Oregon W4 PDF Form

What is the Oregon W4 PDF

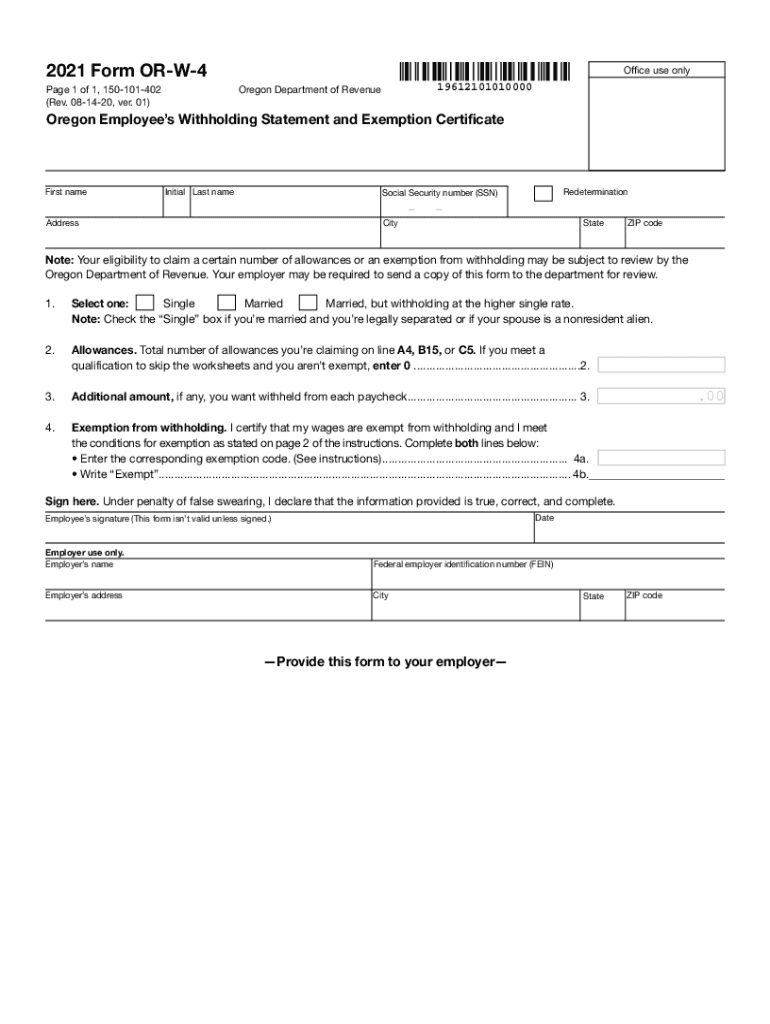

The Oregon W4 PDF is a state-specific form used by employees to determine the amount of state income tax withholding from their paychecks. This form is essential for ensuring that the correct amount of tax is withheld based on an individual's financial situation, including allowances and additional withholding requests. Completing the Oregon W4 accurately helps prevent under-withholding or over-withholding, which can affect tax returns and overall financial planning.

How to use the Oregon W4 PDF

To use the Oregon W4 PDF effectively, begin by downloading the form from a reliable source. Once you have the form, review the instructions carefully. Fill in your personal information, including your name, address, and Social Security number. Specify your filing status and the number of allowances you are claiming. If applicable, indicate any additional amount you wish to withhold. After completing the form, submit it to your employer to ensure your payroll deductions are adjusted accordingly.

Steps to complete the Oregon W4 PDF

Completing the Oregon W4 PDF involves several straightforward steps:

- Download the Oregon W4 PDF form from an official source.

- Enter your personal information, including your name and Social Security number.

- Select your filing status: single, married, or head of household.

- Determine the number of allowances you are eligible for based on your situation.

- If desired, specify any additional amount to be withheld from your paycheck.

- Review the completed form for accuracy.

- Submit the form to your employer for processing.

Legal use of the Oregon W4 PDF

The Oregon W4 PDF is legally binding when completed and submitted correctly. It complies with state tax regulations, ensuring that employers withhold the appropriate amount of state income tax from employees’ wages. To maintain its legal validity, the form must be filled out accurately and submitted to the employer in a timely manner. Employers are responsible for keeping the form on file for their records and for using it to calculate tax withholdings.

Key elements of the Oregon W4 PDF

Several key elements are crucial to understand when working with the Oregon W4 PDF:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Allowances: The number of allowances affects the withholding amount.

- Additional Withholding: Option to specify an extra amount to be withheld.

- Signature: Required to validate the form.

IRS Guidelines

The IRS provides guidelines that influence the completion of the Oregon W4 PDF. Employees should refer to the IRS Publication 505 for information on withholding allowances and tax rates. Understanding these guidelines helps ensure that individuals make informed decisions regarding their allowances and withholding amounts, aligning their state tax obligations with federal requirements.

Quick guide on how to complete oregon w4 pdf

Access Oregon W4 Pdf effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the correct template and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without hold-ups. Manage Oregon W4 Pdf on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign Oregon W4 Pdf without any hassle

- Locate Oregon W4 Pdf and select Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important portions of the documents or obscure sensitive details using tools that airSlate SignNow specifically provides for such purposes.

- Create your autograph with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review the details and click on the Done button to secure your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Oregon W4 Pdf to ensure seamless communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon w4 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W4 form PDF?

A W4 form PDF is a digital version of the IRS Form W-4, which employees fill out to inform their employers about their tax withholding. Using a W4 form PDF allows for easier distribution and completion, streamlining the process for both employees and employers. airSlate SignNow provides a user-friendly platform to manage your W4 form PDF efficiently.

-

How can I obtain a W4 form PDF?

You can easily obtain a W4 form PDF directly from the IRS website, where it is available for download. Additionally, airSlate SignNow allows you to create and customize your own W4 form PDF, enabling seamless document handling. Simply visit our site to explore these options.

-

Is the W4 form PDF compatible with e-signatures?

Yes, the W4 form PDF is fully compatible with electronic signatures, making it easy to sign and send digitally. airSlate SignNow ensures that your W4 form PDF retains its legality and authenticity when completed electronically. This eliminates the need for physical signatures and speeds up the process.

-

What features does airSlate SignNow offer for managing W4 form PDFs?

airSlate SignNow offers features such as document templates, secure storage, and real-time tracking for your W4 form PDFs. You can customize and send forms quickly while ensuring all parties can e-sign easily. These features simplify the management of W4 forms in your organization.

-

What are the benefits of using a W4 form PDF over paper forms?

Using a W4 form PDF provides several benefits, including time savings, improved accuracy, and enhanced security. Digital forms can be completed and submitted faster, reducing the chances of errors associated with handwritten documents. airSlate SignNow streamlines the process, ensuring your W4 form PDFs are securely stored and easily accessible.

-

Can I integrate airSlate SignNow with other applications for managing W4 form PDFs?

Yes, airSlate SignNow offers integrations with a variety of applications such as Google Drive, Dropbox, and Salesforce, allowing you to manage your W4 form PDFs easily. These integrations enhance your workflow by enabling you to send, receive, and store documents in your preferred platforms. This ensures a seamless experience across different tools.

-

What is the pricing model for using airSlate SignNow for W4 form PDFs?

airSlate SignNow offers various pricing plans designed to accommodate different business sizes and needs when managing W4 form PDFs. You can choose from pay-as-you-go options to monthly subscriptions to find a plan that fits your budget. Each plan provides features that help businesses streamline document management.

Get more for Oregon W4 Pdf

- Ccap system used by the circuit courts form

- Efileecourts circuit court efiling wisconsin court system form

- This is an accurate account of the administration of the trust for the period from date form

- Certificate of descent form

- 867055 wisconsin legislature form

- Fillable online state show nbha scnbhacom fax email form

- Ancillary letters wisconsin free legal forms court

- Fillable online industrial disaster fax email print form

Find out other Oregon W4 Pdf

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney