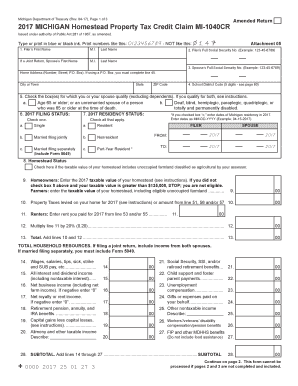

Michigan Homestead Property Tax Credit Claim MI 1040CR Form

What is the Michigan Homestead Property Tax Credit Claim MI 1040CR

The Michigan Homestead Property Tax Credit Claim MI 1040CR is a form designed for Michigan residents to apply for a tax credit on property taxes paid for their primary residence. This credit aims to provide financial relief to homeowners, particularly those with lower incomes or those who are senior citizens. By completing this form, eligible taxpayers can reduce the amount of property tax they owe, which can significantly ease their financial burden.

Eligibility Criteria for the Michigan Homestead Property Tax Credit

To qualify for the Michigan Homestead Property Tax Credit, applicants must meet specific criteria. These include:

- Being a Michigan resident for the tax year in question.

- Owning or renting a primary residence in Michigan.

- Meeting income limits set by the state, which may vary annually.

- Filing the claim within the designated timeframe, typically by the tax filing deadline.

Understanding these eligibility requirements is crucial for ensuring that the claim is valid and accepted.

Steps to Complete the Michigan Homestead Property Tax Credit Claim MI 1040CR

Completing the MI 1040CR form involves several steps to ensure accurate submission:

- Gather necessary documentation, including proof of income, property tax statements, and any other relevant financial information.

- Download or obtain the MI 1040CR form from the Michigan Department of Treasury website or local offices.

- Fill out the form carefully, ensuring all personal and property details are correct.

- Calculate the credit amount based on the instructions provided on the form.

- Review the completed form for accuracy and completeness.

- Submit the form by the appropriate deadline, either electronically or via mail.

Following these steps can help streamline the process and improve the chances of a successful claim.

Required Documents for the Michigan Homestead Property Tax Credit Claim

When filing the MI 1040CR, certain documents are essential to support your claim. These typically include:

- Proof of income, such as W-2 forms or 1099 statements.

- Property tax statements showing the amount paid.

- Any additional documentation that demonstrates eligibility, such as age verification for senior citizens.

Having these documents ready can facilitate a smoother application process and reduce the likelihood of delays.

Form Submission Methods for the Michigan Homestead Property Tax Credit Claim

The MI 1040CR form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Michigan Department of Treasury's e-filing system.

- Mailing the completed form to the appropriate address listed on the form.

- In-person submission at designated local offices or tax assistance centers.

Choosing the right submission method can depend on personal preference and convenience.

Key Elements of the Michigan Homestead Property Tax Credit Claim MI 1040CR

Understanding the key elements of the MI 1040CR form is vital for successful completion. Important components include:

- Personal information section, where taxpayers provide their name, address, and Social Security number.

- Income section, which requires detailed reporting of all sources of income.

- Property information, including the address and tax amount of the primary residence.

- Signature section, where the taxpayer certifies the accuracy of the information provided.

Familiarity with these elements can help ensure that all necessary information is included, reducing the risk of errors.

Quick guide on how to complete 2017 michigan homestead property tax credit claim mi 1040cr

Complete Michigan Homestead Property Tax Credit Claim MI 1040CR effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely archive it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your documents promptly without delays. Manage Michigan Homestead Property Tax Credit Claim MI 1040CR on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest method to edit and eSign Michigan Homestead Property Tax Credit Claim MI 1040CR seamlessly

- Find Michigan Homestead Property Tax Credit Claim MI 1040CR and click Get Form to initiate the process.

- Utilize the tools at your disposal to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose your preferred method to send your form via email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Michigan Homestead Property Tax Credit Claim MI 1040CR to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2017 michigan homestead property tax credit claim mi 1040cr

How to create an eSignature for your 2017 Michigan Homestead Property Tax Credit Claim Mi 1040cr online

How to generate an eSignature for your 2017 Michigan Homestead Property Tax Credit Claim Mi 1040cr in Chrome

How to create an eSignature for signing the 2017 Michigan Homestead Property Tax Credit Claim Mi 1040cr in Gmail

How to create an electronic signature for the 2017 Michigan Homestead Property Tax Credit Claim Mi 1040cr right from your smartphone

How to generate an electronic signature for the 2017 Michigan Homestead Property Tax Credit Claim Mi 1040cr on iOS

How to generate an electronic signature for the 2017 Michigan Homestead Property Tax Credit Claim Mi 1040cr on Android OS

People also ask

-

What is the Michigan Homestead Property Tax Credit Claim MI 1040CR?

The Michigan Homestead Property Tax Credit Claim MI 1040CR is a tax form used by Michigan residents to apply for property tax credits. This credit helps reduce property taxes for eligible homeowners, making housing more affordable. Understanding how to properly fill out this claim can lead to signNow savings.

-

Who is eligible to file the Michigan Homestead Property Tax Credit Claim MI 1040CR?

To be eligible for the Michigan Homestead Property Tax Credit Claim MI 1040CR, you must be a resident of Michigan, occupy your home as your principal residence, and meet certain income thresholds. Additionally, your property must not exceed a specific value to qualify. It's important to check the latest requirements to ensure eligibility.

-

How can airSlate SignNow help with the Michigan Homestead Property Tax Credit Claim MI 1040CR?

airSlate SignNow simplifies the process of completing and submitting the Michigan Homestead Property Tax Credit Claim MI 1040CR by allowing you to easily eSign and send documents online. Our platform is user-friendly and ensures that your tax claims are submitted securely and efficiently. You can track the status of your submissions, reducing the chances of errors.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers a range of features for effective tax document management, including customizable templates, secure eSigning, and real-time tracking. These features make it easier to prepare and submit your Michigan Homestead Property Tax Credit Claim MI 1040CR. Our cloud-based solution ensures that you can access your documents anywhere, anytime.

-

Is there a cost associated with using airSlate SignNow for the Michigan Homestead Property Tax Credit Claim MI 1040CR?

Yes, there is a cost associated with using airSlate SignNow, but our pricing is competitive and offers excellent value for the features provided. We provide different subscription plans to suit various needs, ensuring you can effectively manage your Michigan Homestead Property Tax Credit Claim MI 1040CR without breaking your budget.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, enhancing your workflow. By integrating with these tools, you can streamline the process of preparing your Michigan Homestead Property Tax Credit Claim MI 1040CR, making it easier to manage all aspects of your tax filings.

-

How secure is my information when using airSlate SignNow for the Michigan Homestead Property Tax Credit Claim MI 1040CR?

Security is a top priority at airSlate SignNow. We utilize advanced encryption measures and secure data storage to keep your information safe while you complete your Michigan Homestead Property Tax Credit Claim MI 1040CR. You can confidently eSign and manage your documents, knowing your personal information is protected.

Get more for Michigan Homestead Property Tax Credit Claim MI 1040CR

Find out other Michigan Homestead Property Tax Credit Claim MI 1040CR

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online