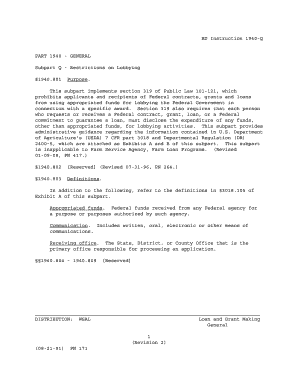

1940 Q Form

What is the 1940 Q Form

The 1940 Q Form is a tax-related document primarily used by certain organizations to report their financial activities and compliance with federal regulations. It is essential for ensuring transparency and accountability in financial reporting. This form is often associated with tax-exempt organizations, including charities and non-profits, that must disclose specific information to the Internal Revenue Service (IRS).

How to use the 1940 Q Form

Using the 1940 Q Form involves several steps to ensure accurate and complete reporting. First, gather all necessary financial information, including income, expenses, and other relevant data. Next, carefully fill out each section of the form, ensuring that all figures are accurate and reflect the organization’s financial status. It is crucial to review the completed form for any errors before submission. Once finalized, the form can be submitted electronically or by mail, depending on the requirements set by the IRS.

Steps to complete the 1940 Q Form

Completing the 1940 Q Form requires a methodical approach. Start by downloading the form from the IRS website or obtaining it through authorized channels. Follow these steps:

- Review the instructions provided with the form to understand the requirements.

- Input the organization’s basic information, including name, address, and Employer Identification Number (EIN).

- Detail the organization’s financial activities, including revenue sources and expenditures.

- Include any additional disclosures required by the IRS.

- Double-check all entries for accuracy and completeness.

Legal use of the 1940 Q Form

The legal use of the 1940 Q Form is governed by IRS regulations, which mandate accurate reporting of financial information by tax-exempt organizations. To ensure compliance, organizations must adhere to the guidelines outlined in the IRS instructions for the form. Failure to use the form correctly can result in penalties, including fines or loss of tax-exempt status.

Key elements of the 1940 Q Form

Key elements of the 1940 Q Form include sections that require detailed financial information, such as:

- Revenue and expenses for the reporting period.

- Details of any grants or contributions received.

- Information on the organization’s governance and management structure.

- Disclosures related to compliance with federal regulations.

Filing Deadlines / Important Dates

Filing deadlines for the 1940 Q Form are critical to ensure compliance with IRS requirements. Organizations typically must submit the form annually, with specific deadlines varying based on their fiscal year-end. It is important to mark these dates on the calendar to avoid late submissions, which can incur penalties.

Form Submission Methods (Online / Mail / In-Person)

The 1940 Q Form can be submitted through various methods, providing flexibility for organizations. Options include:

- Online submission through the IRS e-file system, which is often the fastest method.

- Mailing a paper copy of the form to the designated IRS address.

- In-person submission at local IRS offices, although this method may require an appointment.

Quick guide on how to complete 1940 q form

Complete 1940 Q Form effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle 1940 Q Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign 1940 Q Form with ease

- Find 1940 Q Form and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize relevant parts of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign 1940 Q Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1940 q form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1940 Q Form and who needs it?

The 1940 Q Form is a crucial document required for certain financial and tax-related filings. Businesses and individuals involved in investment activities may need to use this form to maintain compliance with regulations. Understanding the details of the 1940 Q Form ensures proper reporting and avoids potential fines.

-

How does airSlate SignNow simplify the 1940 Q Form signing process?

airSlate SignNow offers a streamlined solution for electronic signatures, making the 1940 Q Form signing process quick and efficient. Users can easily upload, sign, and send the form securely from any device. This eliminates the hassle of printing and mailing documents.

-

What features does airSlate SignNow provide for managing the 1940 Q Form?

With airSlate SignNow, users can efficiently manage the 1940 Q Form by utilizing features like templates, automated workflows, and secure storage. The platform allows for easy editing and tracking of document status, ensuring that the form is completed accurately and promptly.

-

Are there any costs associated with using airSlate SignNow for the 1940 Q Form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including those who need to manage the 1940 Q Form. Pricing is competitive and presents great value considering the features provided. Potential users can choose a plan that best fits their document signing frequency and requirements.

-

Can I integrate airSlate SignNow with other applications for the 1940 Q Form?

Absolutely! airSlate SignNow supports integrations with a variety of applications, enhancing the workflow for managing the 1940 Q Form. Users can connect tools like CRM systems, cloud storage, and project management apps to streamline their document processes.

-

What are the benefits of using airSlate SignNow for the 1940 Q Form?

Using airSlate SignNow for the 1940 Q Form comes with several benefits, including increased efficiency, enhanced security, and ease of use. The platform reduces the time spent on paperwork, helping businesses focus on their core activities. Additionally, it provides a secure method for electronic signatures, ensuring compliance.

-

Is airSlate SignNow compliant with regulatory requirements for the 1940 Q Form?

Yes, airSlate SignNow is designed to comply with regulations related to digital signatures and document handling, making it suitable for the 1940 Q Form. The platform adheres to security standards to protect sensitive information. This compliance helps users ensure that their filings meet all required regulations.

Get more for 1940 Q Form

- This agreement is signed by lienholder as of the date of the acknowledgment below but is form

- Boisterous conduct is avoided form

- Form nj 864 1lt

- Certification of lost verbatim court record form

- Ninth circuit appellate guide ninth circuit court of appeals form

- Derecho para la tercera edad pace law school form

- Appendix thesis and dissertation research guides at sam form

- Appellate division checklist for preparation of brief nj courts form

Find out other 1940 Q Form

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself