Indiana W4 Form

What is the Indiana W-4 Form

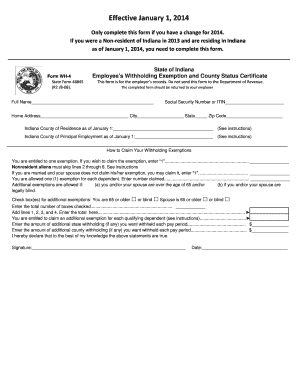

The Indiana W-4 form, officially known as the Indiana State Withholding Form, is a crucial document used by employees to inform their employers about the amount of state income tax to withhold from their paychecks. This form is essential for ensuring that the correct amount of taxes is deducted, helping to avoid underpayment or overpayment of state taxes. By completing the Indiana W-4, employees can specify their filing status, the number of allowances they are claiming, and any additional withholding amounts they wish to apply.

Steps to Complete the Indiana W-4 Form

Completing the Indiana W-4 form involves a few straightforward steps:

- Obtain the form: Download the Indiana W-4 form from the official state website or request a copy from your employer.

- Fill in personal information: Provide your name, address, and Social Security number at the top of the form.

- Select your filing status: Indicate whether you are single, married, or head of household.

- Claim allowances: Use the worksheet provided to determine the number of allowances you can claim based on your personal and financial situation.

- Additional withholding: If you wish to have extra amounts withheld, specify this in the appropriate section.

- Sign and date: Ensure you sign and date the form to validate it before submitting it to your employer.

Legal Use of the Indiana W-4 Form

The Indiana W-4 form is legally binding when filled out correctly and submitted to your employer. It complies with state tax laws, ensuring that the withholding amounts reflect your financial situation accurately. Employers are required to maintain this form on file for their records and to use it for calculating the appropriate withholding amounts. Proper completion of the form helps prevent issues with the Indiana Department of Revenue regarding tax liabilities.

How to Obtain the Indiana W-4 Form

To obtain the Indiana W-4 form, you can visit the official Indiana Department of Revenue website, where the form is available for download. Additionally, employers often provide copies of the form to new employees during the onboarding process. If you prefer a physical copy, you may request one directly from your employer or print it from the website for personal use.

Key Elements of the Indiana W-4 Form

Several key elements are included in the Indiana W-4 form that are essential for accurate tax withholding:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Allowances: The number of allowances claimed, which affects the withholding amount.

- Additional Withholding: An option to specify any extra amount to be withheld from each paycheck.

- Signature and Date: Required to validate the form.

Form Submission Methods

Once you have completed the Indiana W-4 form, you can submit it to your employer through various methods:

- In-Person: Hand the completed form directly to your HR or payroll department.

- By Mail: If your employer allows it, you may send the form via postal mail.

- Electronically: Some employers may accept electronic submissions, allowing you to send the form via email or an online portal.

Quick guide on how to complete indiana w4 form

Complete Indiana W4 Form effortlessly on any gadget

Online document management has surged in popularity among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to find the right template and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage Indiana W4 Form on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest method to modify and eSign Indiana W4 Form with ease

- Find Indiana W4 Form and click Get Form to begin.

- Utilize the features we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for such tasks.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form—via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worry about lost or misplaced paperwork, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management demands with just a few clicks from any device you choose. Modify and eSign Indiana W4 Form to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana w4 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the w 4 indiana form and why is it important?

The w 4 indiana form is essential for Indiana employees to communicate their tax withholding preferences to their employers. Completing this form correctly ensures accurate tax deductions from your paycheck, helping you manage your finances effectively and avoid underpayment penalties.

-

How can airSlate SignNow streamline the process of filling out the w 4 indiana?

airSlate SignNow allows users to easily create, fill out, and eSign the w 4 indiana electronically. This convenient solution saves time compared to paper forms and ensures that all information is accurately captured and securely stored.

-

Is there a cost associated with using airSlate SignNow for the w 4 indiana?

airSlate SignNow offers a range of pricing plans, allowing you to choose one that fits your budget while providing full access to eSigning tools for w 4 indiana forms. With options for businesses of all sizes, you’ll find a cost-effective solution to streamline document workflows.

-

What features does airSlate SignNow offer for managing the w 4 indiana?

AirSlate SignNow provides features such as customizable templates, real-time tracking, and automated reminders for the w 4 indiana. These tools help ensure that all necessary documents are completed and signed on time, enhancing overall operational efficiency.

-

Can airSlate SignNow integrate with other software when managing the w 4 indiana?

Yes, airSlate SignNow seamlessly integrates with numerous applications, allowing you to manage your w 4 indiana forms alongside your other business tools. This streamlining of workflows can signNowly enhance productivity and collaboration within your team.

-

What are the benefits of using airSlate SignNow for the w 4 indiana over traditional methods?

Using airSlate SignNow for the w 4 indiana offers numerous advantages including reduced processing time, enhanced security with encrypted signatures, and the ability to access documents remotely. These benefits lead to smoother operations and a better experience for both employers and employees.

-

How secure is the data processed with the w 4 indiana on airSlate SignNow?

AirSlate SignNow prioritizes the security of your documents, employing advanced encryption protocols to protect your w 4 indiana forms. This ensures that sensitive information remains confidential and reduces the risk of data bsignNowes.

Get more for Indiana W4 Form

- Bill of sale form unimproved property contract templates

- Texas real estate commission residential sales contract form

- Trec no 28 2 environmental assessment addendum form

- Addendum for abstract of title form

- Notice not for use where seller owns fee simple title to land beneath unit form

- Fha or va financed residential condominium contract form

- Trec no 32 4 condominium resale certificate texasgov form

- One to four family residential contract resale williamson form

Find out other Indiana W4 Form

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online