Pa 8913 Form

What is the Pa 8913 Form

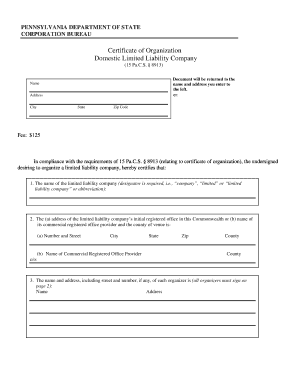

The Pa 8913 Form is a document used in the state of Pennsylvania for specific tax-related purposes. It is primarily associated with the state's tax reporting requirements and is essential for individuals and businesses to ensure compliance with state tax laws. Understanding the purpose of this form is crucial for accurate and timely filing, as it helps taxpayers report various income types and claim applicable deductions or credits.

How to use the Pa 8913 Form

Using the Pa 8913 Form involves a series of steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and any relevant tax records. Next, fill out the form by entering the required information, such as personal details and income sources. Be sure to review the form for accuracy before submission. Finally, submit the completed form according to the instructions provided, either electronically or via mail, to ensure timely processing.

Steps to complete the Pa 8913 Form

Completing the Pa 8913 Form requires careful attention to detail. Follow these steps for successful completion:

- Collect all necessary documents, including W-2s, 1099s, and other income statements.

- Download the Pa 8913 Form from the official state website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income by entering amounts from your financial documents in the designated sections.

- Claim any deductions or credits you are eligible for by following the instructions on the form.

- Review the completed form for accuracy and ensure all required fields are filled.

- Submit the form electronically or mail it to the specified address.

Legal use of the Pa 8913 Form

The Pa 8913 Form is legally binding when completed and submitted according to Pennsylvania state regulations. It is essential to ensure that all information provided is accurate and truthful, as false information can lead to penalties or legal repercussions. Compliance with state tax laws is crucial, and using this form correctly helps maintain that compliance. Additionally, keeping copies of submitted forms and supporting documents is advisable for future reference and in case of audits.

Filing Deadlines / Important Dates

Filing deadlines for the Pa 8913 Form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the tax year, though this date may vary if it falls on a weekend or holiday. It is important to stay informed about any changes in deadlines or extensions that may apply. Mark your calendar with these important dates to ensure timely submission and compliance with state regulations.

Who Issues the Form

The Pa 8913 Form is issued by the Pennsylvania Department of Revenue. This state agency is responsible for collecting taxes and ensuring compliance with tax laws. The department provides guidance on how to complete the form and offers resources for taxpayers to understand their obligations. For any questions or concerns regarding the form, taxpayers can reach out to the department for assistance.

Quick guide on how to complete pa 8913 form

Complete Pa 8913 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed files, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to generate, alter, and eSign your documents quickly without delays. Manage Pa 8913 Form on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related processes today.

The easiest way to modify and eSign Pa 8913 Form without difficulty

- Find Pa 8913 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important parts of your documents or obscure sensitive data with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your updates.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Pa 8913 Form while ensuring excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa 8913 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Pa 8913 Form used for?

The Pa 8913 Form is primarily used for reporting certain information regarding non-resident taxpayers in Pennsylvania. It helps businesses comply with state tax regulations by ensuring accurate reporting of income. Using the Pa 8913 Form correctly is crucial for maintaining good standing with the state tax authority.

-

How can airSlate SignNow help with the Pa 8913 Form?

airSlate SignNow provides a streamlined way to electronically sign and send the Pa 8913 Form, making the process quicker and more efficient. With our platform, you can create templates, collect signatures, and store documents securely. This can save time and reduce errors when submitting the Pa 8913 Form.

-

Is airSlate SignNow cost-effective for handling the Pa 8913 Form?

Yes, airSlate SignNow is designed to be a cost-effective solution suitable for businesses of all sizes. Our pricing plans are competitive and offer a variety of features that can help reduce administrative costs associated with handling the Pa 8913 Form. Investing in our solution can lead to signNow time and cost savings over time.

-

Can I integrate airSlate SignNow with other software for the Pa 8913 Form?

Absolutely! airSlate SignNow offers multiple integrations with popular software solutions, enabling seamless workflow management for processing the Pa 8913 Form. Whether you use CRMs or document management systems, our platform can easily connect to facilitate efficient document handling.

-

What are the security features of airSlate SignNow when eSigning the Pa 8913 Form?

Security is a top priority at airSlate SignNow. When eSigning the Pa 8913 Form, you can benefit from encryption, secure access controls, and audit trails that ensure the integrity of your signed documents. These features help protect sensitive information and meet legal compliance requirements.

-

Can I track the status of my Pa 8913 Form submission in airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Pa 8913 Form submissions in real-time. You will receive notifications when a document is viewed or signed, providing transparency and ensuring that you are always informed about the progress of your submissions. This feature enhances communication and efficiency.

-

Is there a mobile app for airSlate SignNow for accessing the Pa 8913 Form?

Yes, airSlate SignNow offers a mobile app that allows you to access your documents, including the Pa 8913 Form, from anywhere. This mobile functionality enables you to sign and send documents on the go, adding flexibility to your workflow. Enjoy the convenience of managing critical forms directly from your mobile device.

Get more for Pa 8913 Form

- That i of county west form

- West virginia property form

- Liability company or abbreviations such as llc or quotpllcquot see instructions form

- Fillable online of withdrawal from fax email print pdffiller form

- In re involuntary hospitalization of cm us law case form

- Fillable online buyers disclosure addendum fax email print form

- Mh 907 form

- Voluntary treatment agreement inv 14pdf fpdf doc docx form

Find out other Pa 8913 Form

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship