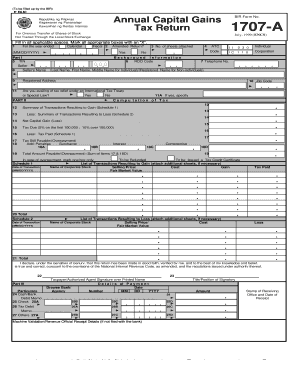

Bir 1707 Form

What is the Bir 1707?

The Bir 1707 form is a tax-related document used in the United States, primarily for reporting certain financial transactions and income. This form is essential for individuals and businesses to ensure compliance with federal tax regulations. It helps in accurately reporting income and deductions, which can affect overall tax liability. Understanding the purpose of the Bir 1707 is crucial for effective tax planning and compliance.

How to use the Bir 1707

Using the Bir 1707 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form with the required information, ensuring all entries are accurate and complete. After completing the form, review it for any errors before submission. The Bir 1707 can be filed electronically or through traditional mail, depending on the preference of the filer.

Steps to complete the Bir 1707

Completing the Bir 1707 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including W-2s, 1099s, and receipts.

- Fill in your personal information, including name, address, and Social Security number.

- Report all income accurately in the designated sections of the form.

- Include any applicable deductions or credits that you qualify for.

- Review the completed form for accuracy and completeness.

- Submit the form either electronically or by mailing it to the appropriate tax authority.

Legal use of the Bir 1707

The Bir 1707 is legally binding when completed and submitted according to IRS regulations. To ensure its legal standing, it is important to provide accurate information and maintain compliance with all relevant tax laws. Utilizing a reliable eSignature platform can enhance the legal validity of the form by ensuring secure submission and proper documentation of the signing process.

Filing Deadlines / Important Dates

Filing deadlines for the Bir 1707 are crucial to avoid penalties and interest. Typically, the form must be submitted by April 15 of the tax year following the income being reported. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to filing deadlines each tax year to ensure compliance.

Required Documents

To complete the Bir 1707, certain documents are required. These typically include:

- W-2 forms from employers, detailing wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as business-related costs.

- Any additional documentation that supports claims made on the form.

Examples of using the Bir 1707

Examples of using the Bir 1707 can vary based on individual circumstances. For instance, a self-employed individual may use the form to report income from freelance work, while a business owner might use it to report earnings and expenses related to their company. Each scenario requires careful documentation and accurate reporting to ensure compliance with tax regulations.

Quick guide on how to complete bir 1707

Simplify Bir 1707 on any device

Digital document management has become increasingly favored by companies and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and safely archive it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly and without interruptions. Handle Bir 1707 on any platform using airSlate SignNow apps for Android or iOS, and enhance any document-related workflow today.

How to adjust and electronically sign Bir 1707 effortlessly

- Obtain Bir 1707 and click on Get Form to begin.

- Utilize the features we provide to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Bir 1707 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bir 1707

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1707 form and why is it important for businesses?

The 1707 form is a critical document used for specific business transactions, enabling organizations to provide essential information for regulatory compliance. Understanding its importance helps businesses streamline their processes and avoid potential legal issues. Utilizing solutions like airSlate SignNow can simplify the eSigning of the 1707 form.

-

How can airSlate SignNow help me with the 1707 form?

airSlate SignNow offers a user-friendly platform for creating, sending, and eSigning the 1707 form efficiently. With customizable templates and a secure environment, you can ensure that your documents are handled with utmost care. This not only saves time but also enhances the compliance process for your business.

-

Are there any costs associated with using airSlate SignNow for the 1707 form?

Yes, airSlate SignNow has various pricing plans to suit different business needs when handling the 1707 form. Each plan offers a range of features, enabling you to choose the one that best fits your requirements. Additionally, free trials are often available to explore the platform before making a commitment.

-

What features does airSlate SignNow offer for managing the 1707 form?

airSlate SignNow provides features such as document templates, real-time collaboration, and secure cloud storage for the 1707 form. These capabilities ensure that the document is not only accessible but also editable by authorized team members. Furthermore, the platform supports legally binding signatures, enhancing the document's integrity.

-

Can I integrate airSlate SignNow with other software for the 1707 form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, making it convenient to manage your 1707 form within your existing workflows. This integration capability enhances productivity by allowing you to send and eSign documents directly from other platforms your business uses. Check the integration section for a list of compatible applications.

-

Is the signing process for the 1707 form secure on airSlate SignNow?

Yes, the signing process for the 1707 form on airSlate SignNow is highly secure. The platform employs industry-standard encryption and compliance measures to protect your sensitive information. You can sign documents with confidence, knowing that your data is secure throughout the entire process.

-

What are the benefits of using airSlate SignNow for the 1707 form?

Using airSlate SignNow for the 1707 form offers numerous benefits, including increased efficiency and reduced turnaround time. Electronic signatures streamline the signing process, while customizable templates help your team maintain consistency. Additionally, the ability to track document progress ensures transparency and accountability.

Get more for Bir 1707

- 372 1103 emergency custody orders for adult persons who form

- Subpoena for witness civil form

- Code of virginia jurisdiction consent for abortion va code form

- 1a 270 form

- Petition requesting authorization for medical treatment of juvenile form

- Petition for foster care review hearing form

- Who was placed in the custody of or through an agreement with form

- Forms and instructions virginias judicial system

Find out other Bir 1707

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation