Fannie Mae Income Worksheet 2014-2026

What is the Fannie Mae Income Worksheet

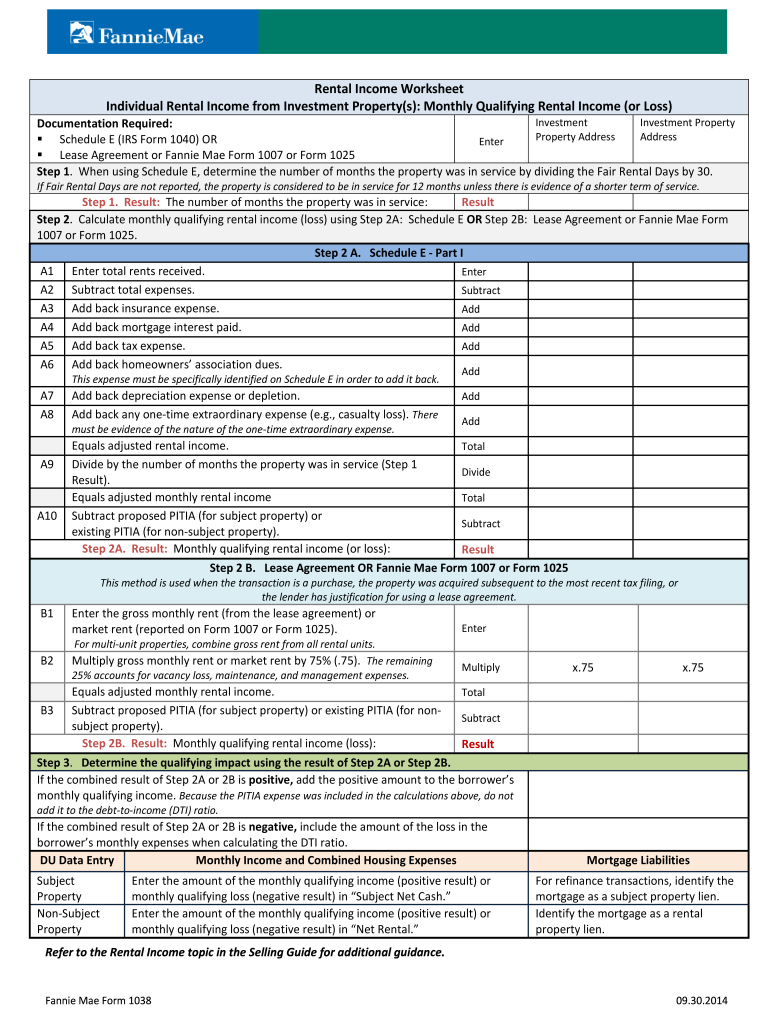

The Fannie Mae Income Worksheet is a crucial document used in the mortgage application process, particularly for assessing the income of borrowers. This worksheet helps lenders evaluate an applicant's financial stability and ability to repay a loan by detailing various income sources. It is specifically designed to comply with Fannie Mae guidelines, ensuring that the income calculations are standardized and reliable. By using this worksheet, lenders can streamline the underwriting process, making it easier to determine eligibility for loan products.

How to use the Fannie Mae Income Worksheet

Utilizing the Fannie Mae Income Worksheet involves several steps to ensure accurate reporting of income. Begin by gathering all necessary financial documents, including pay stubs, tax returns, and any additional income sources. Next, fill out the worksheet by entering your gross monthly income, which includes salary, bonuses, and any other earnings. It is important to categorize income correctly, distinguishing between stable and variable income sources. After completing the worksheet, review it for accuracy and completeness before submitting it to your lender for evaluation.

Key elements of the Fannie Mae Income Worksheet

The Fannie Mae Income Worksheet contains several key elements that are essential for accurate income assessment. These include:

- Gross Monthly Income: The total income before taxes and deductions.

- Income Sources: Detailed sections for various income types, such as employment income, self-employment income, and rental income.

- Documentation Requirements: Specific guidelines on what documents are needed to support the income reported.

- Calculations: Instructions for calculating average income for self-employed individuals or those with variable income.

Steps to complete the Fannie Mae Income Worksheet

Completing the Fannie Mae Income Worksheet involves a systematic approach to ensure all information is accurately captured. Follow these steps:

- Collect all relevant income documentation, including pay stubs, tax returns, and any other sources of income.

- Begin filling out the worksheet by entering your gross monthly income in the designated fields.

- Clearly categorize different income sources, ensuring that stable income is separated from variable income.

- Double-check all entries for accuracy and completeness, ensuring that all necessary documentation is included.

- Submit the completed worksheet to your lender along with your loan application.

Eligibility Criteria

To effectively use the Fannie Mae Income Worksheet, applicants must meet certain eligibility criteria. These typically include:

- Being a legal resident of the United States.

- Having a verifiable source of income.

- Meeting the minimum credit score requirements set by the lender.

- Providing all necessary documentation to support income claims.

Required Documents

When completing the Fannie Mae Income Worksheet, specific documents are required to substantiate the income reported. These documents may include:

- Recent pay stubs covering the last thirty days.

- W-2 forms from the past two years.

- Tax returns for the previous two years, including all schedules.

- Documentation for any additional income sources, such as rental agreements or business financial statements.

Quick guide on how to complete fannie mae income worksheet form

The simplest method to locate and sign Fannie Mae Income Worksheet

At the level of a whole organization, ineffective procedures surrounding document authorization can take up considerable working hours. Signing documents such as Fannie Mae Income Worksheet is an inherent part of operations across any sector, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the company’s overall efficiency. With airSlate SignNow, signing your Fannie Mae Income Worksheet can be as straightforward and rapid as possible. This platform provides you with the latest version of nearly any form. Even better, you can sign it instantly without the necessity of installing external applications on your computer or printing out physical copies.

Steps to obtain and sign your Fannie Mae Income Worksheet

- Browse our collection by category or utilize the search function to locate the document you require.

- Examine the form preview by clicking Learn more to confirm it is the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and include any necessary information using the toolbar.

- Once finished, click the Sign tool to sign your Fannie Mae Income Worksheet.

- Choose the signature method that is most suitable for you: Draw, Create initials, or upload a picture of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options if needed.

With airSlate SignNow, you have everything required to handle your documents efficiently. You can search for, complete, edit, and even send your Fannie Mae Income Worksheet in a single tab without any trouble. Optimize your procedures with one intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do you qualify for a mortgage if you are self-employed (I.e. have founded a startup)?

According to typically underwriting guidelines, you are considered to be self-employed if you own 25% or more of the company. If you own less than 25%, you may be able to qualify just using your salaried income. That being said, assuming you do own more than 25% of your company, you would be subject to additional underwriting criteria specific to self-employed borrowers:Business has been in operations for at least 2 years2 years of W2s and personal tax returns2 years of business tax returnThe underwriter will want to review your business tax returns to make sure that your business is no generating signNow cash flow losses. If you're like most start-ups, your business probably would show cash flow losses. The underwriter would likely deduct an average of cash flow losses from a 2 year average of your W2 income to determine your qualifying income regardless of the fact that you would not be personally responsible for those losses. In effect your qualifying income could be dramatically lower than your actual salary thus creating the difficulty with traditional loan qualification.Although a traditional mortgage might be an issue there are some additional possibilities that you might want to explore: Stated income loanBack before the housing crisis you probably would have been able to qualify with a stated income program but today those programs are hard to come by. There are a few lenders that offer stated income loans today but you would still need to be able to provide the business has been in operation for 2 years and would likely need a 20%-25% down payment. Asset-backed mortgageIf you have substantial assets in the form of liquid investments, you might be able to qualify for an asset-backed mortgage. Basically, your investment account would become additional collateral for the loan. Private mortgageYou might explore a private mortgage. A great place to start would be to ask your current investors in your company. They may be motivated to help you out or have resources that can help in our situation. Given they know your business prospects, they may be willing to structure a mortgage to help you out until your able to qualify for a traditional refinance loan.

-

What is the right way to fill out Two-Earners Worksheet tax form?

Wages, in this context, are what you expect to appear in box 1 of your W-2.The IRS recommends that the additional withholding be applied to the higher-paid spouse and that the lesser-paid spouse should simply claim zero withholding allowances, as this is usually more accurate (due to the way that withholding is actually calculated by payroll programs, you may wind up with less withheld than you want if you split it).

-

How much did we pay to bail out Freddie Mac and Fannie Mae?

Fannie Mae and Freddie Mac were put into conservatorship by the Federal Housing Finance Agency (FHFA) on September 17, 2008. This meant that the two government-sponsored enterprises (GSEs) have been managed by the government since then. The U.S. Treasury Department was authorized to purchase up to $100 billion in the GSEs' preferred stock and mortgage-backed securities (MBS). It was supposed to be temporary, but economic conditions have not improved enough to allow the government to sell the shares it owned and return Fannie and Freddie to private ownership.This was the direct cost. There were also a lot other indirect costs like -$3.9 billion in CDBG grants to help homeowners in poor neighborhoods.Approval for the Treasury Department to buy shares of Fannie's and Freddie's stock to support stock price levels and allow the two to continue to raise capital on the private market.Approval for the Federal Housing Administration (FHA) to guarantee $300 billion in new loans to keep 400,000 homeowners out of foreclosure.About $15 billion in housing tax breaks, including a credit of up to $7,500 for first-time buyers.An increase in the statutory limit on the national debt by $800 billion, to $10.6 trillion.A new regulatory agency to oversee Fannie and Freddie, including executive pay levels.Found this at - What Was the Fannie Mae and Freddie Mac Bailout?

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

For the new 2018 W-4 form, do I also print out the separate A-H worksheet and fill that out for my employer?

No, an employee is not required to give the separate worksheet to the employer. Keep it for your own records.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the fannie mae income worksheet form

How to create an electronic signature for your Fannie Mae Income Worksheet Form in the online mode

How to create an eSignature for your Fannie Mae Income Worksheet Form in Chrome

How to create an eSignature for putting it on the Fannie Mae Income Worksheet Form in Gmail

How to create an eSignature for the Fannie Mae Income Worksheet Form straight from your smart phone

How to make an eSignature for the Fannie Mae Income Worksheet Form on iOS devices

How to make an electronic signature for the Fannie Mae Income Worksheet Form on Android

People also ask

-

What is the mgic income worksheet and how can it benefit my business?

The mgic income worksheet is a tool designed to help you streamline your income calculation process. By using this worksheet, businesses can ensure accuracy and efficiency in their financial assessments. This can ultimately lead to better decision-making and improved financial forecasting for your organization.

-

Is the mgic income worksheet included in airSlate SignNow's pricing plans?

Yes, the mgic income worksheet is part of the comprehensive features offered in airSlate SignNow's pricing plans. Our cost-effective solution provides access to various templates, including the mgic income worksheet, allowing you to maximize your workflow efficiency. You can choose from different plans based on your business needs.

-

Can I customize the mgic income worksheet for my specific needs?

Absolutely! The mgic income worksheet can be easily customized to fit your particular business requirements. With airSlate SignNow, you can modify the template, adding or removing fields as necessary to gather the relevant income data that matters to you. This customization ensures you are collecting the right information at all times.

-

How does airSlate SignNow integrate with other applications for the mgic income worksheet?

AirSlate SignNow offers seamless integrations with various applications, making it easier to work with the mgic income worksheet. You can connect with CRM tools, accounting software, and more to ensure all your data is synchronized. This integration simplifies your workflow and enhances productivity.

-

What features are included with the mgic income worksheet?

The mgic income worksheet includes key features like easy data entry, built-in formulas for automatic calculations, and the ability to eSign documents instantly. These features streamline the income assessment process, reducing the chances of errors and saving you time. With airSlate SignNow, you can manage everything from document creation to signing in one place.

-

Is the mgic income worksheet easy to use for new users?

Yes, the mgic income worksheet is designed with user-friendliness in mind, making it accessible even for those new to financial documentation. With intuitive navigation and straightforward instructions, you can easily get started. Our support team is also available to assist if you encounter any challenges.

-

Can the mgic income worksheet help in preparing for audits?

Definitely! The mgic income worksheet provides a clear and organized method for tracking income, which is beneficial during audits. Having a standardized format aids in maintaining accurate records, making it easier for you to present necessary information during auditing processes. This can also reduce potential discrepancies in your financial reporting.

Get more for Fannie Mae Income Worksheet

- Wv cst 280 form

- Cfra application form

- Scholastic scope is this mountain cursed form

- Dhh form for court

- Marine cargo proposal form

- Taxi subsidy form qld

- California 540 forms amp instructions personal income tax booklet california 540 forms amp instructions personal income tax

- Solved complete the tax return on form 540nr and

Find out other Fannie Mae Income Worksheet

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report