Hawaii Estate Form

What is the Hawaii Estate

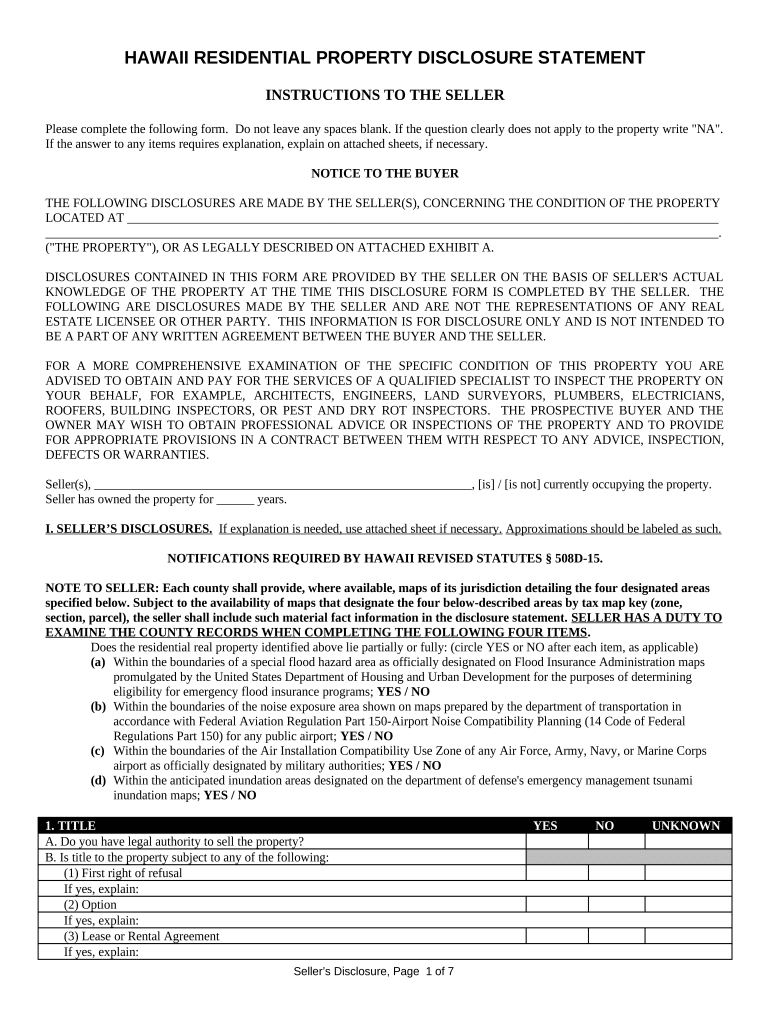

The Hawaii estate refers to the legal framework governing the distribution of a deceased person's assets in the state of Hawaii. This process typically involves the probate court, which oversees the administration of the estate, ensuring that debts are settled and assets are distributed according to the deceased's wishes or state law. Understanding the Hawaii estate is crucial for individuals involved in estate planning or those managing the affairs of a deceased loved one.

Steps to complete the Hawaii Estate

Completing the Hawaii estate process involves several key steps:

- Gather necessary documents: Collect the deceased's will, financial statements, and any other relevant documents.

- File a petition: Submit a petition for probate to the appropriate court, along with the will and death certificate.

- Notify interested parties: Inform heirs, beneficiaries, and creditors about the probate proceedings.

- Inventory the estate: Compile a comprehensive list of all assets and liabilities of the deceased.

- Settle debts: Pay off any outstanding debts and taxes owed by the estate.

- Distribute assets: Distribute the remaining assets to the beneficiaries as per the will or state law.

Legal use of the Hawaii Estate

The legal use of the Hawaii estate encompasses the processes and regulations that govern how estates are managed and distributed. This includes adhering to state laws regarding probate, ensuring that all debts and taxes are settled, and distributing assets according to the deceased's wishes. Legal compliance is essential to avoid disputes and ensure a smooth transition of assets to beneficiaries.

Required Documents

To initiate the Hawaii estate process, several key documents are required:

- Last will and testament: If available, this document outlines the deceased's wishes regarding asset distribution.

- Death certificate: This official document verifies the death of the individual.

- Financial statements: These include bank statements, property deeds, and any other financial records related to the estate.

- List of heirs and beneficiaries: A detailed list of individuals entitled to inherit from the estate.

State-specific rules for the Hawaii Estate

Hawaii has specific rules governing estate administration, which can differ from other states. Key aspects include:

- Probate process: The probate process in Hawaii is generally streamlined, with options for informal probate for smaller estates.

- Intestate succession: If there is no will, Hawaii law dictates how assets are distributed among surviving relatives.

- Estate taxes: Hawaii has its own estate tax regulations, which may apply depending on the total value of the estate.

Form Submission Methods (Online / Mail / In-Person)

Submitting the necessary forms for the Hawaii estate can be done through various methods:

- Online: Some courts may offer online filing options for probate petitions and related documents.

- Mail: Forms can be printed and mailed to the appropriate probate court.

- In-person: Individuals can also file documents directly at the courthouse, ensuring that all paperwork is submitted correctly.

Quick guide on how to complete hawaii estate 497304463

Complete Hawaii Estate effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the desired form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Hawaii Estate on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to edit and eSign Hawaii Estate with ease

- Locate Hawaii Estate and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize pertinent sections of the documents or redact confidential information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Hawaii Estate to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it benefit Hawaii estate professionals?

airSlate SignNow is a powerful eSignature solution designed for seamless document signing and management. For Hawaii estate professionals, it provides an easy-to-use interface that saves time and increases efficiency in handling real estate paperwork. This means quicker transactions and improved customer satisfaction, essential in the fast-paced Hawaii estate market.

-

What are the pricing options for airSlate SignNow in the context of Hawaii estate transactions?

airSlate SignNow offers flexible pricing plans that cater to various needs, including options suitable for Hawaii estate agents and firms. Our pricing is competitive, designed to provide value for frequent users managing multiple estate documents. Check our website for detailed plans tailored for Hawaii estate professionals.

-

Can airSlate SignNow handle multiple document formats for Hawaii estate transactions?

Yes, airSlate SignNow supports multiple document formats essential for Hawaii estate transactions. Whether you're dealing with PDFs, Word documents, or images, our platform makes it easy to upload, sign, and manage these files. This versatility is crucial for estate professionals who need to work with various legal documents seamlessly.

-

Is airSlate SignNow compliant with Hawaii estate laws?

Absolutely, airSlate SignNow complies with all necessary electronic signature laws, including those specific to Hawaii estate transactions. Our platform adheres to the UETA and ESIGN Acts, ensuring that every document signed through our service is legally binding. This compliance is vital for any Hawaii estate professional to maintain trust and legality in their transactions.

-

What integrations are available with airSlate SignNow for Hawaii estate agents?

airSlate SignNow integrates with several tools and platforms widely used in the Hawaii estate sector, such as CRM systems, cloud storage, and document management solutions. These integrations streamline your workflow by allowing you to manage your estate documents within familiar environments. This means less time switching between applications and more focus on closing deals.

-

How does airSlate SignNow improve the efficiency of managing Hawaii estate documents?

With airSlate SignNow, managing Hawaii estate documents becomes signNowly more efficient thanks to features like bulk sending, customizable templates, and automated workflows. These tools reduce the manual effort required in processing paperwork, allowing professionals to focus on client relationships and property transactions. Efficiency translates to faster closings, crucial in the competitive Hawaii estate market.

-

Are there any mobile capabilities for using airSlate SignNow in Hawaii estate operations?

Yes, airSlate SignNow offers mobile capabilities that allow Hawaii estate professionals to access, sign, and manage documents on the go. This flexibility means you can finalize important estate agreements anywhere, whether at a property showing or during a meeting. Mobile access enhances your responsiveness and effectiveness in a constantly moving environment.

Get more for Hawaii Estate

Find out other Hawaii Estate

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online