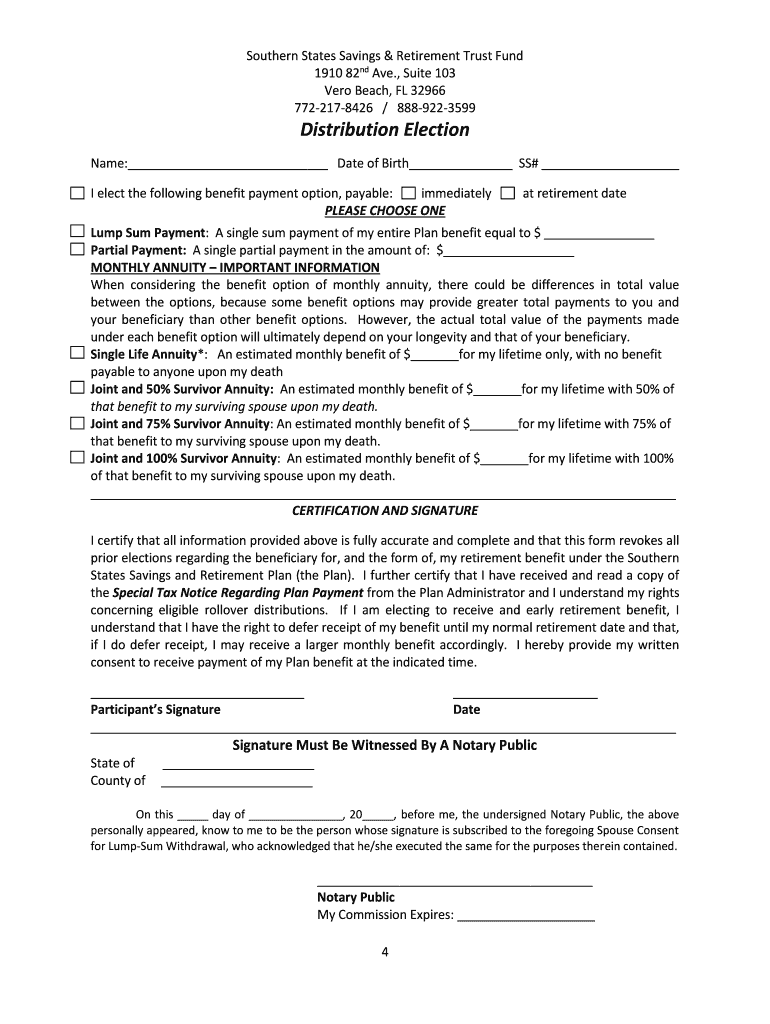

Southern States Savings and Retirement Trust Fund Form

What is the Southern States Savings And Retirement Trust Fund

The Southern States Savings and Retirement Trust Fund is a financial vehicle designed to help individuals save for retirement while providing certain tax advantages. This fund typically allows participants to contribute a portion of their income, which can grow over time through various investment options. The fund is particularly beneficial for employees in the southern states, offering a structured approach to saving for retirement, ensuring financial security in later years.

Steps to complete the Southern States Savings And Retirement Trust Fund

Completing the Southern States Savings and Retirement Trust Fund involves several key steps:

- Gather necessary personal information, including Social Security number and employment details.

- Review the fund's terms and conditions to understand contribution limits and withdrawal options.

- Fill out the required application form, ensuring all information is accurate and complete.

- Submit the application electronically or via mail, depending on the submission options provided by the fund.

- Keep a copy of the submitted documents for your records.

Eligibility Criteria

To participate in the Southern States Savings and Retirement Trust Fund, individuals typically need to meet specific eligibility criteria. These may include:

- Being employed by a participating employer in one of the southern states.

- Meeting age requirements, often set at eighteen years or older.

- Agreeing to the terms and conditions set forth by the fund.

Required Documents

When applying for the Southern States Savings and Retirement Trust Fund, certain documents are necessary to complete the process. Commonly required documents include:

- Proof of identity, such as a driver's license or passport.

- Social Security card or number.

- Employment verification, which may include recent pay stubs or an employment letter.

Legal use of the Southern States Savings And Retirement Trust Fund

The Southern States Savings and Retirement Trust Fund must be used in compliance with federal and state regulations. This includes adhering to contribution limits and withdrawal rules established by the Internal Revenue Service (IRS). Participants should be aware of the legal implications of early withdrawals, which may incur penalties and tax liabilities.

Form Submission Methods (Online / Mail / In-Person)

Participants can submit their applications for the Southern States Savings and Retirement Trust Fund through various methods:

- Online: Many funds allow for electronic submissions through secure online portals.

- Mail: Applicants can print the application form and send it via postal service to the designated address.

- In-Person: Some individuals may choose to submit their applications directly at their employer's HR department or the fund's office.

Quick guide on how to complete southern states savings and retirement trust fund

Easily set up Southern States Savings And Retirement Trust Fund on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly and without holdups. Handle Southern States Savings And Retirement Trust Fund on any device with the airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

How to modify and electronically sign Southern States Savings And Retirement Trust Fund effortlessly

- Obtain Southern States Savings And Retirement Trust Fund and select Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form: via email, SMS, or a shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Southern States Savings And Retirement Trust Fund to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the southern states savings and retirement trust fund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the southern states savings and retirement trust fund withdrawal process?

The southern states savings and retirement trust fund withdrawal process involves submitting a request through our platform. Users will need to provide necessary documentation to ensure a smooth processing of their withdrawal. Once submitted, the processing team will review and expedite the request as quickly as possible.

-

Are there any fees associated with southern states savings and retirement trust fund withdrawal?

Yes, there may be nominal fees associated with managing withdrawals from the southern states savings and retirement trust fund. It is essential to review our pricing page for detailed information about any applicable fees. Transparency is key, and we strive to make the withdrawal process as cost-effective as possible.

-

How long does it take to process a southern states savings and retirement trust fund withdrawal?

Typically, a southern states savings and retirement trust fund withdrawal may take between 5 to 10 business days for processing. However, timeframes can vary based on the completeness of your documentation and the current workload of our processing team. We recommend submitting your request as early as possible to avoid delays.

-

What features does airSlate SignNow offer for handling withdrawals?

airSlate SignNow provides a user-friendly interface that simplifies the southern states savings and retirement trust fund withdrawal process. Key features include eSignature capabilities, document templates, and real-time tracking for your withdrawal requests. This ensures you stay informed throughout the entire process.

-

Can I integrate airSlate SignNow with other financial tools for managing withdrawals?

Absolutely! airSlate SignNow offers seamless integrations with various financial tools to facilitate the southern states savings and retirement trust fund withdrawal process. Our integrations are designed to enhance your workflow, making it easier to manage documents and transactions from a centralized platform.

-

What benefits do I gain by using airSlate SignNow for my southern states savings and retirement trust fund withdrawal?

Using airSlate SignNow for your southern states savings and retirement trust fund withdrawal ensures a faster, secure, and more efficient process. Our platform allows you to handle all documents electronically, reducing paperwork and saving time. Additionally, you can track your requests at any time, providing peace of mind during your financial transactions.

-

Is there customer support available for issues related to southern states savings and retirement trust fund withdrawal?

Yes, airSlate SignNow offers reliable customer support to assist with any issues related to your southern states savings and retirement trust fund withdrawal. You can signNow out to our support team via chat, email, or phone for timely help with your inquiries. We want to ensure your experience is as smooth as possible.

Get more for Southern States Savings And Retirement Trust Fund

- Cipc changes to the company authorised shares form

- Partial satisfaction of child support judgment form

- Bidder certification cec form 50 los angeles world airports lawa

- Lnesg2 study guidelines for the treatment of chped form

- Doc4000 form

- Undertale download chromebook form

- Karya siddhi hanuman temple calendar pdf form

- Polimas kejuruteraan elektrik dan elektronik program form

Find out other Southern States Savings And Retirement Trust Fund

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed