ID Form ST 133 Sales Tax Exemption Certificate Transfer Affidavit PDF

What is the ID Form ST 133 Sales Tax Exemption Certificate Transfer Affidavit?

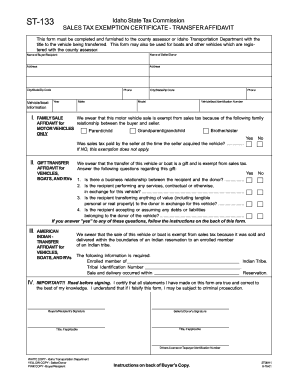

The ID Form ST 133, commonly referred to as the Sales Tax Exemption Certificate Transfer Affidavit, is a crucial document used in the United States for claiming sales tax exemptions. This form is typically utilized by organizations or individuals who qualify for tax exemptions under specific circumstances, such as non-profit entities or government agencies. By completing this affidavit, the claimant asserts their eligibility for sales tax exemption on purchases made for qualified purposes, thereby avoiding unnecessary tax expenses.

Steps to Complete the ID Form ST 133 Sales Tax Exemption Certificate Transfer Affidavit

Completing the ID Form ST 133 requires careful attention to detail to ensure compliance with state regulations. Here are the essential steps:

- Gather Required Information: Collect all necessary information, including your business name, address, and tax identification number.

- Specify the Exemption Reason: Clearly indicate the reason for the exemption, which must align with state guidelines.

- Complete the Form: Fill out the form accurately, ensuring all sections are completed, including signatures where required.

- Review for Accuracy: Double-check all entries for correctness to prevent delays or issues during processing.

- Submit the Form: Follow the submission guidelines specific to your state, which may include online, mail, or in-person options.

Legal Use of the ID Form ST 133 Sales Tax Exemption Certificate Transfer Affidavit

The legal use of the ID Form ST 133 is governed by state tax laws and regulations. This form serves as a declaration of the claimant's eligibility for sales tax exemption. For the affidavit to be considered legally binding, it must be filled out accurately and submitted according to state requirements. Additionally, the form may be subject to audits by tax authorities, so maintaining accurate records and documentation is essential for compliance.

Key Elements of the ID Form ST 133 Sales Tax Exemption Certificate Transfer Affidavit

Understanding the key elements of the ID Form ST 133 is vital for successful completion and submission. The primary components include:

- Claimant Information: Details about the individual or organization claiming the exemption.

- Exemption Type: A clear indication of the type of exemption being claimed.

- Signature: The form must be signed by an authorized representative of the claimant.

- Date: The date of signing is essential for record-keeping and compliance verification.

How to Obtain the ID Form ST 133 Sales Tax Exemption Certificate Transfer Affidavit

The ID Form ST 133 can typically be obtained from the official state tax authority's website or office. Many states provide downloadable versions of the form in PDF format, allowing for easy access and completion. Additionally, some states may offer the option to request a physical copy through mail or in-person visits to tax offices. Ensure that you are using the most current version of the form to avoid any compliance issues.

Eligibility Criteria for the ID Form ST 133 Sales Tax Exemption Certificate Transfer Affidavit

Eligibility for using the ID Form ST 133 varies by state but generally includes specific criteria that must be met. Common eligibility requirements include:

- Type of Entity: Non-profit organizations, government agencies, and certain educational institutions often qualify.

- Intended Use: The purchases must be for exempt purposes, such as resale or specific charitable activities.

- Compliance with State Laws: Claimants must adhere to the regulations set forth by their respective state tax authorities.

Quick guide on how to complete id form st 133 sales tax exemption certificate transfer affidavit pdf

Complete ID Form ST 133 Sales Tax Exemption Certificate Transfer Affidavit pdf seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle ID Form ST 133 Sales Tax Exemption Certificate Transfer Affidavit pdf on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign ID Form ST 133 Sales Tax Exemption Certificate Transfer Affidavit pdf effortlessly

- Obtain ID Form ST 133 Sales Tax Exemption Certificate Transfer Affidavit pdf and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Edit and eSign ID Form ST 133 Sales Tax Exemption Certificate Transfer Affidavit pdf and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the id form st 133 sales tax exemption certificate transfer affidavit pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form st 133gt used for?

The form st 133gt is a tax form used in specific contexts to ensure proper compliance. Businesses utilize it to report transactions effectively, and airSlate SignNow offers seamless signing capabilities to manage this form easily and securely.

-

How can I fill out the form st 133gt using airSlate SignNow?

Filling out the form st 133gt with airSlate SignNow is straightforward. Simply upload your document, add the necessary fields, and send it out for eSignature. Our intuitive interface ensures that your form is completed quickly and accurately.

-

What are the pricing options for using airSlate SignNow for form st 133gt?

airSlate SignNow provides flexible pricing plans to accommodate various business needs. Each plan includes comprehensive features for managing documents like the form st 133gt, with competitive pricing that reflects our value in the eSigning market.

-

Are there any integrations available for the form st 133gt with airSlate SignNow?

Yes, airSlate SignNow integrates with a variety of applications to enhance your workflow. You can connect with popular platforms, enabling efficient management of the form st 133gt alongside your existing tools, streamlining your processes.

-

What features does airSlate SignNow offer for managing the form st 133gt?

airSlate SignNow provides a host of features for the form st 133gt, including customizable templates, automated reminders, and secure cloud storage. These tools help businesses manage their documents efficiently while ensuring compliance through easy-to-track audit trails.

-

Is airSlate SignNow secure for submitting the form st 133gt?

Absolutely! airSlate SignNow prioritizes security, implementing advanced encryption and authentication methods. When you submit the form st 133gt, you can be assured that your sensitive information is protected against unauthorized access.

-

How does airSlate SignNow improve the workflow for the form st 133gt?

airSlate SignNow signNowly enhances workflow by simplifying the signing process for the form st 133gt. With features like bulk sending and real-time tracking, businesses can reduce delays and ensure timely completion of their documentation.

Get more for ID Form ST 133 Sales Tax Exemption Certificate Transfer Affidavit pdf

- The total length of the inmates original sentence on this count is form

- 302053e wisconsin legislature form

- Cr 265 order on petition for determination of eligibility for form

- Determination of eligibility for form

- Not guilty by reason of form

- Mental disease or defect form

- State of wisconsin circuit court dane county published form

- 97117 wisconsin legislature form

Find out other ID Form ST 133 Sales Tax Exemption Certificate Transfer Affidavit pdf

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free