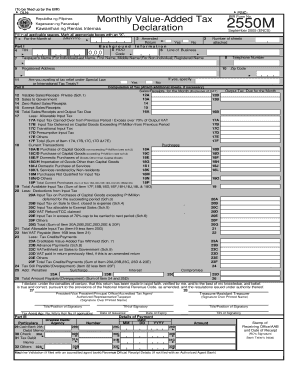

Monthly Value Added Tax Declaration 2550m Form 2005-2026

What is the Monthly Value Added Tax Declaration 2550m Form

The Monthly Value Added Tax Declaration 2550m form is a crucial document for businesses in the Philippines that are required to report their value-added tax (VAT) transactions. This form is used to declare the VAT due for a specific month, detailing the sales and purchases subject to VAT. It is essential for ensuring compliance with tax regulations and for maintaining accurate financial records.

How to use the Monthly Value Added Tax Declaration 2550m Form

Using the 2550m form involves several steps. First, gather all necessary financial records for the month, including sales invoices and purchase receipts. Next, fill out the form by entering the total sales, purchases, and VAT amounts. Ensure that all calculations are accurate to avoid discrepancies. Once completed, the form can be submitted to the Bureau of Internal Revenue (BIR) either online or in person, depending on the preferred submission method.

Steps to complete the Monthly Value Added Tax Declaration 2550m Form

Completing the 2550m form requires careful attention to detail. Follow these steps:

- Gather all relevant documents, including sales and purchase invoices.

- Calculate the total sales and purchases subject to VAT.

- Determine the VAT amount based on the applicable rates.

- Fill in the required fields on the form, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the form to the BIR by the specified deadline.

Legal use of the Monthly Value Added Tax Declaration 2550m Form

The 2550m form is legally binding and must be completed accurately to meet regulatory requirements. It serves as an official record of a business's VAT obligations and is subject to audit by tax authorities. Ensuring compliance with the instructions and deadlines associated with this form is vital to avoid penalties and maintain good standing with the BIR.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the 2550m form to avoid penalties. The form must be filed monthly, typically on or before the 20th day of the following month. For example, the form for January must be submitted by February 20. Keeping track of these dates helps ensure timely compliance and avoids unnecessary fines.

Form Submission Methods (Online / Mail / In-Person)

The Monthly Value Added Tax Declaration 2550m form can be submitted through various methods. Businesses can file online through the BIR's electronic filing and payment system, which offers convenience and faster processing. Alternatively, the form can be mailed to the appropriate BIR office or submitted in person. Each method has its own requirements, so it's essential to choose the one that best fits your business needs.

Quick guide on how to complete monthly value added tax declaration 2550m form

Effortlessly prepare Monthly Value Added Tax Declaration 2550m Form on any device

The management of online documents has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly without delays. Manage Monthly Value Added Tax Declaration 2550m Form on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related processes today.

How to edit and eSign Monthly Value Added Tax Declaration 2550m Form with ease

- Locate Monthly Value Added Tax Declaration 2550m Form and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes seconds and holds the same legal significance as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Set aside worries about lost or misfiled documents, tedious form searching, or errors that require new printed copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign Monthly Value Added Tax Declaration 2550m Form and guarantee effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the monthly value added tax declaration 2550m form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the bir form 2550m?

The bir form 2550m is a tax form used in the Philippines for the Value Added Tax (VAT) returns on a monthly basis. It allows businesses to report their VAT due and any payments made to the Bureau of Internal Revenue (BIR). Understanding this form is crucial for compliance with tax regulations and effective financial management.

-

How can airSlate SignNow help with the bir form 2550m?

airSlate SignNow streamlines the process of preparing and signing the bir form 2550m, making it easy for businesses to manage their VAT submissions. With our eSignature capabilities, you can quickly gather the necessary approvals and submit the form digitally. This efficiency reduces paperwork and helps maintain compliance.

-

Is there a cost associated with using airSlate SignNow for the bir form 2550m?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. These plans provide access to features that can simplify the completion and signing of the bir form 2550m. We also offer a free trial so you can gauge the value before committing to a subscription.

-

What features does airSlate SignNow provide for handling the bir form 2550m?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure storage for documents like the bir form 2550m. Our platform ensures that all your forms are easily accessible and can be signed on any device, enhancing productivity.

-

Are there any integrations available with airSlate SignNow for submitting the bir form 2550m?

Yes, airSlate SignNow integrates with various applications that can help streamline your financial processes, including accounting software. These integrations allow for seamless data transfer when preparing the bir form 2550m, thereby minimizing errors and saving time.

-

Can I track the status of my bir form 2550m submission with airSlate SignNow?

Absolutely, airSlate SignNow provides tracking features that allow users to monitor the status of their bir form 2550m submissions. You can see when the document is viewed, signed, or completed, ensuring you always stay informed about your tax compliance.

-

What are the benefits of using airSlate SignNow for the bir form 2550m?

Using airSlate SignNow for the bir form 2550m offers numerous benefits, including enhanced efficiency, reduced turnaround time for signatures, and improved compliance with tax regulations. Our platform simplifies the entire signing process, allowing you to focus more on your core business activities.

Get more for Monthly Value Added Tax Declaration 2550m Form

- Direct admission reservation form reservation form

- Sheridan wyoming elks lodge 520 form

- California mercy high school form

- Rcbc application form

- Power of attorney city of colorado springs finance division sales tax form

- Quick phonics screener form

- Mental fitness certificate form

- Letter of good standing for godparent form

Find out other Monthly Value Added Tax Declaration 2550m Form

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application