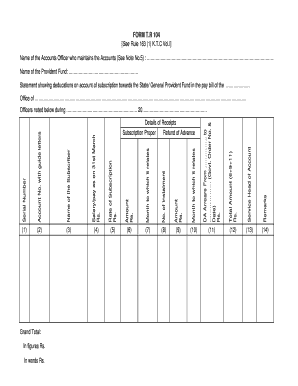

Form Tr 104

What is the Form Tr 104

The Form Tr 104 is a specific document used in various legal and administrative contexts within the United States. It serves as a formal declaration or request, often required by governmental agencies or organizations. Understanding its purpose is essential for ensuring compliance with relevant laws and regulations. The form typically includes sections for personal information, details about the request or declaration, and any necessary signatures.

How to use the Form Tr 104

Using the Form Tr 104 involves several key steps to ensure its proper completion and submission. First, gather all required information, including personal details and any supporting documentation. Next, fill out the form accurately, paying close attention to the instructions provided. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified guidelines, which may include online submission, mailing, or in-person delivery.

Steps to complete the Form Tr 104

Completing the Form Tr 104 requires careful attention to detail. Follow these steps for successful completion:

- Read the instructions thoroughly to understand the requirements.

- Gather necessary documents, such as identification or proof of eligibility.

- Fill in your personal information accurately, ensuring all fields are completed.

- Provide any additional information required by the form.

- Review the form for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form as directed, ensuring you keep a copy for your records.

Legal use of the Form Tr 104

The legal use of the Form Tr 104 is governed by specific regulations and requirements. It is essential to ensure that the form is filled out correctly to maintain its legal validity. This includes providing accurate information and obtaining necessary signatures. Additionally, the form must be submitted within any applicable deadlines to avoid penalties or complications. Understanding the legal implications of the form can help users navigate the process effectively.

Key elements of the Form Tr 104

Key elements of the Form Tr 104 include various sections that capture essential information. Typically, these elements consist of:

- Personal identification information, such as name and address.

- Details regarding the purpose of the form.

- Signature lines for the individual completing the form.

- Any required supporting documentation or evidence.

Each element is crucial for ensuring the form's effectiveness and compliance with legal standards.

Form Submission Methods (Online / Mail / In-Person)

The Form Tr 104 can be submitted through various methods, depending on the requirements set forth by the issuing agency. Common submission methods include:

- Online: Many agencies offer electronic submission options through secure portals.

- Mail: The completed form can be sent via postal service to the designated address.

- In-Person: Some forms may need to be submitted directly at a designated office or agency location.

Choosing the appropriate submission method is important for ensuring timely processing of the form.

Quick guide on how to complete form tr 104 31827642

Complete Form Tr 104 effortlessly on any device

Digital document management has become widespread among organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents promptly without waiting. Manage Form Tr 104 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Form Tr 104 with ease

- Find Form Tr 104 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which only takes moments and carries the same legal significance as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Form Tr 104 and ensure outstanding communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form tr 104 31827642

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form TR 104 and how can it be used?

The form TR 104 is a document used for tax purposes, specifically for certain financial transactions and reporting. With airSlate SignNow, you can easily create, send, and eSign the form TR 104, ensuring compliance with regulations while streamlining your workflow.

-

How much does it cost to eSign form TR 104 using airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. You can start with a free trial to eSign form TR 104 and choose a plan that fits your needs, ensuring you only pay for features that benefit your workflow.

-

What features does airSlate SignNow provide for managing the form TR 104?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows specifically for managing the form TR 104. These tools help you reduce errors and increase efficiency throughout the signing process.

-

Can I integrate airSlate SignNow with other applications while handling form TR 104?

Yes, airSlate SignNow supports various integrations with popular applications like Google Drive, Dropbox, and CRM systems. This functionality allows you to seamlessly manage form TR 104 alongside other business operations, enhancing productivity.

-

What are the benefits of using airSlate SignNow for form TR 104?

Using airSlate SignNow to manage the form TR 104 offers several benefits, including speed, ease of use, and improved security. The platform ensures that your documents are safely stored and can be signed from anywhere, streamlining your document management process.

-

Is it easy to customize the form TR 104 with airSlate SignNow?

Absolutely! airSlate SignNow provides user-friendly tools to easily customize the form TR 104 according to your specific needs. This allows you to adjust fields, add company branding, and ensure that the document meets your requirements effortlessly.

-

How secure is the process of eSigning form TR 104 with airSlate SignNow?

The eSigning process for form TR 104 using airSlate SignNow is highly secure, featuring encryption and compliance with industry standards. Your data is protected, giving you peace of mind when handling sensitive information through our platform.

Get more for Form Tr 104

Find out other Form Tr 104

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document