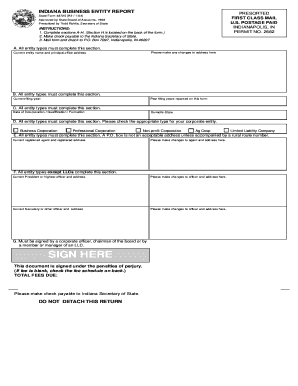

INDIANA BUSINESS ENTITY REPORT FormSend

What is the Indiana Business Entity Report?

The Indiana Business Entity Report is a crucial document required by the Indiana Secretary of State for all registered business entities in the state. This report provides essential information about the business, including its legal name, registered agent, and principal office address. Filing this report is necessary to maintain good standing with the state and to ensure compliance with local regulations. The report must be submitted annually, and it serves as a public record of the business's existence and operational status.

Steps to Complete the Indiana Business Entity Report

Completing the Indiana Business Entity Report involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including your business's legal name, address, and registered agent details.

- Access the Indiana Business Entity Report form through the Indiana Secretary of State's website.

- Fill out the form with accurate and up-to-date information.

- Review the completed report for any errors or omissions.

- Submit the form electronically or by mail, depending on your preference.

Legal Use of the Indiana Business Entity Report

The Indiana Business Entity Report is legally binding and serves as an official record of a business's compliance with state laws. It is essential for maintaining the legal status of your business entity. Failure to file this report can lead to penalties, including administrative dissolution of the business. Therefore, ensuring the report is completed accurately and submitted on time is vital for legal and operational continuity.

Filing Deadlines / Important Dates

Businesses in Indiana must adhere to specific deadlines for filing the Business Entity Report. The report is due annually, and the deadline typically falls on the anniversary date of the business's formation. It is important to mark this date on your calendar to avoid late fees or penalties. Checking the Indiana Secretary of State's website for any updates regarding deadlines is also advisable.

Form Submission Methods

The Indiana Business Entity Report can be submitted through various methods, providing flexibility for business owners:

- Online: The most efficient method is to file the report electronically through the Indiana Secretary of State's online portal.

- By Mail: Businesses can also print the completed form and send it via postal mail to the appropriate state office.

- In-Person: For those who prefer face-to-face interaction, submitting the report in person at the local Secretary of State office is an option.

Penalties for Non-Compliance

Failing to file the Indiana Business Entity Report on time can result in significant penalties. Businesses may face late fees, and repeated non-compliance can lead to administrative dissolution. This means the business may lose its legal status, making it unable to operate legally in the state. It is essential for business owners to prioritize timely filing to avoid these consequences.

Quick guide on how to complete indiana business entity report formsend

Complete INDIANA BUSINESS ENTITY REPORT FormSend seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without hold-ups. Manage INDIANA BUSINESS ENTITY REPORT FormSend on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign INDIANA BUSINESS ENTITY REPORT FormSend effortlessly

- Find INDIANA BUSINESS ENTITY REPORT FormSend and click Get Form to begin.

- Leverage the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your adjustments.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from your preferred device. Alter and eSign INDIANA BUSINESS ENTITY REPORT FormSend and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana business entity report formsend

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a business entity report?

A business entity report is a document that provides key information about a company's legal status and operational details. It typically includes data on registration, compliance, and ownership structure. By reviewing a business entity report, stakeholders can understand a company's legitimacy and standing in the market.

-

How can airSlate SignNow help with obtaining a business entity report?

airSlate SignNow streamlines the process of acquiring a business entity report by enabling the electronic signing and sharing of necessary documents. Our intuitive platform ensures that all stakeholders can quickly provide consent. This efficiency helps save time and reduces any administrative bottlenecks.

-

Are there any costs associated with getting a business entity report?

The cost of obtaining a business entity report may vary depending on the state or country of registration. However, using airSlate SignNow can often minimize additional fees by simplifying the document processing and signature flow. We provide various pricing plans to accommodate different business needs, ensuring a cost-effective solution.

-

What features does airSlate SignNow offer for managing business entity reports?

airSlate SignNow offers features like secure eSignatures, document templates, and real-time status tracking for managing business entity reports. You can automate reminders and notifications, ensuring timely completion of necessary paperwork. These features help enhance the efficiency and accuracy of managing your business documents.

-

Can I integrate airSlate SignNow with other software to manage business entity reports?

Yes, airSlate SignNow seamlessly integrates with various business applications, making it easier to manage your business entity reports. You can connect with tools like CRM systems, cloud storage, and project management software to enhance overall workflow. This ensures you have all your necessary documents and information readily accessible.

-

What are the benefits of using airSlate SignNow for business entity reports?

Using airSlate SignNow for your business entity reports offers benefits like improved efficiency, enhanced security, and reduced operational costs. The platform allows for real-time collaboration and easy access to documents across teams. Furthermore, its user-friendly design makes it accessible for all employees, regardless of their technical expertise.

-

Is airSlate SignNow secure for handling business entity reports?

Absolutely, airSlate SignNow employs advanced encryption and secure cloud storage to protect your business entity reports and other confidential documents. We follow industry-standard security protocols to ensure data integrity and compliance with regulations. This commitment to security gives businesses peace of mind while managing sensitive information.

Get more for INDIANA BUSINESS ENTITY REPORT FormSend

- Notice of termination for violation of residential lease form

- Prepared by and after recording return to name firm form

- Answer to petition for guardianship packet delaware courts form

- Family court permanent guardianship forms family court

- Rev 718 form

- Form 126s

- Re proposed purchase of any horse form

- State of delaware certificate of incorporation a stock corporation form

Find out other INDIANA BUSINESS ENTITY REPORT FormSend

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document