City of Omaha Restaurant and Drinking Places Occupational Privilege Tax Form

Understanding the City of Omaha Restaurant and Drinking Places Occupational Privilege Tax Form

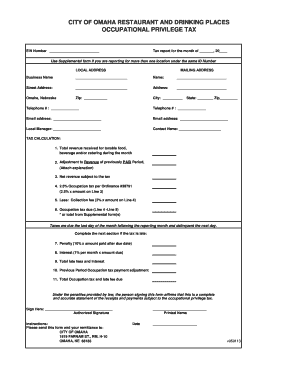

The City of Omaha Restaurant and Drinking Places Occupational Privilege Tax Form is a specific tax document required for businesses operating within the food and beverage sector in Omaha. This form is essential for ensuring compliance with local tax regulations. The tax is levied on establishments that serve food and drinks, contributing to the city's revenue. Understanding this form is crucial for business owners to fulfill their tax obligations and avoid penalties.

Steps to Complete the City of Omaha Restaurant and Drinking Places Occupational Privilege Tax Form

Completing the City of Omaha Restaurant and Drinking Places Occupational Privilege Tax Form involves several key steps:

- Gather necessary information about your business, including the legal name, address, and type of services provided.

- Calculate the appropriate tax amount based on your business's gross receipts from the previous year.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form by the designated deadline, either online or via mail.

How to Obtain the City of Omaha Restaurant and Drinking Places Occupational Privilege Tax Form

The City of Omaha Restaurant and Drinking Places Occupational Privilege Tax Form can be obtained through the official city website or by visiting the local tax office. It is important to ensure you have the most current version of the form to comply with any updates in tax regulations. Additionally, many resources are available online to assist in understanding the requirements associated with this form.

Legal Use of the City of Omaha Restaurant and Drinking Places Occupational Privilege Tax Form

To ensure the legal use of the City of Omaha Restaurant and Drinking Places Occupational Privilege Tax Form, businesses must adhere to specific guidelines. This includes accurately reporting income and paying the correct tax amount. Non-compliance can lead to penalties, including fines and potential legal action. Utilizing a reliable eSignature solution can also help in maintaining the legality of the form by ensuring secure and verified submissions.

Required Documents for the City of Omaha Restaurant and Drinking Places Occupational Privilege Tax Form

When completing the City of Omaha Restaurant and Drinking Places Occupational Privilege Tax Form, certain documents may be required. These typically include:

- Proof of business registration.

- Financial statements or records of gross receipts.

- Identification documents for the business owner or authorized representative.

Having these documents ready can streamline the completion and submission process, ensuring compliance with local tax laws.

Penalties for Non-Compliance with the City of Omaha Restaurant and Drinking Places Occupational Privilege Tax Form

Failure to comply with the requirements of the City of Omaha Restaurant and Drinking Places Occupational Privilege Tax Form can result in significant penalties. These may include:

- Fines imposed by the city.

- Interest on unpaid taxes.

- Potential legal action against the business.

It is crucial for business owners to stay informed about their tax obligations to avoid these consequences.

Quick guide on how to complete city of omaha restaurant and drinking places occupational privilege tax form

Manage City Of Omaha Restaurant And Drinking Places Occupational Privilege Tax Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle City Of Omaha Restaurant And Drinking Places Occupational Privilege Tax Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to edit and eSign City Of Omaha Restaurant And Drinking Places Occupational Privilege Tax Form with minimal effort

- Find City Of Omaha Restaurant And Drinking Places Occupational Privilege Tax Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal significance as a standard handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign City Of Omaha Restaurant And Drinking Places Occupational Privilege Tax Form and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of omaha restaurant and drinking places occupational privilege tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the omaha restaurant tax and how does it affect my business?

The Omaha restaurant tax is a local tax imposed on the sales of food and drinks in restaurants within Omaha. This tax can impact your business's pricing strategies and overall profitability. Understanding this tax is essential for compliance and ensuring you're correctly calculating it in your financial practices.

-

How can airSlate SignNow help manage financial documents related to the omaha restaurant tax?

With airSlate SignNow, you can easily send, sign, and store important documents related to the Omaha restaurant tax. Our platform streamlines the process of managing contracts, tax forms, and payment agreements, ensuring that all your tax-related paperwork is organized and accessible whenever you need it.

-

What are the pricing options for using airSlate SignNow for managing omaha restaurant tax documents?

AirSlate SignNow offers flexible pricing plans to accommodate the needs of all businesses, whether small or large. You can choose a plan that best fits your budget and usage requirements, enabling you to manage your Omaha restaurant tax documents efficiently without breaking the bank.

-

Can airSlate SignNow integrate with other accounting software to track the omaha restaurant tax?

Yes, airSlate SignNow can integrate with various accounting software platforms, making it easy to track and manage the Omaha restaurant tax. By syncing your documents with your preferred accounting tools, you can streamline your tax management and ensure accurate reporting.

-

What features of airSlate SignNow can help me with compliance regarding the omaha restaurant tax?

AirSlate SignNow offers features such as customizable templates, automated reminders, and secure document storage to help you maintain compliance with the Omaha restaurant tax regulations. These tools ensure you never miss important deadlines and that all documents are properly signed and archived.

-

Is it easy to eSign documents related to the omaha restaurant tax using airSlate SignNow?

Absolutely! AirSlate SignNow provides a user-friendly interface that simplifies the eSigning process for documents related to the Omaha restaurant tax. You can quickly send documents for signature and receive them back in a matter of minutes, saving you valuable time.

-

How does airSlate SignNow enhance the overall efficiency of my restaurant business concerning the omaha restaurant tax?

By utilizing airSlate SignNow for managing your documents related to the Omaha restaurant tax, you can reduce administrative burdens and improve workflow efficiency. This platform automates many tasks, allowing you and your employees to focus more on serving customers and less on paperwork.

Get more for City Of Omaha Restaurant And Drinking Places Occupational Privilege Tax Form

- Total number of pages transmitted including cover page form

- Of the stockholders of form

- Employee forms city of wisconsin rapids

- Letter to santa from precocious child form

- Waiver of notice waiver of notice of meeting with sample form

- Form of employment confidential information and

- Landlords consent to assignment form

- Acknowledgement of shipping delay form

Find out other City Of Omaha Restaurant And Drinking Places Occupational Privilege Tax Form

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure