Gst190 Ontario Rebate Schedule Form

What is the GST190 Ontario Rebate Schedule

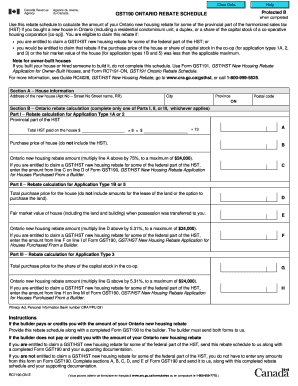

The GST190 Ontario Rebate Schedule is a form used by residents of Ontario to claim a rebate on the Goods and Services Tax (GST) and the Harmonized Sales Tax (HST). This rebate is designed to assist individuals and families with low to moderate incomes by providing financial relief from the taxes they have paid. The schedule outlines the eligibility criteria, the calculation of the rebate, and the necessary documentation required for submission. Understanding this form is essential for those who wish to benefit from the available tax relief.

How to complete the GST190 Ontario Rebate Schedule

Completing the GST190 Ontario Rebate Schedule involves several key steps. First, gather all necessary documents, including proof of income and any relevant tax information. Next, accurately fill out the form, ensuring that all personal details and financial information are correct. It is important to follow the instructions carefully to avoid errors that could delay processing. Once the form is completed, review it thoroughly before submission to ensure all information is accurate and complete.

Eligibility Criteria for the GST190 Ontario Rebate Schedule

To qualify for the GST190 Ontario Rebate, applicants must meet specific eligibility criteria. Generally, individuals must be residents of Ontario and have a total family income below a certain threshold. The rebate is also available to families with children, as well as seniors. It is crucial to check the most current income limits and family size requirements, as these can change annually. Meeting these criteria is essential to successfully claim the rebate.

Required Documents for the GST190 Ontario Rebate Schedule

When submitting the GST190 Ontario Rebate Schedule, certain documents are required to support your application. These typically include proof of income, such as tax returns or pay stubs, and identification that verifies your residency in Ontario. Additional documentation may be necessary if you are claiming for dependents. Ensuring that all required documents are included will help facilitate a smoother processing experience.

Filing Deadlines for the GST190 Ontario Rebate Schedule

Filing deadlines for the GST190 Ontario Rebate Schedule are critical to ensure that your application is processed in a timely manner. Generally, the form must be submitted by a specific date each year, often aligned with the tax filing deadline. It is important to stay informed about these dates to avoid missing out on the rebate. Late submissions may result in the loss of eligibility for that tax year.

Form Submission Methods for the GST190 Ontario Rebate Schedule

The GST190 Ontario Rebate Schedule can be submitted through various methods, providing flexibility for applicants. Individuals may choose to file online, which often allows for quicker processing times. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Understanding the available submission methods can help streamline the application process and ensure timely receipt of the rebate.

Quick guide on how to complete gst190 ontario rebate schedule

Prepare Gst190 Ontario Rebate Schedule effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing users to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without delays. Handle Gst190 Ontario Rebate Schedule on any device with airSlate SignNow Android or iOS applications and ease your document-related processes today.

The easiest method to modify and eSign Gst190 Ontario Rebate Schedule with ease

- Locate Gst190 Ontario Rebate Schedule and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal authority as a conventional handwritten signature.

- Review all the details and click the Done button to finalize your changes.

- Choose how you wish to share your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Modify and eSign Gst190 Ontario Rebate Schedule and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gst190 ontario rebate schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the gst190 ontario rebate schedule?

The gst190 ontario rebate schedule is a form used by residents of Ontario to claim a rebate for the GST/HST they paid on certain items. Understanding this schedule is crucial for those looking to ensure they maximize their tax refunds efficiently. With airSlate SignNow, you can easily sign and submit such documents with just a few clicks.

-

How does airSlate SignNow help with the gst190 ontario rebate schedule?

airSlate SignNow streamlines the process of completing and submitting your gst190 ontario rebate schedule. Our platform allows you to digitally sign the necessary forms securely, ensuring that your information is protected and submitted quickly. Simplifying this process helps you focus on getting your rebate faster.

-

What features does airSlate SignNow offer for managing my gst190 ontario rebate schedule?

airSlate SignNow offers a variety of features to assist with your gst190 ontario rebate schedule, including easy-to-use templates, automated reminders, and secure storage for all your documents. These features help ensure that you can efficiently track, manage, and submit your rebate claims without hassle.

-

Is airSlate SignNow a cost-effective solution for filing the gst190 ontario rebate schedule?

Yes, airSlate SignNow provides a cost-effective solution for filing your gst190 ontario rebate schedule. Our pricing plans are designed to accommodate various business needs, ensuring that you receive excellent value while managing your document signing processes effectively. This saves time and money overall.

-

Can I integrate airSlate SignNow with other financial software to manage my gst190 ontario rebate schedule?

Absolutely! airSlate SignNow can be integrated with numerous financial software applications, allowing for seamless management of your gst190 ontario rebate schedule. This integration simplifies data transfer and helps you maintain organized records for easier filing and tracking.

-

What benefits does airSlate SignNow provide for businesses submitting the gst190 ontario rebate schedule?

Using airSlate SignNow provides businesses with a user-friendly interface and fast turnaround times for submitting the gst190 ontario rebate schedule. The platform enhances efficiency and reduces the risk of errors by guiding users through the signing and submission process, ensuring that all submissions are compliant and timely.

-

Is technical support available for issues related to the gst190 ontario rebate schedule?

Yes, airSlate SignNow offers dedicated technical support to assist users with the gst190 ontario rebate schedule as needed. Our expert support team is available to address any queries or technical difficulties, ensuring that you can complete your forms with confidence and ease.

Get more for Gst190 Ontario Rebate Schedule

- The eleventh judicial circuit miami dade county florida form

- At least one party has been a resident of the state of florida for more than 6 months immediately form

- 2018 form fl 12994a fill online printable fillable

- Supplemental final judgment modifying florida courts form

- Supplemental final judgment modifying alimony form

- In the circuit court of the judicial circuit in and for 490119720 form

- Florida supreme court approved family law form 12994a

- 995a parenting plan 0309 form

Find out other Gst190 Ontario Rebate Schedule

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template