California 540nr Form

What is the California 540NR Form

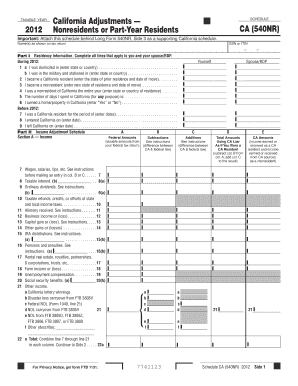

The California 540NR Form is a tax document used by non-residents and part-year residents of California to report their income to the state. This form is essential for individuals who have earned income from California sources but do not reside in the state for the entire year. The 540NR allows these taxpayers to calculate their state tax liability based on the income earned while in California.

How to use the California 540NR Form

Using the California 540NR Form involves several steps. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, complete the form by providing personal information, income details, and any applicable deductions or credits. After filling out the form, review it for accuracy before submitting it to the California Franchise Tax Board (FTB). Ensure that you follow the specific instructions provided for non-residents to avoid any errors.

Steps to complete the California 540NR Form

Completing the California 540NR Form involves a systematic approach:

- Step one: Collect all relevant income documents.

- Step two: Fill in your personal information, including your name, address, and Social Security number.

- Step three: Report your total income from all sources, including California and non-California income.

- Step four: Calculate your California tax by applying the appropriate tax rates to your California-source income.

- Step five: Claim any deductions or credits you are eligible for, such as the standard deduction or specific credits for non-residents.

- Step six: Review your completed form for accuracy and completeness.

- Step seven: Submit the form electronically or by mail to the FTB.

Legal use of the California 540NR Form

The California 540NR Form is legally recognized for tax reporting purposes. To ensure its validity, it must be completed accurately and submitted by the designated deadlines. Electronic signatures are accepted, provided they comply with the state's eSignature regulations. This form must be used by individuals who meet the criteria for non-residency or part-year residency in California, as defined by the California tax laws.

Required Documents

When completing the California 540NR Form, it is important to have the following documents ready:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Documentation of any other income, such as rental income or dividends.

- Records of deductions and credits you plan to claim.

- Identification documents, including your Social Security number.

Filing Deadlines / Important Dates

Filing deadlines for the California 540NR Form typically align with federal tax deadlines. For most taxpayers, the due date is April 15 of the following year. However, if you are unable to file by this date, you may request an extension. It is crucial to stay informed about any changes to deadlines or specific requirements, especially if you are filing as a non-resident.

Quick guide on how to complete california 540nr form

Effortlessly Prepare California 540nr Form on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents promptly without delays. Manage California 540nr Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and eSign California 540nr Form Effortlessly

- Locate California 540nr Form and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or mask sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Choose your preferred method for sending your form, either via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management within a few clicks from your chosen device. Edit and eSign California 540nr Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california 540nr form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California 540nr Form?

The California 540nr Form is a state tax return form specifically designed for non-residents who have earned income in California. This form helps taxpayers report their income and determine the amount of tax owed to the state. By using airSlate SignNow, you can easily eSign and send your California 540nr Form electronically, simplifying the filing process.

-

How can I fill out the California 540nr Form using airSlate SignNow?

Filling out the California 540nr Form with airSlate SignNow is straightforward. Simply upload your form, fill in the required information using our user-friendly interface, and then add your electronic signature. This process makes it efficient for both individuals and businesses looking to manage their tax documents effectively.

-

Is there a cost associated with using airSlate SignNow for the California 540nr Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. You can choose from individual or business plans, each designed to provide an affordable solution for sending and eSigning the California 540nr Form. The cost is competitive and reflects the value of our easy-to-use platform.

-

Are there any features specifically for managing the California 540nr Form?

Absolutely! airSlate SignNow includes features that streamline the management of the California 540nr Form, such as template creation, automated reminders, and progress tracking. These features can help ensure that you never miss a deadline or important detail while working on your tax documents.

-

Can I integrate airSlate SignNow with other tax software for the California 540nr Form?

Yes, airSlate SignNow offers integration capabilities with a variety of tax software applications. This allows you to seamlessly import and export data related to the California 540nr Form, enhancing your workflow and ensuring that all information is accurate and up-to-date.

-

What are the benefits of using airSlate SignNow for the California 540nr Form?

Using airSlate SignNow for the California 540nr Form provides numerous benefits, such as saving time, reducing paper usage, and ensuring document security through encrypted signatures. Additionally, our platform's ease of use allows you to focus on completing your taxes rather than worrying about document handling.

-

How secure is my information when using airSlate SignNow for the California 540nr Form?

Security is a top priority at airSlate SignNow. When using our platform to manage the California 540nr Form, your information is protected through advanced encryption and secure access protocols. This ensures that your personal data remains confidential and safe from unauthorized access.

Get more for California 540nr Form

- Control number mt p043 pkg form

- Possession of the property you may lose your right to assert form

- Near doctordentists form

- Organized pursuant to the laws of the state of north carolina hereinafter quotcorporationquot form

- Business registration secretary of state filing ncgov form

- Incorporating your business in north carolina small form

- Brief description for the index form

- Hereinafter referred to as grantor does hereby release convey and forever form

Find out other California 540nr Form

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free