Calculating Tax on Beer Omb No 1513 0083 Form

What is the Calculating Tax On Beer OMB No

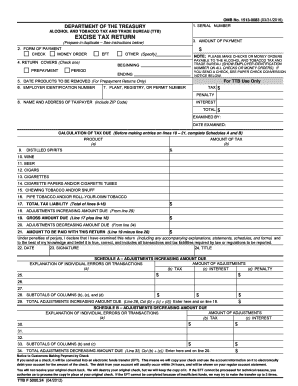

The Calculating Tax on Beer OMB No form is a crucial document used by breweries and distributors to report and calculate federal excise taxes on beer production and sales. This form ensures compliance with the Alcohol and Tobacco Tax and Trade Bureau (TTB) regulations. It is essential for businesses involved in the brewing industry to accurately complete this form to avoid penalties and ensure proper tax reporting.

Steps to Complete the Calculating Tax On Beer OMB No

Completing the Calculating Tax on Beer OMB No form involves several key steps:

- Gather necessary information, including production volumes, sales data, and any applicable deductions.

- Fill out the form accurately, ensuring all sections are completed, including calculations for excise taxes owed.

- Review the form for accuracy, checking all figures and ensuring compliance with TTB guidelines.

- Sign and date the form, as electronic signatures may be required to validate the submission.

Legal Use of the Calculating Tax On Beer OMB No

The legal use of the Calculating Tax on Beer OMB No form is governed by federal regulations. It is essential for businesses to use this form to report their tax obligations accurately. Failure to do so can result in legal repercussions, including fines and penalties. Compliance with the TTB's requirements ensures that businesses operate within the law while fulfilling their tax responsibilities.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Calculating Tax on Beer OMB No form. These guidelines include instructions on how to calculate the excise tax based on production levels and sales. It is important for businesses to familiarize themselves with these guidelines to ensure accurate reporting and compliance. The IRS may also update these guidelines periodically, so staying informed is crucial.

Filing Deadlines / Important Dates

Filing deadlines for the Calculating Tax on Beer OMB No form are critical for compliance. Typically, businesses must submit this form on a monthly or quarterly basis, depending on their production levels. Important dates include the end of the reporting period and the due date for submission. Missing these deadlines can lead to penalties, making it essential for businesses to maintain a calendar of important dates related to tax filings.

Form Submission Methods

The Calculating Tax on Beer OMB No form can be submitted through various methods, including:

- Online submission through the TTB's electronic filing system.

- Mailing a paper copy of the completed form to the appropriate TTB office.

- In-person submission at designated TTB offices, if applicable.

Choosing the appropriate submission method can streamline the filing process and ensure timely compliance.

Quick guide on how to complete calculating tax on beer omb no 1513 0083

Effortlessly Prepare Calculating Tax On Beer Omb No 1513 0083 on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and eSign your papers swiftly and without hassles. Handle Calculating Tax On Beer Omb No 1513 0083 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to Edit and eSign Calculating Tax On Beer Omb No 1513 0083 with Ease

- Obtain Calculating Tax On Beer Omb No 1513 0083 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key portions of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign feature, which takes seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Calculating Tax On Beer Omb No 1513 0083 and ensure outstanding communication at any stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the calculating tax on beer omb no 1513 0083

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's role in calculating tax on beer OMB No 1513 0083?

airSlate SignNow is a powerful tool that simplifies the process of calculating tax on beer OMB No 1513 0083 by enabling businesses to easily send and eSign necessary documents. Our platform provides templates and workflows that help streamline tax calculations and ensure compliance with regulations. This way, you can focus on your business while keeping tax inquiries organized and efficient.

-

How can airSlate SignNow help with document management related to calculating tax on beer OMB No 1513 0083?

With airSlate SignNow, you can efficiently manage all your documents related to calculating tax on beer OMB No 1513 0083. The platform allows you to store, organize, and access important tax-related documents securely. By digitizing your paperwork, you simplify record-keeping and ensure that all relevant information is readily available.

-

Is airSlate SignNow cost-effective for businesses involved in calculating tax on beer OMB No 1513 0083?

Absolutely! airSlate SignNow offers a cost-effective solution for businesses needing to handle calculations related to tax on beer OMB No 1513 0083. By utilizing our electronic signature features and document management tools, you can reduce operational costs and improve efficiency, making it a smart investment for your business.

-

What features does airSlate SignNow offer to assist with tax calculations on beer OMB No 1513 0083?

airSlate SignNow includes features such as document templates, customizable workflows, and electronic signatures that facilitate the process of calculating tax on beer OMB No 1513 0083. These functionalities help ensure that all necessary documents are in order and that tax submissions are completed accurately and on time, enhancing your compliance and operational efficiency.

-

Can airSlate SignNow integrate with other software for calculating tax on beer OMB No 1513 0083?

Yes, airSlate SignNow offers integrations with various software applications that can assist in calculating tax on beer OMB No 1513 0083. This capability allows you to connect with accounting systems and other tools, ensuring that all your tax-related data is seamlessly shared and organized. Integration enhances overall productivity and accuracy in tax management.

-

How does airSlate SignNow ensure the security of documents related to calculating tax on beer OMB No 1513 0083?

Security is a top priority for airSlate SignNow. All documents related to calculating tax on beer OMB No 1513 0083 are encrypted during transmission and storage, providing peace of mind to users. Our compliance with industry standards ensures that sensitive information remains protected from unauthorized access.

-

What are the benefits of using airSlate SignNow for calculating tax on beer OMB No 1513 0083?

Using airSlate SignNow simplifies the entire process of calculating tax on beer OMB No 1513 0083, making it more straightforward for businesses. The benefits include faster document turnaround times, enhanced collaboration among team members, and improved compliance with tax regulations. Overall, airSlate SignNow empowers your business to operate more efficiently and effectively.

Get more for Calculating Tax On Beer Omb No 1513 0083

Find out other Calculating Tax On Beer Omb No 1513 0083

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation