Crs Form

What is the CRS Form

The CRS form, or Common Reporting Standard form, is a document used for the automatic exchange of financial account information between countries. This form is primarily utilized by financial institutions to collect information about account holders who are tax residents in jurisdictions that participate in the CRS framework. The purpose of the form is to ensure compliance with international tax regulations and to combat tax evasion.

How to Use the CRS Form

Using the CRS form involves several key steps. First, financial institutions must identify account holders who are tax residents in participating jurisdictions. Once identified, they must collect the necessary information, which includes the individual's name, address, tax identification number, and account details. This information is then reported to the relevant tax authorities, who exchange it with other countries as part of the CRS initiative. It is essential for institutions to ensure that the information collected is accurate and up-to-date to maintain compliance.

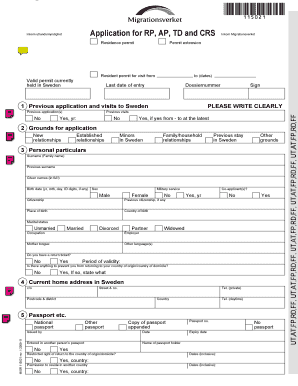

Steps to Complete the CRS Form

Completing the CRS form requires careful attention to detail. Here are the steps involved:

- Gather Information: Collect all necessary data from the account holder, including personal identification and tax residency details.

- Fill Out the Form: Enter the collected information accurately into the CRS form template.

- Review for Accuracy: Double-check all entries to ensure there are no mistakes or omissions.

- Submit the Form: Send the completed form to the appropriate tax authority, adhering to submission deadlines.

Legal Use of the CRS Form

The CRS form must be used in accordance with legal guidelines established by the OECD and participating jurisdictions. Compliance with these regulations is crucial for financial institutions to avoid penalties and ensure that they are not facilitating tax evasion. The form serves as a legal document that supports the transparency of financial transactions and the exchange of information between countries.

Examples of Using the CRS Form

Examples of the CRS form's application include its use by banks and other financial institutions to report information about foreign account holders. For instance, a U.S. bank must report details of an account held by a resident of a CRS participating country. This reporting helps tax authorities track foreign income and ensure that individuals are paying the correct amount of tax in their home jurisdictions.

Required Documents

To complete the CRS form, several documents may be required, including:

- Proof of Identity: Government-issued identification such as a passport or driver's license.

- Tax Identification Number: A unique number assigned to the individual by their home country's tax authority.

- Address Verification: Utility bills or bank statements that confirm the individual's residential address.

Form Submission Methods

The CRS form can typically be submitted through various methods, including:

- Online Submission: Many jurisdictions allow for electronic submission through secure portals.

- Mail: Physical copies of the form can be sent to the appropriate tax authority.

- In-Person: Some institutions may allow for in-person submission at local tax offices.

Quick guide on how to complete crs form

Prepare Crs Form seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Manage Crs Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest method to modify and electronically sign Crs Form effortlessly

- Locate Crs Form and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize pertinent sections of the documents or hide sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes just moments and carries the same legal authority as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Crs Form to maintain excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the crs form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CRS form?

The CRS form, or Common Reporting Standard form, is an important document for financial institutions to collect information on account holders and reporting to tax authorities. Understanding how to fill out and submit this form accurately is crucial for compliance and avoiding penalties.

-

How does airSlate SignNow facilitate the signing of a CRS form?

AirSlate SignNow provides a seamless platform for users to electronically sign and manage their CRS form. With a user-friendly interface, businesses can quickly send out CRS forms for signature, track their status, and ensure secure and legal eSignatures.

-

Are there any fees associated with using airSlate SignNow for CRS forms?

AirSlate SignNow offers various pricing plans that cater to different business needs, including converting documentation processes involving CRS forms. By assessing your requirements, you can choose a plan that provides the best value without any hidden fees.

-

What features does airSlate SignNow offer for CRS form management?

AirSlate SignNow includes features like template creation, customizable fields, and automated workflows to ease CRS form management. This ensures businesses can tailor their forms as needed and streamline the signing process.

-

Can airSlate SignNow integrate with other software for handling CRS forms?

Yes, airSlate SignNow integrates with a variety of third-party applications such as CRM and accounting software. This capability helps businesses maintain a unified workflow while managing their CRS forms alongside other critical processes.

-

Is airSlate SignNow secure for submitting CRS forms?

Absolutely, airSlate SignNow is built with security in mind, featuring encryption and compliance with regulations to protect your CRS form submissions. Businesses can trust that their sensitive information is kept safe throughout the eSignature process.

-

What are the benefits of using airSlate SignNow for CRS forms?

Using airSlate SignNow for CRS forms signNowly reduces paperwork and processing time. The digital workflow enhances efficiency, ensuring that forms are completed and returned quickly while maintaining legal compliance.

Get more for Crs Form

- Control number nh sdeed 4 form

- Control number nh sdeed 5 form

- Limited partnership or llc as the grantor form

- Control number nh sdeed 8 1 form

- In the matter of karen alexander and jonathan evans new form

- New hampshire judicial branch faq form

- Of the association of the bar of the city of new york form

- Topicality grammatical tense insurance form

Find out other Crs Form

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself