February Department of the Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs Form

What is the February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs

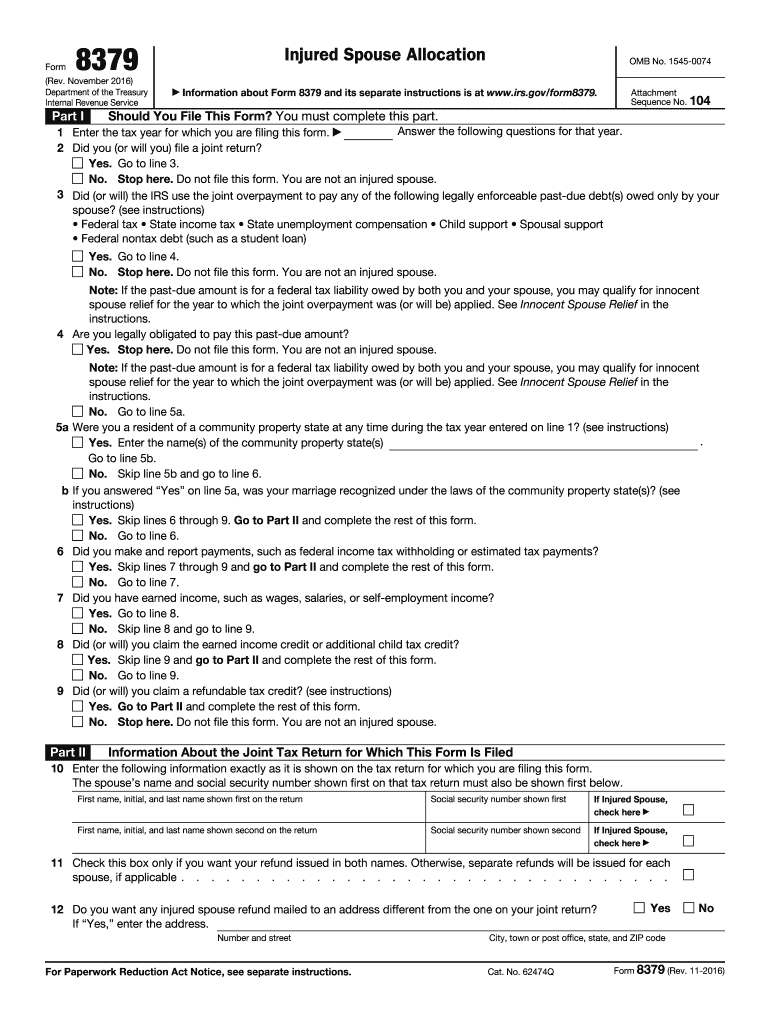

The February Department of the Treasury Internal Revenue Service Part I Injured Spouse Allocation form is designed for taxpayers who are married and filing jointly but wish to claim their share of a tax refund that may be offset due to their spouse's tax liabilities. This form helps protect the injured spouse's portion of the refund from being applied to the other spouse's debts, such as unpaid taxes, student loans, or child support. By completing this form, the injured spouse can ensure that their tax refund is allocated correctly and received in full.

Steps to complete the February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs

To successfully complete the February Department of the Treasury Internal Revenue Service Part I Injured Spouse Allocation form, follow these steps:

- Gather necessary information, including your and your spouse's Social Security numbers, tax filing status, and income details.

- Fill out the form accurately, ensuring that all required fields are completed. Pay special attention to the allocation of income and tax withholding.

- Attach any supporting documents that may be required, such as copies of your tax returns.

- Review the completed form for accuracy and completeness before submission.

- Submit the form to the appropriate IRS address based on your filing status and location.

How to use the February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs

Using the February Department of the Treasury Internal Revenue Service Part I Injured Spouse Allocation form involves filling it out correctly to ensure your tax refund is protected. Begin by identifying yourself as the injured spouse and providing all relevant financial information. The form requires you to detail your income and tax payments, which will help the IRS determine your rightful share of the refund. Once completed, submit the form alongside your tax return or separately, depending on your situation.

Legal use of the February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs

The legal use of the February Department of the Treasury Internal Revenue Service Part I Injured Spouse Allocation form is crucial for taxpayers seeking protection of their tax refunds. By filing this form, the injured spouse asserts their legal right to their share of the refund, which may otherwise be seized to satisfy the other spouse's debts. It is essential to ensure that the form is completed accurately and submitted in accordance with IRS guidelines to maintain its legal validity.

Eligibility Criteria

To be eligible to file the February Department of the Treasury Internal Revenue Service Part I Injured Spouse Allocation form, you must meet certain criteria:

- You must have filed a joint tax return with your spouse.

- Your tax refund is being offset due to your spouse's tax liabilities.

- You must have reported income on the joint return.

- You must not have any legal obligations that would allow the IRS to seize your refund.

Required Documents

When completing the February Department of the Treasury Internal Revenue Service Part I Injured Spouse Allocation form, certain documents may be required to support your claim. These may include:

- Copies of your joint tax return for the year in question.

- Documentation of your income, such as W-2 forms or 1099s.

- Any notices from the IRS regarding the offset of your refund.

Quick guide on how to complete february department of the treasury internal revenue service part i injured spouse allocation irs

Prepare February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents since you can access the appropriate format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents efficiently without delays. Handle February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to alter and eSign February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs seamlessly

- Locate February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs and click Get Form to initiate.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and eSign February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the february department of the treasury internal revenue service part i injured spouse allocation irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs?

The February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs refers to the IRS form used to allocate tax refunds between spouses when one individual has a past due obligation that may affect the refund. This allocation process ensures that the injured spouse receives their rightful portion of the refund, protecting their financial interests.

-

How can airSlate SignNow help with the February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs?

airSlate SignNow simplifies the process of filling out and submitting the February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs form electronically. With its user-friendly interface, businesses can quickly gather necessary signatures, ensuring compliance and accuracy in handling sensitive tax information.

-

What are the pricing options for using airSlate SignNow for IRS forms?

airSlate SignNow offers flexible pricing plans that accommodate various business needs, including those handling the February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs. Users can select from monthly or annual subscriptions, ensuring they only pay for the features and usage relevant to their requirements.

-

Does airSlate SignNow offer any features specifically for tax forms like the IRS allocation forms?

Yes, airSlate SignNow provides features tailored for managing tax forms, such as templates for the February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs. These features streamline the document creation, signing, and submission process, improving efficiency and reducing the risk of errors.

-

Can airSlate SignNow integrate with accounting software for IRS-related tasks?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, enhancing the handling of documents related to the February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs. This integration allows for efficient data transfer and improved accuracy in financial processes.

-

What are the benefits of using airSlate SignNow for IRS forms versus traditional methods?

Using airSlate SignNow for the February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs offers signNow benefits over traditional methods, including faster processing times, reduced paper usage, and improved document security. The electronic signing feature also enhances convenience, allowing users to sign documents from anywhere, at any time.

-

Is airSlate SignNow secure for handling sensitive IRS documents?

Yes, airSlate SignNow employs advanced security measures to ensure that all documents, including the February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs, are protected. Features like encrypted storage and secure access protocols help safeguard sensitive tax information from unauthorized access.

Get more for February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs

- Public notice is hereby given that has received an form

- Free missouri secured promissory note template word form

- Missouri fixed rate note installment payments secured commercial property form

- On this day of in the year before me the form

- Missouri legal forms missouri legal documents

- Control number mo p005 pkg form

- Control number mo p007 pkg form

- Advance directive for mental health of i your name being form

Find out other February Department Of The Treasury Internal Revenue Service Part I Injured Spouse Allocation Irs

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form