Ghana Revenue Authority Forms

What is the Ghana Revenue Authority Forms

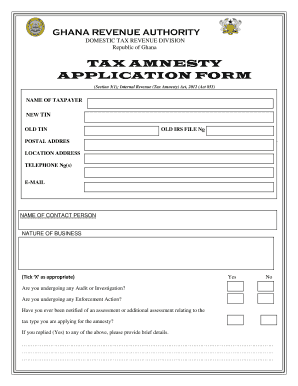

The Ghana Revenue Authority forms are official documents required for various tax-related processes in Ghana. These forms facilitate the collection of taxes, the issuance of Tax Identification Numbers (TIN), and the reporting of income. Understanding the purpose of each form is crucial for compliance with tax regulations and for ensuring that businesses and individuals meet their tax obligations accurately.

How to use the Ghana Revenue Authority Forms

Using the Ghana Revenue Authority forms involves several steps to ensure proper completion and submission. First, identify the specific form required for your situation, whether for tax registration, filing returns, or other purposes. Next, gather all necessary information and documentation, such as identification, financial records, and any previous tax filings. Once you have the required data, fill out the form accurately, ensuring all sections are completed. Finally, submit the form through the appropriate channels, which may include online submission, mailing, or in-person delivery to the relevant tax office.

Steps to complete the Ghana Revenue Authority Forms

Completing the Ghana Revenue Authority forms requires careful attention to detail. Follow these steps for successful completion:

- Identify the correct form needed for your tax situation.

- Gather necessary documentation, including identification and financial records.

- Fill out the form, ensuring accuracy in all provided information.

- Review the completed form for any errors or omissions.

- Submit the form through the designated method, ensuring you keep a copy for your records.

Legal use of the Ghana Revenue Authority Forms

The legal use of the Ghana Revenue Authority forms is essential for ensuring compliance with tax laws. These forms must be filled out accurately and submitted within specified deadlines to avoid penalties. Electronic submissions are considered legally binding, provided they meet the requirements set forth by relevant regulations. It is important to understand that any inaccuracies or omissions can lead to legal consequences, including fines or audits.

Required Documents

When completing the Ghana Revenue Authority forms, certain documents are typically required to support your application or filing. These may include:

- Identification documents, such as a national ID or passport.

- Proof of address, such as utility bills or bank statements.

- Financial records, including income statements and previous tax returns.

- Any additional documentation specific to the type of form being submitted.

Form Submission Methods

There are several methods available for submitting the Ghana Revenue Authority forms. These include:

- Online Submission: Many forms can be completed and submitted electronically through the Ghana Revenue Authority's online portal.

- Mail: Forms can be printed and mailed to the appropriate tax office.

- In-Person: Individuals may also choose to deliver their forms directly to a tax office for processing.

Quick guide on how to complete ghana revenue authority forms

Complete Ghana Revenue Authority Forms effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Ghana Revenue Authority Forms on any platform with the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest method to modify and eSign Ghana Revenue Authority Forms seamlessly

- Locate Ghana Revenue Authority Forms and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Ghana Revenue Authority Forms and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ghana revenue authority forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Ghana Revenue Authority forms and why are they important?

Ghana Revenue Authority forms are essential documents required for various tax and regulatory compliance in Ghana. These forms help businesses report income, claim deductions, and ensure adherence to tax obligations. Understanding and properly completing these forms is vital to avoid penalties and maintain good standing with the authorities.

-

How can airSlate SignNow assist with Ghana Revenue Authority forms?

airSlate SignNow streamlines the process of completing and submitting Ghana Revenue Authority forms by allowing users to eSign and manage documents digitally. This solution reduces time spent on paperwork and enhances efficiency, ensuring your forms are submitted correctly and on time. Integration with other tools further simplifies this process.

-

What is the pricing structure for using airSlate SignNow for Ghana Revenue Authority forms?

airSlate SignNow offers a flexible pricing structure that caters to various business sizes and needs. Users can select from different plans that provide access to features specifically designed for managing Ghana Revenue Authority forms and other documents. A free trial is also available, allowing potential customers to evaluate the service before committing.

-

Are there any features specifically designed for Ghana Revenue Authority forms?

Yes, airSlate SignNow includes features tailored for managing Ghana Revenue Authority forms, such as customizable templates, automated reminders, and secure eSignature capabilities. These features help ensure that your forms are filled out correctly and submitted in accordance with local regulations. The platform also allows for easy tracking and management of these forms.

-

Can airSlate SignNow integrate with other software for handling Ghana Revenue Authority forms?

Absolutely, airSlate SignNow integrates seamlessly with various software applications, allowing users to efficiently manage Ghana Revenue Authority forms alongside other business processes. These integrations facilitate data import/export and improve workflow continuity, making it easier to access and manage your tax documents. Popular integrations include CRM systems and accounting software.

-

What are the benefits of using airSlate SignNow for tax compliance in Ghana?

Using airSlate SignNow for tax compliance, especially for Ghana Revenue Authority forms, offers numerous benefits, including time savings, cost-effectiveness, and enhanced accuracy. The platform prevents common errors associated with manual document handling and reduces the likelihood of delays in submission. Additionally, the secure eSignature feature ensures that your forms are legally binding.

-

Is airSlate SignNow suitable for both small and large businesses dealing with Ghana Revenue Authority forms?

Yes, airSlate SignNow is designed to accommodate businesses of all sizes, including small and large companies dealing with Ghana Revenue Authority forms. The scalability of the platform allows for tools and features that grow with your business, ensuring that both small startups and large corporations can efficiently manage their regulatory requirements.

Get more for Ghana Revenue Authority Forms

Find out other Ghana Revenue Authority Forms

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney