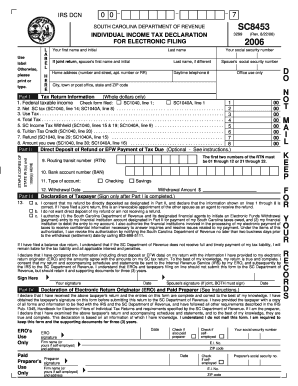

Sc8453 Form

What is the SC8453 Form

The SC8453 form, also known as the SC 8453 tax form, is a crucial document used for electronically filing tax returns in the United States. This form serves as a declaration by the taxpayer, confirming that the information provided in the electronic return is accurate and complete. It is particularly important for individuals and businesses that file their taxes online, as it provides a necessary signature for the submission process. The SC8453 form must be signed by the taxpayer or an authorized representative, ensuring that the filing complies with IRS regulations.

How to Use the SC8453 Form

To effectively use the SC8453 form, taxpayers should first ensure they have completed their electronic tax return using compatible tax software. After filling out the necessary information, the SC8453 form must be signed electronically. This signature validates the return and confirms that the taxpayer agrees to the terms outlined in the form. It is essential to retain a copy of the signed SC8453 for personal records, as it may be required for future reference or audits.

Steps to Complete the SC8453 Form

Completing the SC8453 form involves several straightforward steps:

- Ensure that all personal and financial information is accurately entered in your electronic tax return.

- Access the SC8453 form through your tax software, which will guide you through the process.

- Review the information on the form for accuracy, including your Social Security number and filing status.

- Sign the form electronically, which may require entering a PIN or other verification methods.

- Submit the completed form along with your electronic tax return to the IRS.

Legal Use of the SC8453 Form

The SC8453 form is legally binding when completed and signed according to IRS guidelines. It must be used in conjunction with an electronic tax return, and failure to submit the form correctly can result in delays or rejections of your tax filing. The form is compliant with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that electronic signatures hold the same legal weight as traditional handwritten signatures. Taxpayers should familiarize themselves with the legal implications of using the SC8453 to ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for the SC8453 form align with general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth, while extensions may push deadlines to October fifteenth. It is crucial for taxpayers to be aware of these dates to avoid penalties. Additionally, if you are filing for a business entity, the deadlines may vary based on the type of entity and its fiscal year. Always check the IRS website for the most current deadlines relevant to your tax situation.

Form Submission Methods

The SC8453 form can be submitted electronically alongside your tax return through approved tax software. This method is the most efficient and ensures immediate processing by the IRS. Alternatively, if you prefer to file by mail, you must print the completed SC8453 form, sign it, and send it to the appropriate IRS address based on your filing status. It is advisable to keep a copy of the submitted form for your records, regardless of the submission method chosen.

Quick guide on how to complete sc8453 form

Effortlessly prepare Sc8453 Form on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle Sc8453 Form on any gadget with airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The simplest method to edit and eSign Sc8453 Form with ease

- Locate Sc8453 Form and then click Obtain Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Finish button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, exhausting form searches, or errors that require printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from a device of your choice. Edit and eSign Sc8453 Form and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc8453 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form SC8453 and why is it important?

Form SC8453 is a crucial document used for eFiling federal tax returns. It ensures that taxpayers can securely sign and submit their documents electronically. Understanding Form SC8453 is essential for anyone looking to streamline their tax filing process.

-

How does airSlate SignNow help with Form SC8453 submissions?

airSlate SignNow simplifies the entire process of submitting Form SC8453 by offering secure eSigning solutions. With its user-friendly interface, businesses can easily prepare and send this form for signatures, ensuring compliance with IRS regulations. This makes the submission process not only faster but also more efficient.

-

What features does airSlate SignNow offer for handling Form SC8453?

airSlate SignNow includes features like real-time status tracking, customizable templates, and secure cloud storage specifically for Form SC8453. These features help users manage documents seamlessly and ensure that every submission meets the necessary standards. Additionally, the platform’s compliance with eSignature laws bolsters its reliability.

-

Is there a pricing plan for using airSlate SignNow for Form SC8453?

Yes, airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes looking to handle Form SC8453. The plans are designed to provide value, allowing users to manage multiple documents efficiently. Visit our pricing page to find a plan that best fits your needs.

-

Can I integrate airSlate SignNow with other software for Form SC8453?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, enhancing your workflow for handling Form SC8453. Whether you're using CRM systems or document management tools, these integrations make it easy to send, sign, and store your forms without interruption.

-

What are the benefits of using airSlate SignNow for eSigning Form SC8453?

Using airSlate SignNow for eSigning Form SC8453 provides numerous benefits, including enhanced security, time savings, and increased accuracy. The platform minimizes the risk of errors associated with paper documents and accelerates the eFiling process, ensuring you meet deadlines effortlessly.

-

Is airSlate SignNow compliant with eSignature laws for Form SC8453?

Yes, airSlate SignNow is fully compliant with eSignature laws, ensuring that your Form SC8453 submissions are legally binding. This compliance gives users peace of mind, knowing that their electronically signed documents meet all regulatory requirements. Trust airSlate SignNow to keep your eFiling processes secure.

Get more for Sc8453 Form

- Use this form to notify arise health plan and wps health insurance of any changes additions

- Va form 21 0960g 5 hepatitis cirrhosis and other liver conditions disability benefits questionnaire vba va

- Standardized recipe template form

- Request for release of fire medical andor marine safety records form

- Internal revenue service tax 79397211 form

- Receipt of required claimant information receipt of required claimant information

- Online oayslip form

- Fillable online dge door by jerry michalski churn form

Find out other Sc8453 Form

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template