CE 4 Petition for Abatement Validity of Debt Rev 5 13 Kansas Ksrevenue Form

What is the CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas Ksrevenue

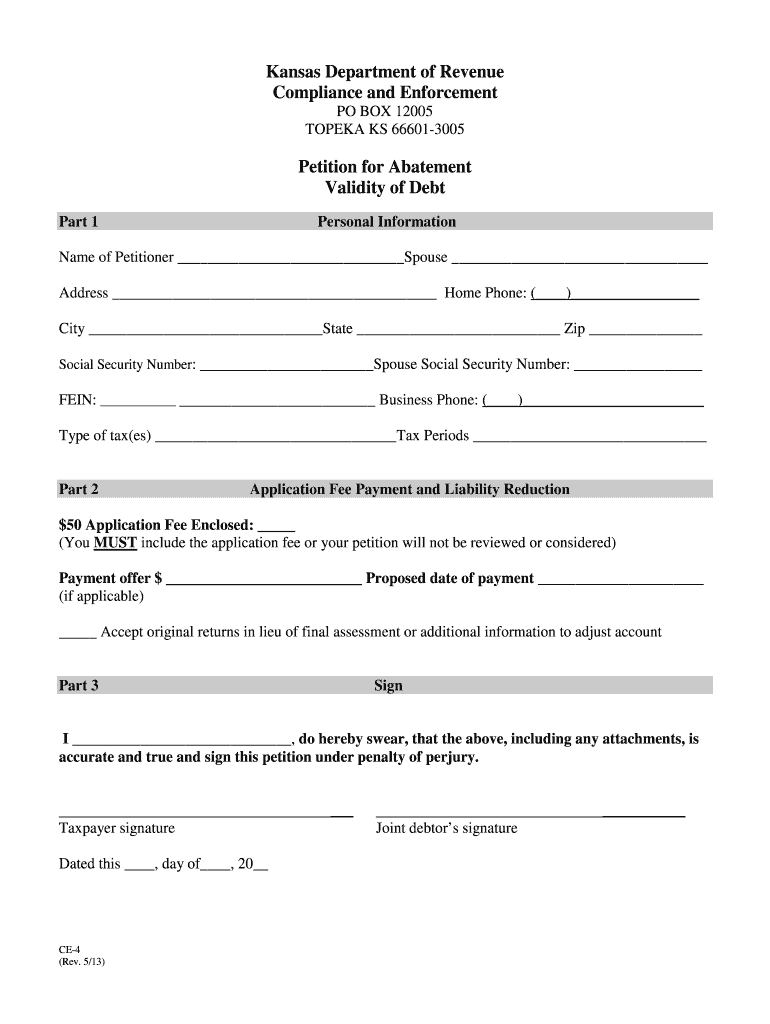

The CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas Ksrevenue is a formal document used in the state of Kansas to contest the validity of a debt. This petition allows individuals or entities to request an abatement, or reduction, of a tax liability based on specific grounds. The form is particularly relevant for those seeking to challenge assessments made by the Kansas Department of Revenue. Understanding the purpose and implications of this petition is essential for effectively navigating tax disputes.

Steps to complete the CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas Ksrevenue

Completing the CE 4 Petition For Abatement requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary documentation that supports your claim, including tax returns and assessment notices.

- Clearly state the reasons for your abatement request, ensuring they align with the legal grounds specified by Kansas tax law.

- Fill out the form accurately, providing all required information, such as your name, address, and tax identification number.

- Review the form for any errors or omissions before submission to avoid delays.

- Submit the completed petition to the appropriate Kansas Department of Revenue office, either electronically or via mail.

Legal use of the CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas Ksrevenue

The legal use of the CE 4 Petition For Abatement is governed by Kansas tax regulations. This form is designed to ensure that taxpayers have a formal avenue to dispute tax liabilities they believe are incorrect. When filed properly, it can lead to a reassessment of the debt in question. It is crucial to adhere to all legal requirements and deadlines to maintain the validity of the petition.

Eligibility Criteria

To file the CE 4 Petition For Abatement, certain eligibility criteria must be met. Generally, the petitioner must be the individual or entity responsible for the tax liability in question. Additionally, the grounds for abatement must be valid under Kansas law, which may include errors in assessment, changes in property value, or other legitimate reasons. It is advisable to consult with a tax professional if there are uncertainties regarding eligibility.

Form Submission Methods

The CE 4 Petition For Abatement can be submitted through various methods. Taxpayers have the option to file the form online via the Kansas Department of Revenue’s electronic filing system, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate office or delivered in person. Each submission method has specific guidelines and deadlines that must be followed to ensure timely processing.

Required Documents

When submitting the CE 4 Petition For Abatement, it is essential to include all required documents to support your case. These may include:

- Copies of tax returns related to the debt.

- Assessment notices from the Kansas Department of Revenue.

- Any additional documentation that substantiates your claim for abatement.

Ensuring that all relevant documents are attached will enhance the likelihood of a favorable outcome.

Quick guide on how to complete ce 4 petition for abatement validity of debt rev 5 13 kansas ksrevenue

Effortlessly Prepare CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas Ksrevenue on Any Device

The management of documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, enabling you to obtain the right format and safely store it in the cloud. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Manage CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas Ksrevenue on any device through the airSlate SignNow applications on Android or iOS and simplify any document-related task today.

Effortlessly Modify and eSign CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas Ksrevenue

- Find CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas Ksrevenue and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information, then click on the Done button to save your changes.

- Choose how you wish to send your form — via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced papers, frustrating form searches, or errors that necessitate reprinting documents. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and eSign CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas Ksrevenue while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ce 4 petition for abatement validity of debt rev 5 13 kansas ksrevenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas KSrevenue?

The CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas KSrevenue is a legal document used in Kansas to challenge the validity of a debt. This petition aims to provide a formal request to the Kansas revenue authorities, allowing individuals to dispute debts they believe are unjust or invalid. Utilizing airSlate SignNow can streamline this process by allowing users to easily create, send, and eSign this important document.

-

How much does it cost to use airSlate SignNow for filing the CE 4 Petition For Abatement Validity Of Debt?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including the ability to file the CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas KSrevenue. Users can choose from monthly or annual subscriptions, which provide access to unlimited document sends and eSignatures at an affordable price. The cost-effectiveness of the platform ensures that you can efficiently manage your legal documents without exceeding your budget.

-

What features does airSlate SignNow offer to support the CE 4 Petition For Abatement Validity Of Debt process?

airSlate SignNow includes robust features that facilitate the preparation and filing of the CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas KSrevenue. Users can take advantage of customizable templates, document editing tools, and secure eSigning capabilities. These features make it easier to ensure that your petition is completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with other applications while preparing the CE 4 Petition For Abatement Validity Of Debt?

Yes, airSlate SignNow offers seamless integrations with various applications such as Google Drive, Dropbox, and CRM systems. These integrations allow users to easily import and manage documents required for the CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas KSrevenue. This level of connectivity enhances workflow efficiency and ensures that all relevant information is readily accessible.

-

How can airSlate SignNow help me track the status of my CE 4 Petition For Abatement Validity Of Debt?

airSlate SignNow provides real-time tracking for all documents sent through the platform, including the CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas KSrevenue. Users receive notifications when their documents are viewed and signed, ensuring transparency throughout the process. This tracking feature helps you stay informed and follow up as needed to ensure your petition is handled promptly.

-

Is airSlate SignNow secure for submitting the CE 4 Petition For Abatement Validity Of Debt?

Absolutely. airSlate SignNow takes data security seriously, applying rigorous measures to protect your documents, including the CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas KSrevenue. The platform employs advanced encryption protocols and complies with industry standards to ensure that your sensitive information remains confidential and secure during the eSigning process.

-

What benefits does eSigning the CE 4 Petition For Abatement Validity Of Debt provide?

eSigning the CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas KSrevenue simplifies the submission process and enhances efficiency. By using airSlate SignNow, you can quickly gather signatures and submit your petition without the delays associated with traditional paper methods. Moreover, eSigning is legally recognized in Kansas, ensuring that your petition holds up in legal proceedings.

Get more for CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas Ksrevenue

- Form of amended and restated operating secgov

- Complaint for ejectment pinellas county clerk form

- What does co mean on property deed example john doe co jane form

- Enclosed herewith please find copies of additional documents relative to the settlement with form

- Letter to reschedule an event apologetic form

- Affidavitloss of certificate of title to vehicle form

- Stop payment notice by subcontractor to the holder of construction project funds form

- South carolina legislature mobile form

Find out other CE 4 Petition For Abatement Validity Of Debt Rev 5 13 Kansas Ksrevenue

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization