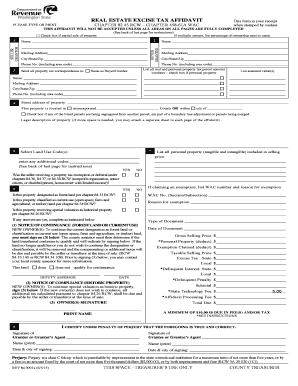

Revenue Form No 84 0001b

What is the Revenue Form No 84 0001b

The Revenue Form No 84 0001b, commonly referred to as the dor form 84 0001b, is a crucial document used in various financial and tax-related processes within the United States. This form is primarily utilized for reporting specific revenue information to state authorities. Understanding its purpose is essential for compliance and accurate reporting, especially for businesses and individuals engaged in activities that require formal revenue disclosure.

How to use the Revenue Form No 84 0001b

Using the Revenue Form No 84 0001b involves several key steps to ensure proper completion and submission. First, gather all necessary information related to your revenue activities. Next, accurately fill out each section of the form, ensuring that all figures and details are correct. Once completed, the form should be submitted according to the guidelines provided by the issuing authority, which may include online submission, mailing, or in-person delivery.

Steps to complete the Revenue Form No 84 0001b

Completing the Revenue Form No 84 0001b requires careful attention to detail. Follow these steps for successful completion:

- Review the form instructions thoroughly to understand each section's requirements.

- Gather supporting documents that provide evidence for the revenue figures reported.

- Fill in your personal or business information accurately in the designated fields.

- Enter revenue amounts and any relevant deductions or credits as applicable.

- Double-check all entries for accuracy and completeness before submission.

Legal use of the Revenue Form No 84 0001b

The legal use of the Revenue Form No 84 0001b is governed by specific regulations that ensure its validity. To be considered legally binding, the form must be completed in accordance with state laws and regulations. This includes providing accurate information and obtaining necessary signatures. Additionally, using a compliant eSignature solution can enhance the legal standing of the form, ensuring it meets requirements set forth by the ESIGN Act and UETA.

Key elements of the Revenue Form No 84 0001b

Several key elements are essential to the Revenue Form No 84 0001b. These include:

- Identification Information: Details about the individual or business submitting the form.

- Revenue Reporting: Accurate figures representing the total revenue for the reporting period.

- Signature Section: Required signatures that validate the information provided.

- Submission Instructions: Guidelines on how and where to submit the completed form.

Form Submission Methods

The Revenue Form No 84 0001b can be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online Submission: Many states offer electronic filing options for convenience.

- Mail: Completed forms can be sent via postal service to the designated office.

- In-Person Submission: Some individuals may prefer to deliver the form directly to the relevant agency.

Quick guide on how to complete revenue form no 84 0001b

Effortlessly prepare Revenue Form No 84 0001b on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Revenue Form No 84 0001b on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to edit and eSign Revenue Form No 84 0001b with ease

- Obtain Revenue Form No 84 0001b and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which only takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your selected device. Edit and eSign Revenue Form No 84 0001b and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the revenue form no 84 0001b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dor form 84 0001b?

The dor form 84 0001b is a specific document used for various administrative processes. It allows users to submit important information to the Department of Revenue efficiently. Understanding this form's requirements is crucial for compliance and avoiding delays.

-

How can airSlate SignNow help with the dor form 84 0001b?

airSlate SignNow streamlines the process of completing and eSigning the dor form 84 0001b. You can easily fill out the form online, ensure that all necessary fields are completed, and send it securely for signatures. This features enhances efficiency and reduces paperwork hassle.

-

Is there a cost associated with using airSlate SignNow for the dor form 84 0001b?

airSlate SignNow offers competitive pricing plans that cater to different needs, whether you're an individual or a business. Signing the dor form 84 0001b through our platform comes at a great value, providing signNow savings on operational costs. Explore our pricing to find a plan that meets your budget.

-

Can I integrate airSlate SignNow with other applications when managing the dor form 84 0001b?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing users to upload, manage, and eSign the dor form 84 0001b efficiently. Our platform can connect with popular tools like Google Drive, Dropbox, and more. This enhances your workflow and simplifies document management.

-

What features does airSlate SignNow offer for the dor form 84 0001b?

With airSlate SignNow, you can benefit from features like customizable templates, text tagging, and document tracking specifically for the dor form 84 0001b. These tools ensure that you complete the form accurately and keep track of its status. Additionally, our user-friendly interface makes navigation easy.

-

How secure is my information when using airSlate SignNow for the dor form 84 0001b?

Security is a top priority at airSlate SignNow. When managing the dor form 84 0001b, your data is protected with advanced encryption methods and compliance with industry standards. You can confidently eSign documents knowing that your sensitive information is safeguarded.

-

What are the benefits of using airSlate SignNow for eSigning the dor form 84 0001b?

Using airSlate SignNow to eSign the dor form 84 0001b offers numerous benefits, including saving time, reducing printing costs, and improving workflow efficiency. The ability to sign documents anytime and anywhere adds flexibility for users. Embrace modern technology for a hassle-free experience.

Get more for Revenue Form No 84 0001b

- 1099 nec form 2021 fill and sign printable template

- Wwwfiskeduwp contentuploadsacademic program declaration or change form office of the

- Formsingovdownloadnumber and street city state and zip code iara

- Registerstategovcontactusus department of state contact us form

- Umh properties application form

- Dermalogica consultation card form

- Mn birth certificate application form

- W 4 withholding form

Find out other Revenue Form No 84 0001b

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form