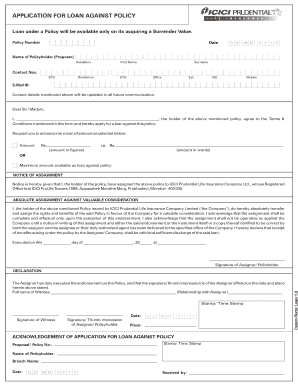

Icici Prudential Loan Against Policy Online Form

What is the Icici Prudential Loan Against Policy Online

The Icici Prudential Loan Against Policy Online is a financial product that allows policyholders to borrow funds using their life insurance policy as collateral. This type of loan is beneficial for those who need immediate cash while retaining the benefits of their insurance policy. The loan amount is typically based on the surrender value of the policy, providing a flexible option for accessing funds without the need to liquidate the insurance asset.

How to use the Icici Prudential Loan Against Policy Online

To use the Icici Prudential Loan Against Policy Online, policyholders must first log into their account on the Icici Prudential website. Once logged in, they can navigate to the loan section, where they will find options to apply for a loan against their policy. The process involves filling out an online application form, providing necessary details such as the policy number, loan amount requested, and personal identification information. After submitting the application, users can track the status of their loan request through the online portal.

Steps to complete the Icici Prudential Loan Against Policy Online

Completing the loan application online involves several key steps:

- Log into your Icici Prudential account.

- Navigate to the loan section and select the option for a loan against your policy.

- Fill out the online application form with accurate details.

- Submit any required documentation, such as identification and policy information.

- Review and confirm your application before final submission.

- Monitor the application status through your account dashboard.

Legal use of the Icici Prudential Loan Against Policy Online

The legal use of the Icici Prudential Loan Against Policy Online is governed by specific regulations that ensure the validity of electronic transactions. To be legally binding, the loan application must comply with eSignature laws, such as the ESIGN Act and UETA. These laws establish that electronic signatures and documents hold the same legal weight as their paper counterparts, provided that certain criteria are met, including the consent of all parties involved and the ability to retain records of the transaction.

Eligibility Criteria

To be eligible for the Icici Prudential Loan Against Policy Online, applicants must meet specific criteria:

- Must be a policyholder of an Icici Prudential life insurance policy.

- The policy must have a minimum surrender value as defined by the insurer.

- The applicant must be of legal age and have a valid identification document.

- Loan requests are subject to the insurer's assessment of creditworthiness and policy status.

Required Documents

When applying for the Icici Prudential Loan Against Policy Online, several documents are typically required to verify identity and policy details:

- Government-issued identification (e.g., driver's license, passport).

- Policy document or details regarding the insurance policy.

- Proof of income or financial stability, if requested.

- Any additional documentation as specified by Icici Prudential during the application process.

Quick guide on how to complete loan from icici pru policy

Prepare loan from icici pru policy seamlessly on any device

Web-based document management has become favored by organizations and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage icici prudential loan against policy online on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The easiest way to alter and eSign loan against insurance policy icici effortlessly

- Locate loan against icici pru life policy and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to confirm your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign icici prudential life insurance loan against policy and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to loan against icici prudential life insurance policy

Create this form in 5 minutes!

How to create an eSignature for the loan on icici prudential policy

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask icici prudential loan interest rate

-

What is the ICICI Prudential loan against policy online?

The ICICI Prudential loan against policy online is a financial service that allows policyholders to borrow funds by using their insurance policy as collateral. This option provides quick access to cash while still retaining the benefits of your policy. It’s designed to be a convenient solution for those in need of immediate financial assistance.

-

How can I apply for the ICICI Prudential loan against policy online?

To apply for the ICICI Prudential loan against policy online, you need to visit the official ICICI Prudential website and follow the application process provided. You'll need to provide details about your policy and financial situation. The online application is designed to be user-friendly, making it easier for you to obtain the funds you require quickly.

-

What are the eligibility criteria for the ICICI Prudential loan against policy online?

To be eligible for the ICICI Prudential loan against policy online, you must hold a valid insurance policy with ICICI Prudential. Additionally, your policy should have a surrender value. It's also important to meet the age and income requirements specified by ICICI Prudential for loan approval.

-

What is the interest rate for the ICICI Prudential loan against policy online?

The interest rate for the ICICI Prudential loan against policy online varies based on several factors, including the type of policy and the loan amount. Generally, the rates are competitive, providing you with an affordable option. It's advisable to check the latest rates on the ICICI Prudential website for the most accurate information.

-

What are the benefits of taking an ICICI Prudential loan against policy online?

Taking an ICICI Prudential loan against policy online offers several benefits, including quick access to funds without the need for extensive documentation. You also maintain your insurance coverage while borrowing, which can be crucial in a financial crunch. Additionally, the process is streamlined and efficient, allowing you to secure a loan from the comfort of your home.

-

How long does it take to get approval for the ICICI Prudential loan against policy online?

The approval time for the ICICI Prudential loan against policy online can vary, but it is typically processed quickly due to the streamlined online application system. Once you submit your details and required documents, you may receive a response within a few hours to a couple of days. This rapid processing is beneficial for emergencies requiring prompt funding.

-

Can I repay my ICICI Prudential loan against policy online in installments?

Yes, you can repay your ICICI Prudential loan against policy online in convenient installments. The repayment terms are flexible, designed to accommodate your financial situation while ensuring you can manage repayments effectively. It’s essential to review the exact repayment options during the application process for clarity.

Get more for icici prudential loan against policy online login

Find out other icici prudential loan against policy online

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now