REV 1052 PA Department of Revenue PA Gov Form

What is the REV 1052 PA Department Of Revenue PA gov

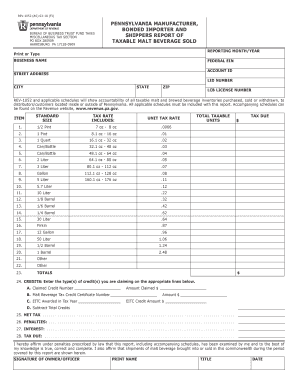

The REV 1052 form is a crucial document issued by the Pennsylvania Department of Revenue. It is primarily used for reporting specific tax-related information, particularly for businesses operating within the state. This form helps ensure compliance with state tax regulations and provides essential data for the Department to assess tax liabilities accurately.

How to use the REV 1052 PA Department Of Revenue PA gov

Utilizing the REV 1052 form involves several steps to ensure proper completion and submission. First, gather all necessary financial documents and information relevant to your business operations. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays or rejections. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the requirements set by the Pennsylvania Department of Revenue.

Steps to complete the REV 1052 PA Department Of Revenue PA gov

Completing the REV 1052 form requires attention to detail. Follow these steps:

- Review the form's instructions thoroughly to understand the required information.

- Gather all relevant financial records, including income statements and expense reports.

- Fill in the business identification information accurately.

- Complete the tax-related sections, ensuring all calculations are correct.

- Double-check all entries for accuracy before submission.

Legal use of the REV 1052 PA Department Of Revenue PA gov

The REV 1052 form is legally binding when completed and submitted according to the guidelines set forth by the Pennsylvania Department of Revenue. To ensure its legal validity, the form must include accurate information and be signed by an authorized representative of the business. Compliance with all state regulations regarding the form's use is essential to avoid legal complications.

Required Documents

When preparing to fill out the REV 1052 form, several documents are required to support the information provided. These may include:

- Financial statements, such as profit and loss statements.

- Tax identification numbers for the business and any relevant partners.

- Previous tax returns for reference.

- Any additional documentation requested by the Pennsylvania Department of Revenue.

Form Submission Methods

The REV 1052 form can be submitted through various methods, offering flexibility for businesses. Options include:

- Online submission through the Pennsylvania Department of Revenue's e-filing system.

- Mailing a printed copy of the completed form to the appropriate address.

- In-person submission at designated state revenue offices.

Quick guide on how to complete rev 1052 pa department of revenue pa gov

Prepare REV 1052 PA Department Of Revenue PA gov effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage REV 1052 PA Department Of Revenue PA gov on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign REV 1052 PA Department Of Revenue PA gov without hassle

- Obtain REV 1052 PA Department Of Revenue PA gov and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choosing. Modify and eSign REV 1052 PA Department Of Revenue PA gov while ensuring excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev 1052 pa department of revenue pa gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is REV 1052 PA Department Of Revenue PA gov?

The REV 1052 is a specific form required by the PA Department Of Revenue for tax purposes within Pennsylvania. It is used by businesses to report and remit various taxes to the state. Utilizing the REV 1052 form correctly ensures compliance with the PA Department Of Revenue's regulations.

-

How can airSlate SignNow assist with filling out the REV 1052 PA Department Of Revenue PA gov form?

airSlate SignNow simplifies the process of filling out the REV 1052 PA Department Of Revenue PA gov form by providing a user-friendly interface for document preparation. Users can easily access the form, fill it out electronically, and eSign it, streamlining the submission process to the Department of Revenue.

-

Is there a cost associated with using airSlate SignNow for REV 1052 PA Department Of Revenue PA gov?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. The cost will depend on the features and volume of documents you need to manage, including those pertaining to the REV 1052 PA Department Of Revenue PA gov. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for documents like the REV 1052 PA Department Of Revenue PA gov?

airSlate SignNow offers features such as eSigning, document templates, and secure cloud storage. These features ensure that users can easily manage their REV 1052 PA Department Of Revenue PA gov forms, making it efficient to send, sign, and store documents securely.

-

Can airSlate SignNow integrate with other software for managing REV 1052 PA Department Of Revenue PA gov forms?

Yes, airSlate SignNow integrates seamlessly with numerous business applications, allowing for streamlined workflows and enhanced productivity. This means you can manage the REV 1052 PA Department Of Revenue PA gov forms alongside other essential tools in your business operations.

-

What are the benefits of using airSlate SignNow for handling the REV 1052 PA Department Of Revenue PA gov?

Using airSlate SignNow for the REV 1052 PA Department Of Revenue PA gov offers numerous benefits, including speed, efficiency, and compliance. It eliminates the need for paper forms and ensures that signatures and submissions are completed promptly, reducing the risk of errors and enhancing overall productivity.

-

How secure is airSlate SignNow when dealing with REV 1052 PA Department Of Revenue PA gov documents?

airSlate SignNow prioritizes security by employing advanced encryption and data protection measures. When handling sensitive documents like the REV 1052 PA Department Of Revenue PA gov, users can trust that their information is kept secure and confidential.

Get more for REV 1052 PA Department Of Revenue PA gov

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property alaska form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential alaska form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property alaska form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property alaska form

- Response to subcontractors request by corporation or llc alaska form

- Lenders response to stop lending notice individual alaska form

- Agreed written termination of lease by landlord and tenant alaska form

Find out other REV 1052 PA Department Of Revenue PA gov

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word