the financial institution, along with the institution's official seal, to authenticate the document.

How to obtain a solvency certificate

Obtaining a solvency certificate typically involves a straightforward process. Here are the steps to follow:

- Choose a financial institution: Select a bank or financial institution where you have an account or business relationship.

- Gather required documents: Prepare necessary documents, such as identification, financial statements, and proof of income.

- Submit a request: Approach the bank to formally request a solvency certificate. This may involve filling out a specific application form.

- Verification process: The bank will review your financial status and documents to verify your solvency.

- Receive the certificate: Once approved, the bank will issue the solvency certificate, which you can then use as needed.

Legal use of a solvency certificate

The solvency certificate holds significant legal value in various contexts. It can be used in situations such as:

- Applying for loans or credit facilities, where lenders require proof of financial stability.

- Participating in business contracts, where parties need assurance of each other's financial viability.

- Meeting regulatory requirements for certain industries that mandate proof of solvency.

It is essential to ensure that the certificate is obtained from a reputable financial institution and that it meets all legal standards to be considered valid.

Steps to complete the solvency certificate

Completing a solvency certificate involves careful attention to detail. Here are the steps to ensure accuracy:

- Fill in personal details: Provide your full name, address, and any relevant identification numbers.

- Include financial information: Accurately report your financial status, including assets, liabilities, and income sources.

- Review for accuracy: Double-check all entries for correctness to avoid delays in processing.

- Submit to the bank: Present the completed form to your chosen financial institution for review.

Examples of using a solvency certificate

There are various scenarios where a solvency certificate may be required or beneficial:

- When starting a new business, potential partners may request a solvency certificate to assess financial health.

- Individuals applying for a mortgage may need to provide a solvency certificate to demonstrate their ability to repay the loan.

- Companies seeking government contracts may be required to submit a solvency certificate as part of the bidding process.

Quick guide on how to complete economic solvency letter

Complete economic solvency letter seamlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly and without delays. Handle solvency certificate on any platform using airSlate SignNow's Android or iOS apps and simplify any document-related process today.

How to modify and eSign bank solvency certificate effortlessly

- Find solvency letter and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the information and then click the Done button to save your changes.

- Decide how you would like to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign solvency letter template and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to proof of solvency

Create this form in 5 minutes!

How to create an eSignature for the solvency certificate meaning

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask letter of solvency template

-

What is a bank solvency certificate?

A bank solvency certificate is an official document issued by a bank that confirms a customer's financial stability and ability to meet their financial obligations. It is often required for various financial transactions, international trade, and loan applications.

-

How can airSlate SignNow help me obtain a bank solvency certificate?

AirSlate SignNow simplifies the process of requesting a bank solvency certificate by allowing you to easily send and eSign the necessary documents online. By streamlining workflows, businesses can minimize delays and improve the speed at which they receive their certificates.

-

What features does airSlate SignNow offer for managing bank solvency certificates?

AirSlate SignNow offers a range of features for managing bank solvency certificates, including document templates, customizable workflows, and secure electronic signatures. These features enhance efficiency and ensure that all transactions are legally binding.

-

Is airSlate SignNow cost-effective for small businesses needing a bank solvency certificate?

Yes, airSlate SignNow provides an affordable solution for small businesses needing a bank solvency certificate. With pricing plans designed to suit various budgets, companies can access powerful document management tools without breaking the bank.

-

How does airSlate SignNow integrate with banking software for bank solvency certificates?

AirSlate SignNow seamlessly integrates with various banking software platforms, enabling users to generate, send, and track bank solvency certificates effortlessly. This integration helps streamline banking processes and improves overall workflow efficiency.

-

What benefits does using airSlate SignNow for a bank solvency certificate offer?

Using airSlate SignNow for a bank solvency certificate allows businesses to enhance their efficiency and improve document accuracy. The ability to eSign documents remotely means less time spent on paperwork and more time focusing on essential business operations.

-

How secure is the process of obtaining a bank solvency certificate through airSlate SignNow?

AirSlate SignNow prioritizes security by using advanced encryption protocols to protect sensitive information associated with bank solvency certificates. Users can trust that their documents are secure, ensuring peace of mind during the signing process.

Get more for solvency statement template

Find out other what is solvency certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online