Indian Income Tax Return Verification Form K S D & Associates

What is the Indian Income Tax Return Verification Form K S D & Associates

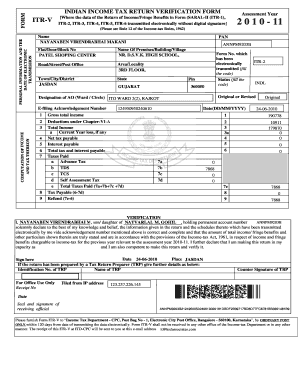

The Indian Income Tax Return Verification Form K S D & Associates is a crucial document for individuals and businesses filing their income tax returns in India. This form serves as a declaration that the information provided in the income tax return is accurate and complete. It is essential for verifying the authenticity of the submitted tax return and is often required by tax authorities for compliance purposes. The form ensures that taxpayers affirm their financial details, which can include income sources, deductions, and tax liabilities.

Steps to complete the Indian Income Tax Return Verification Form K S D & Associates

Completing the Indian Income Tax Return Verification Form K S D & Associates involves several key steps:

- Gather necessary documents, such as your income tax return, proof of income, and any relevant deductions.

- Fill in personal details, including your name, address, and PAN (Permanent Account Number).

- Review the details of your income tax return to ensure accuracy.

- Sign the form electronically or manually, depending on the submission method.

- Submit the completed form to the relevant tax authority or through the designated online portal.

Legal use of the Indian Income Tax Return Verification Form K S D & Associates

The legal validity of the Indian Income Tax Return Verification Form K S D & Associates hinges on its compliance with applicable laws and regulations. This form must be filled out accurately and submitted within the stipulated deadlines to avoid penalties. E-signatures are recognized as legally binding under U.S. laws, provided that they meet specific criteria. Utilizing a trusted electronic signature platform ensures that the form is completed securely and in accordance with legal standards.

Key elements of the Indian Income Tax Return Verification Form K S D & Associates

Several key elements must be included in the Indian Income Tax Return Verification Form K S D & Associates to ensure its completeness:

- Taxpayer Information: Personal details such as name, address, and PAN.

- Income Details: A summary of all income sources reported in the tax return.

- Deductions Claimed: Information on any deductions or exemptions claimed.

- Declaration Statement: A statement affirming the accuracy of the information provided.

- Signature: An electronic or handwritten signature to validate the form.

How to use the Indian Income Tax Return Verification Form K S D & Associates

Using the Indian Income Tax Return Verification Form K S D & Associates is a straightforward process. First, ensure that you have completed your income tax return accurately. Next, access the verification form, either online or in a printable format. Fill out the required fields, ensuring all information matches your tax return. Once completed, sign the form and submit it according to the guidelines provided by the tax authority. It is advisable to keep a copy for your records.

Form Submission Methods (Online / Mail / In-Person)

The Indian Income Tax Return Verification Form K S D & Associates can be submitted through various methods:

- Online Submission: Many tax authorities offer an online portal for electronic submission.

- Mail: You can print the completed form and send it via postal mail to the designated tax office.

- In-Person: Some individuals may choose to submit the form in person at their local tax office.

Quick guide on how to complete indian income tax return verification form k s d ampamp associates

Easily Prepare Indian Income Tax Return Verification Form K S D & Associates on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents rapidly without delays. Manage Indian Income Tax Return Verification Form K S D & Associates on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Modify and eSign Indian Income Tax Return Verification Form K S D & Associates Effortlessly

- Find Indian Income Tax Return Verification Form K S D & Associates and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Alter and eSign Indian Income Tax Return Verification Form K S D & Associates and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indian income tax return verification form k s d ampamp associates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indian Income Tax Return Verification Form K S D & Associates?

The Indian Income Tax Return Verification Form K S D & Associates is a crucial document used for verifying the correctness of your income tax return. This form ensures that your returns are accurately processed and compliant with tax regulations. It's essential for individuals and businesses looking to avoid penalties and maintain proper filing standards.

-

How can I obtain the Indian Income Tax Return Verification Form K S D & Associates?

You can easily obtain the Indian Income Tax Return Verification Form K S D & Associates through our platform at airSlate SignNow. We provide a user-friendly interface that simplifies the process of accessing necessary tax forms. Simply sign up to our service, and you'll have access to the document in no time.

-

What are the benefits of using the Indian Income Tax Return Verification Form K S D & Associates?

Using the Indian Income Tax Return Verification Form K S D & Associates allows you to ensure accuracy in your tax filings and reduce the chances of errors that could lead to penalties. Additionally, it helps streamline the verification process, making it easier for both individuals and small businesses to manage their tax compliance efficiently.

-

Is there a cost associated with the Indian Income Tax Return Verification Form K S D & Associates?

Yes, there is a nominal fee for accessing the Indian Income Tax Return Verification Form K S D & Associates through airSlate SignNow. We offer competitive pricing tailored to fit the needs of individuals and small businesses. Investing in this form can save you money in the long run by ensuring compliance and avoiding potential fines.

-

Can the Indian Income Tax Return Verification Form K S D & Associates be integrated with other tools?

Absolutely! The Indian Income Tax Return Verification Form K S D & Associates can be seamlessly integrated with various accounting and financial software available on our platform. This integration simplifies the tax filing process and enhances the overall efficiency of managing your financial documents.

-

How does airSlate SignNow ensure the security of the Indian Income Tax Return Verification Form K S D & Associates?

At airSlate SignNow, we prioritize the security of your documents, including the Indian Income Tax Return Verification Form K S D & Associates. We implement advanced encryption protocols and data protection mechanisms to safeguard your sensitive information. You can trust us to keep your tax documents secure and confidential.

-

What features does airSlate SignNow offer for the Indian Income Tax Return Verification Form K S D & Associates?

airSlate SignNow offers several features for the Indian Income Tax Return Verification Form K S D & Associates, including eSigning capabilities, document tracking, and customizable templates. These features are designed to enhance the usability of the form and provide a streamlined experience for our users. You'll find it easy to manage and send your tax documents electronically.

Get more for Indian Income Tax Return Verification Form K S D & Associates

- Shopping center lease agreement dcg development form

- Government congratulate a politician on an election form

- Ask alumni for donations to their alma mater form

- Title 13 b 406 powers of incorporators organizational form

- Persuasion it is all about the timelineellwood evidence inc form

- Exhibit 101 unanimous written consent of board of directors form

- Accept an honor form

- K1336exclusive right to sell listing agreement nvarcom form

Find out other Indian Income Tax Return Verification Form K S D & Associates

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT