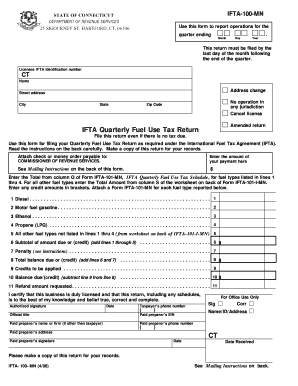

State of Ct Ifta 101 Form

What is the State of Ct Ifta 101 Form

The State of Ct Ifta 101 form is a crucial document used by motor carriers to report and pay fuel taxes across multiple jurisdictions. This form is part of the International Fuel Tax Agreement (IFTA), which simplifies the reporting process for fuel taxes by allowing carriers to file a single quarterly return instead of separate returns for each state or province. The IFTA 101 form collects essential information regarding fuel usage and miles traveled in each jurisdiction, ensuring compliance with tax regulations.

How to use the State of Ct Ifta 101 Form

Using the State of Ct Ifta 101 form involves several steps to ensure accurate reporting. First, gather all necessary data, including total miles driven and fuel purchased in each jurisdiction. Next, complete the form by entering this information in the designated fields. After filling out the form, review it for accuracy before submitting it to the appropriate state agency. This process helps avoid penalties and ensures that all taxes owed are correctly calculated and reported.

Steps to complete the State of Ct Ifta 101 Form

Completing the State of Ct Ifta 101 form requires careful attention to detail. Follow these steps for successful completion:

- Gather records of total miles driven in each jurisdiction.

- Compile fuel purchase receipts for the reporting period.

- Fill in the required fields on the form, including your business information and fuel usage data.

- Double-check all entries for accuracy and completeness.

- Submit the form by the deadline to avoid late fees.

Legal use of the State of Ct Ifta 101 Form

The legal use of the State of Ct Ifta 101 form is governed by the regulations set forth in the International Fuel Tax Agreement. This form must be completed accurately to ensure compliance with tax laws. Failure to file the form correctly can result in penalties, including fines and interest on unpaid taxes. It is essential for motor carriers to understand their legal obligations when using this form to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the State of Ct Ifta 101 form are typically set on a quarterly basis. Carriers must submit their forms by the last day of the month following the end of each quarter. Important dates to remember include:

- Quarter 1: Due by April 30

- Quarter 2: Due by July 31

- Quarter 3: Due by October 31

- Quarter 4: Due by January 31

Form Submission Methods (Online / Mail / In-Person)

The State of Ct Ifta 101 form can be submitted through various methods, providing flexibility for motor carriers. Options include:

- Online: Many states offer online submission through their tax department websites.

- Mail: Carriers can print the completed form and mail it to the designated state agency.

- In-Person: Some carriers may choose to deliver the form in person at their local tax office.

Quick guide on how to complete state of ct ifta 101 form

Effortlessly Prepare State Of Ct Ifta 101 Form on Any Device

Online document management has become a favored option for businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing for the correct form to be obtained and securely stored online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage State Of Ct Ifta 101 Form across any platform with the airSlate SignNow apps available for Android and iOS and enhance any document-centric process today.

The Easiest Way to Edit and Electronically Sign State Of Ct Ifta 101 Form

- Obtain State Of Ct Ifta 101 Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using the specific tools provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form hunting, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign State Of Ct Ifta 101 Form and guarantee excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of ct ifta 101 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IFTA 101 and why is it important for my business?

IFTA 101 refers to the International Fuel Tax Agreement, which simplifies the reporting of fuel use by interstate motor carriers. Understanding IFTA 101 is crucial for businesses in the transportation industry to ensure compliance, avoid penalties, and optimize fuel tax reporting processes.

-

How can airSlate SignNow help with IFTA 101 reporting?

airSlate SignNow simplifies the document management needed for IFTA 101 reporting by allowing you to electronically sign and store important compliance documents. This streamlines your workflow and enhances your ability to maintain accurate records for fuel tax calculations.

-

What features of airSlate SignNow support IFTA 101 compliance?

airSlate SignNow offers features like document templates, automated workflows, and secure eSignature capabilities, making it easier to manage IFTA 101 documentation. These tools help to ensure that all necessary forms are completed and submitted on time.

-

Is airSlate SignNow cost-effective for small businesses dealing with IFTA 101?

Yes, airSlate SignNow is designed to be a cost-effective solution, especially for small businesses managing IFTA 101 reporting. With flexible pricing plans, businesses can choose the features they need without overspending, ensuring they can meet compliance in a budget-friendly way.

-

What are the benefits of using airSlate SignNow for IFTA 101 documentation?

Using airSlate SignNow for IFTA 101 documentation offers several benefits including improved efficiency, reduced paperwork, and increased accuracy in tax reporting. These advantages help ensure your business stays compliant and saves time during tax seasons.

-

Can I integrate airSlate SignNow with other software for IFTA 101 reporting?

Absolutely, airSlate SignNow integrates seamlessly with various accounting and transportation management software. This integration allows you to manage IFTA 101 reporting and documentation within your existing systems, enhancing overall efficiency and accuracy.

-

How secure is airSlate SignNow for handling IFTA 101 documents?

airSlate SignNow prioritizes security for all documents, including those related to IFTA 101. With features like encryption, secure cloud storage, and access controls, you can be confident that your sensitive information is protected at all times.

Get more for State Of Ct Ifta 101 Form

- Clermont county clerk of courts form

- Cheer uniform contract

- Request for ship inspection agence canadienne dinspection des inspection gc form

- Application of credit form

- D0931 spectacles prescription department of veterans affairs dva gov form

- Boiler and refrigeration inspection declaration form 1149

- Polksheriff form

- City of livonia dog license form

Find out other State Of Ct Ifta 101 Form

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free