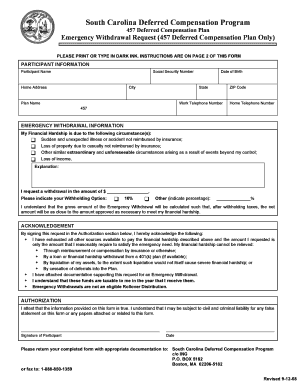

Sc Deferred Comp Form

What is the SC Deferred Comp?

The SC Deferred Comp, or South Carolina Deferred Compensation Plan, is a retirement savings program designed for state employees. It allows participants to set aside a portion of their income on a pre-tax basis, which can help reduce their taxable income while saving for retirement. This plan is similar to a 401(k) but is specifically tailored for government employees in South Carolina. Contributions can be invested in various options, providing flexibility in how participants grow their savings over time.

Steps to Complete the SC Deferred Comp

Completing the SC Deferred Comp involves several key steps to ensure proper enrollment and compliance. First, individuals must review the plan details, including contribution limits and investment options. Next, participants need to fill out the SC Deferred Compensation Withdrawal Form, providing necessary personal information and specifying the amount to withdraw. It is essential to double-check all entries for accuracy before submission. Finally, participants can submit the form electronically through a secure platform, ensuring that all information is transmitted safely and in compliance with legal standards.

Legal Use of the SC Deferred Comp

The SC Deferred Comp is governed by specific legal frameworks that ensure its validity and compliance with federal and state laws. The plan adheres to the Employee Retirement Income Security Act (ERISA) guidelines, which regulate retirement plans in the United States. Additionally, electronic signatures are recognized under the ESIGN and UETA laws, validating the use of digital platforms for completing forms. Participants should ensure that they follow all legal requirements to maintain the integrity of their deferred compensation plan.

Required Documents

To successfully complete the SC Deferred Compensation Withdrawal Form, certain documents are required. Participants must provide valid identification, such as a driver's license or state ID, along with proof of employment with the state. Additionally, any previous withdrawal requests or related documentation may be necessary to process the current request. Having these documents ready can streamline the submission process and help avoid delays.

Eligibility Criteria

Eligibility for the SC Deferred Comp is primarily limited to state employees and certain governmental units in South Carolina. Participants must be actively employed to contribute to the plan. Additionally, there may be age and service requirements that determine the ability to withdraw funds. Understanding these criteria is crucial for potential participants to ensure they meet the necessary qualifications for enrollment and withdrawals.

Form Submission Methods

Participants can submit the SC Deferred Compensation Withdrawal Form through various methods, ensuring convenience and flexibility. The primary method is online submission via a secure digital platform, which allows for immediate processing. Alternatively, individuals may opt to mail the completed form to the designated office or submit it in person at a local government office. Each method has its own processing times and requirements, so participants should choose the one that best fits their needs.

Quick guide on how to complete sc deferred comp

Prepare Sc Deferred Comp seamlessly on any device

Online document management has gained traction with companies and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without interruptions. Handle Sc Deferred Comp on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Sc Deferred Comp with ease

- Find Sc Deferred Comp and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, an invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Edit and eSign Sc Deferred Comp and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc deferred comp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SC deferred comp and how does it work?

SC deferred comp, or South Carolina deferred compensation, is a retirement savings plan that allows employees to defer a portion of their salary for tax-free growth. By participating in an SC deferred comp plan, employees can effectively save for retirement while enjoying potential tax benefits. This strategy helps individuals build a nest egg while deferring taxes until withdrawal.

-

What are the benefits of using an SC deferred comp plan?

Utilizing an SC deferred comp plan provides signNow benefits such as tax deferral, increased retirement savings, and potential employer matching contributions. It enables employees to manage their finances more effectively and potentially reduces their taxable income in the current tax year. An SC deferred comp plan is a powerful tool for enhancing retirement security.

-

How do I enroll in an SC deferred comp plan?

Enrolling in an SC deferred comp plan typically involves contacting your HR department for specific guidelines. Most employers provide an easy-to-use online platform to complete your enrollment. Ensuring that you understand the parameters of the plan, including contribution limits and investment options, is important for maximizing your benefits.

-

What are the contribution limits for SC deferred comp plans?

The contribution limits for SC deferred comp plans may vary yearly, but the IRS sets an annual limit for elective deferrals. For 2023, the limit is $22,500, with an additional catch-up contribution allowed for those aged 50 and above. It's essential to verify these limits with your plan provider to ensure compliance and maximize your savings.

-

Can I change my contributions to the SC deferred comp plan?

Yes, most SC deferred comp plans allow participants to adjust their contributions at any time, subject to the plan's specific rules. Flexible contribution options enable employees to adapt their savings plans based on changing financial circumstances. Always consult your benefits administrator for the procedure to make adjustments to your contributions.

-

What investment options are available under the SC deferred comp plan?

Investment options in an SC deferred comp plan can vary widely, including mutual funds, bond funds, and stable value funds. Participants can typically allocate their contributions among a selection of pre-approved investment vehicles, allowing them to customize their risk and return profiles. It's crucial to review your plan's investment options to align with your retirement goals.

-

How does the SC deferred comp plan affect my taxes?

Participating in an SC deferred comp plan allows you to defer income taxes on the amount you contribute, which means it can lower your taxable income for the year. Taxes are applied when you withdraw funds during retirement, potentially when you are in a lower tax bracket. Understanding the tax implications is essential when strategizing for long-term savings.

Get more for Sc Deferred Comp

Find out other Sc Deferred Comp

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney