Dmv01 Form

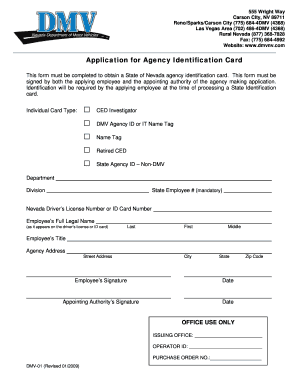

What is the dmv01?

The dmv01 form is a critical document used in various administrative processes within the United States. It typically serves as a vehicle for individuals or businesses to provide necessary information to state authorities, particularly in relation to vehicle registration, licensing, or other motor vehicle-related services. Understanding the purpose and function of the dmv01 is essential for ensuring compliance with state regulations and facilitating smooth transactions.

How to use the dmv01

Using the dmv01 form involves several straightforward steps. First, ensure that you have the correct version of the form, as different states may have variations. Next, gather all necessary information, including personal details, vehicle information, and any supporting documents required. Once the form is filled out, it can be submitted electronically or printed for mailing or in-person delivery, depending on state guidelines. Utilizing a digital platform like signNow can streamline this process, allowing for easy eSigning and secure submission.

Steps to complete the dmv01

Completing the dmv01 form requires careful attention to detail. Follow these steps for successful completion:

- Download the latest version of the dmv01 form from your state’s Department of Motor Vehicles website.

- Fill in your personal information accurately, including your name, address, and contact details.

- Provide relevant vehicle information, such as the make, model, year, and VIN.

- Attach any required supporting documents, such as proof of identity or residency.

- Review the form for accuracy and completeness before submission.

Legal use of the dmv01

The legal use of the dmv01 form is governed by specific state laws and regulations. To ensure that your submission is valid, it is crucial to comply with all legal requirements, including providing accurate information and signing the form as required. Electronic signatures, when executed through a compliant platform, can be legally binding, provided they meet the standards set by the ESIGN Act and UETA. This makes digital tools like signNow a reliable option for completing the dmv01 securely.

Key elements of the dmv01

Several key elements are essential for the dmv01 form to be considered complete and legally valid. These include:

- Accurate personal and vehicle information.

- Signature of the applicant, which can be electronic or handwritten.

- Any necessary attachments that support the information provided.

- Compliance with state-specific regulations regarding submission and processing.

Who Issues the Form

The dmv01 form is typically issued by the Department of Motor Vehicles (DMV) in each state. Each DMV has its own procedures for distributing the form, which may include online downloads, in-person requests, or mail. It is important to obtain the form from the official state DMV website to ensure you are using the correct and most up-to-date version.

Quick guide on how to complete dmv01

Prepare Dmv01 effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly and without delays. Manage Dmv01 on any platform using the airSlate SignNow Android or iOS applications and streamline any document-centric process today.

The easiest way to alter and eSign Dmv01 with ease

- Obtain Dmv01 and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that by airSlate SignNow.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Dmv01 and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dmv01

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dmv01 and how does it relate to airSlate SignNow?

dmv01 is a core feature of airSlate SignNow that simplifies the document signing process for businesses. By using dmv01, users can effortlessly send, receive, and eSign documents, ensuring a smooth workflow and enhancing productivity.

-

How much does airSlate SignNow cost with dmv01 features?

airSlate SignNow offers competitive pricing for its services, including full access to dmv01 capabilities. Subscriptions are flexible, catering to the needs of different businesses, and you can try out the platform with a free trial to evaluate its benefits.

-

What key features does the dmv01 offer in airSlate SignNow?

The dmv01 feature in airSlate SignNow includes advanced eSignature capabilities, document templates, and real-time tracking. These features help streamline document management and improve the overall signing experience for users.

-

How can dmv01 improve my business processes?

By implementing dmv01, businesses can reduce the time spent on document management. The efficiency of airSlate SignNow enables quicker turnaround times for approvals, which can lead to increased customer satisfaction and productivity.

-

Is dmv01 compatible with other software applications?

Yes, dmv01 can integrate seamlessly with various software applications through airSlate SignNow's robust API. This flexibility allows businesses to enhance their existing workflows without disrupting the systems they already use.

-

What are the security measures in place for dmv01 users?

airSlate SignNow prioritizes security for all users, including those utilizing dmv01. Features such as encryption, secure document storage, and compliance with industry standards ensure that your sensitive documents are well-protected.

-

Can I customize documents using dmv01 in airSlate SignNow?

Absolutely! The dmv01 feature allows users to create and customize document templates according to their specific needs. This flexibility helps streamline the signing process and ensures that all necessary information is included.

Get more for Dmv01

- 14 m uniform conveyancing blanks

- Including possible punitive damages form

- Limited warranty deed individuals to joint tenants form

- Limited warranty deed individuals to individuals 102 form

- In any case i intend to continue paying the usual amount of rent and i intend to abide by our form

- Insert name of each grantee form

- Warranty deed individuals to joint tenants form

- Quit claim deed individuals to joint tenants legal forms

Find out other Dmv01

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself