Form Mta 305

What is the Form MTA 305

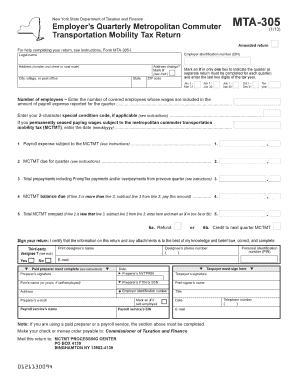

The MTA 305 form is a tax document used in the United States, primarily for reporting specific financial information related to the Metropolitan Transportation Authority (MTA). It is essential for individuals and businesses that engage with MTA services, ensuring compliance with local regulations. This form captures vital data that helps streamline the reporting process for both taxpayers and the MTA.

How to use the Form MTA 305

Using the MTA 305 form involves several straightforward steps. First, ensure you have all necessary information at hand, including your identification details and financial records relevant to MTA transactions. Next, download the fillable MTA 305 PDF from a reliable source. Carefully fill out each section, ensuring accuracy to avoid delays in processing. Once completed, review the form for any errors before submission.

Steps to complete the Form MTA 305

Completing the MTA 305 form requires attention to detail. Follow these steps:

- Gather all required documentation, including identification and financial records.

- Download the fillable MTA 305 PDF from a trusted source.

- Fill in your personal information, ensuring accuracy in names and addresses.

- Provide the necessary financial details as required by the form.

- Review the completed form for any inaccuracies or missing information.

- Submit the form according to the specified submission methods.

Legal use of the Form MTA 305

The MTA 305 form holds legal significance, as it must be filled out accurately to ensure compliance with tax regulations. When submitted correctly, it serves as a legally binding document that can be used in audits or disputes. It is crucial to adhere to all instructions and guidelines to maintain the form's validity.

Form Submission Methods

The MTA 305 form can be submitted through various methods, including:

- Online submission via the designated MTA portal.

- Mailing the completed form to the appropriate MTA office.

- In-person submission at specified MTA locations.

Choosing the right submission method can help ensure timely processing of your form.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the MTA 305 form to avoid penalties. Typically, the form must be submitted by a specific date each year, which can vary based on the financial year or specific circumstances. Keeping track of these deadlines ensures compliance and helps avoid any late fees or complications.

Quick guide on how to complete form mta 305

Complete Form Mta 305 with ease on any device

Managing documents online has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly without unnecessary hold-ups. Handle Form Mta 305 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form Mta 305 effortlessly

- Obtain Form Mta 305 and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Form Mta 305 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mta 305

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to MTA 305 instructions?

AirSlate SignNow provides a range of features that simplify document signing and management, such as eSignatures, customizable templates, and real-time tracking. These features are particularly useful when following MTA 305 instructions for document submissions, ensuring compliance and efficiency. Businesses can utilize these capabilities to streamline their workflows and maintain accuracy.

-

How can I integrate airSlate SignNow with other software when following MTA 305 instructions?

AirSlate SignNow offers seamless integrations with various popular applications, including Google Drive, Salesforce, and more. This allows users to access MTA 305 instructions and related documents directly within the platforms they are already using, enhancing productivity and collaboration. Integration simplifies the process of document management according to MTA 305 standards.

-

What pricing plans does airSlate SignNow offer for users needing MTA 305 instructions?

AirSlate SignNow provides flexible pricing plans tailored to meet various business needs, including essential features for following MTA 305 instructions. Whether you are a small business or a large enterprise, there is a plan suitable for your requirements, and you can choose based on the number of active users and features needed. Transparent pricing ensures no hidden fees, making budgeting straightforward.

-

How does airSlate SignNow enhance the security of documents related to MTA 305 instructions?

Security is crucial for documents requiring MTA 305 instructions, and airSlate SignNow ensures top-level protection through encrypted connections and secure storage. The platform complies with industry standards, providing data integrity and confidentiality. Advanced authentication methods also help protect sensitive information during the signing process.

-

What are the benefits of using airSlate SignNow for MTA 305 instructions?

Using airSlate SignNow for MTA 305 instructions streamlines the signing and document management process, reducing the time spent on manual tasks. It allows for quick, legally binding signatures and easy document sharing, which helps maintain compliance with MTA 305 requirements. Additionally, the platform offers 24/7 accessibility, ensuring you can manage your documents anytime, anywhere.

-

Is airSlate SignNow suitable for large enterprises requiring MTA 305 instructions?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, including large enterprises that need to adhere to MTA 305 instructions. With features that support bulk send, team management, and advanced reporting, larger organizations can efficiently manage their document workflows. This scalability ensures that all users, regardless of the size of the organization, benefit from its capabilities.

-

Can I customize templates in airSlate SignNow for MTA 305 instructions?

Absolutely! AirSlate SignNow allows users to create and customize templates specifically for MTA 305 instructions, making it easier to generate consistent documents. Customizable fields can be added, ensuring that all necessary information is captured when following the MTA 305 guidelines. This functionality enhances efficiency and accuracy across all document submissions.

Get more for Form Mta 305

- Fillable online form xxvi sales tax tribunal orissa

- Fillable online drtinfo drt district 10 workshop reg form

- Defendants bond for levy or seizure form

- Fotm dc 451 fill online printable fillable blankpdffiller form

- Notice to judgment debtor how to claim exemptions from form

- Motion and order for judgment to be marked satisfied form

- Writs of executionloudoun county va official website form

- 462 358 restoration of privilege of driving motor vehicle form

Find out other Form Mta 305

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later