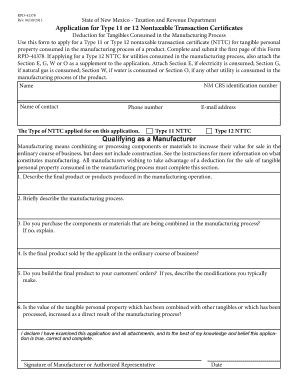

RPD 41378 State of New Mexico Form

What is the RPD 41378 State Of New Mexico

The RPD 41378 State Of New Mexico form is a specific document used for reporting certain tax-related information in New Mexico. This form is primarily associated with property tax assessments and is essential for individuals and businesses that own property within the state. It helps the New Mexico Taxation and Revenue Department collect accurate data to determine property values and tax liabilities.

How to use the RPD 41378 State Of New Mexico

Using the RPD 41378 State Of New Mexico form involves several steps. First, individuals or businesses must gather the necessary information regarding their property, including its location, size, and any improvements made. Once the data is collected, users can fill out the form either digitally or on paper. After completing the form, it should be submitted to the appropriate local tax authority for processing. Ensuring accuracy in the information provided is crucial, as it directly impacts property tax assessments.

Steps to complete the RPD 41378 State Of New Mexico

Completing the RPD 41378 State Of New Mexico form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant property information, including location, size, and improvements.

- Access the RPD 41378 form, either online or in a physical format.

- Fill out the form with accurate details, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the completed form to your local tax authority by the specified deadline.

Legal use of the RPD 41378 State Of New Mexico

The RPD 41378 State Of New Mexico form is legally binding when filled out and submitted correctly. It must comply with state regulations regarding property taxation. This includes providing truthful and accurate information, as any discrepancies can lead to penalties or legal consequences. Using a reliable electronic signature solution can enhance the legal validity of the form when submitted online.

Key elements of the RPD 41378 State Of New Mexico

Key elements of the RPD 41378 form include:

- Property identification details, such as address and parcel number.

- Description of property type and usage.

- Information on any improvements or changes made to the property.

- Owner's contact information and signature.

Form Submission Methods (Online / Mail / In-Person)

The RPD 41378 State Of New Mexico form can be submitted through various methods, depending on the preferences of the user. Options include:

- Online submission via the New Mexico Taxation and Revenue Department's website.

- Mailing a physical copy to the local tax authority.

- In-person submission at designated tax offices within the state.

Quick guide on how to complete rpd 41378 state of new mexico

Complete RPD 41378 State Of New Mexico seamlessly on any device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and store it securely online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle RPD 41378 State Of New Mexico on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign RPD 41378 State Of New Mexico effortlessly

- Locate RPD 41378 State Of New Mexico and click Get Form to begin.

- Make use of the tools provided to complete your form.

- Emphasize pertinent sections of the document or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information thoroughly and click on the Done button to finalize your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that require new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign RPD 41378 State Of New Mexico while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rpd 41378 state of new mexico

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is RPD 41378 State Of New Mexico?

RPD 41378 State Of New Mexico is a specific regulation concerning document compliance and eSignatures. It outlines the requirements for electronic signatures in New Mexico, ensuring that businesses meet legal standards. Understanding this regulation can help organizations streamline their document processes efficiently.

-

How can airSlate SignNow help with RPD 41378 State Of New Mexico compliance?

airSlate SignNow provides a robust platform that complies with RPD 41378 State Of New Mexico by ensuring that electronic signatures are legally binding. Our software meets the necessary security and compliance standards, giving users peace of mind when sending documents for eSigning. By using our solution, businesses can confidently adhere to state regulations.

-

What pricing plans are available for airSlate SignNow regarding RPD 41378 State Of New Mexico?

airSlate SignNow offers various pricing plans tailored to meet your needs, starting at competitive rates. Each plan includes features that support compliance with RPD 41378 State Of New Mexico, making it affordable for small and large businesses alike. Choosing the right plan can enhance your document management processes without breaking the bank.

-

What features does airSlate SignNow offer for RPD 41378 State Of New Mexico users?

Key features of airSlate SignNow for users dealing with RPD 41378 State Of New Mexico include customizable templates, automated workflows, and real-time tracking of document status. These features streamline the signing process and enhance productivity, allowing businesses to focus on their core activities. Additionally, we offer dedicated support for users navigating compliance requirements.

-

Can I integrate airSlate SignNow with other applications for managing RPD 41378 State Of New Mexico documents?

Yes, airSlate SignNow seamlessly integrates with various popular applications to facilitate the management of RPD 41378 State Of New Mexico documents. Our platform supports integrations with productivity tools, cloud storage solutions, and CRM systems, allowing for a smooth workflow. This versatility ensures that users can manage their documents efficiently across platforms.

-

What are the benefits of using airSlate SignNow for RPD 41378 State Of New Mexico transactions?

Using airSlate SignNow for RPD 41378 State Of New Mexico transactions offers numerous benefits such as enhanced efficiency, reduced paper usage, and improved compliance with state regulations. Our user-friendly interface makes it simple to eSign documents, saving businesses time and resources. Furthermore, it provides a secure environment for sensitive information.

-

Is training available for new users of airSlate SignNow focused on RPD 41378 State Of New Mexico?

Absolutely! airSlate SignNow offers comprehensive training and resources for new users focusing on RPD 41378 State Of New Mexico compliance. Our tutorials, webinars, and customer support are designed to help users navigate the platform effectively. This ensures that you can maximize the benefits of our solutions right from the start.

Get more for RPD 41378 State Of New Mexico

Find out other RPD 41378 State Of New Mexico

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document