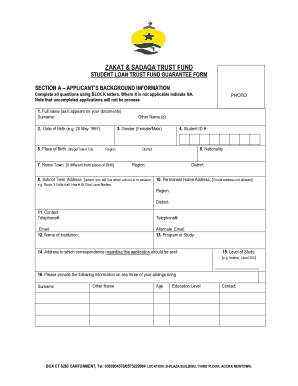

Zakat and Sadaqa Trust Fund Form

What is the Zakat and Sadaqa Trust Fund

The Zakat and Sadaqa Trust Fund is a charitable fund designed to facilitate the collection and distribution of zakat, which is a form of almsgiving treated in Islam as a religious obligation. It serves as a means for individuals to contribute to social welfare and support those in need within their communities. This fund helps ensure that the contributions are managed effectively and used for charitable purposes, aligning with Islamic principles.

How to use the Zakat and Sadaqa Trust Fund

Using the Zakat and Sadaqa Trust Fund involves several straightforward steps. First, individuals can determine the amount of zakat they are obligated to give based on their wealth. Next, they can fill out the zakat form, specifying their contributions. Once completed, the form can be submitted electronically through a secure platform, ensuring that donations reach the intended beneficiaries efficiently. This process promotes transparency and accountability in charitable giving.

Steps to complete the Zakat and Sadaqa Trust Fund

Completing the zakat form requires careful attention to detail. Here are the essential steps:

- Gather necessary financial information to calculate your zakat obligation.

- Access the zakat form through a reliable digital platform.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the information for any errors or omissions.

- Submit the form electronically, ensuring you receive a confirmation of submission.

Legal use of the Zakat and Sadaqa Trust Fund

To ensure the legal validity of the zakat form, it is essential to comply with relevant regulations. Electronic signatures are recognized under U.S. law, provided they meet specific criteria set forth by the ESIGN Act and UETA. Utilizing a trusted platform for eSigning can enhance the legal standing of the submitted zakat form, ensuring that it is binding and compliant with applicable laws.

IRS Guidelines

The IRS provides guidelines on charitable contributions, including zakat, which can be deducted from taxable income under certain conditions. To qualify for tax deductions, donors must keep detailed records of their contributions, including receipts and the completed zakat form. Familiarizing oneself with these guidelines can help maximize the benefits of charitable giving while ensuring compliance with tax regulations.

Required Documents

When completing the zakat form, certain documents may be required to substantiate your contributions. These typically include:

- Financial statements or records that demonstrate your wealth.

- Proof of previous zakat contributions, if applicable.

- Identification documents to verify your identity.

Form Submission Methods (Online / Mail / In-Person)

The zakat form can be submitted through various methods, allowing flexibility for contributors. Common submission methods include:

- Online submission via a secure digital platform, which is the most efficient and preferred method.

- Mailing a printed version of the completed form to the designated trust fund address.

- In-person submission at designated locations, if available, to ensure immediate processing.

Quick guide on how to complete zakat form

Complete zakat form effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed papers, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage zakat form on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign zakat and sadaqa trust fund with ease

- Find zakat form and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, by email, SMS, or invite link, or download it to your computer.

Stop worrying about missing or lost documents, tedious form searches, or mistakes that necessitate printing out new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Alter and eSign zakat and sadaqa trust fund and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the zakat and sadaqa trust fund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask zakat and sadaqa trust fund

-

What is a zakat form and why is it important?

A zakat form is a document that helps individuals and organizations calculate and declare their zakat obligations. It is important because it ensures that the correct amount of zakat is paid, fulfilling religious obligations and supporting those in need.

-

How can airSlate SignNow help with my zakat form?

airSlate SignNow offers an efficient solution to manage your zakat form by allowing you to create, send, and eSign documents easily. This streamlined process saves time and ensures that your zakat form is handled securely and accurately.

-

Is there a cost associated with using airSlate SignNow for my zakat form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan is designed to provide value, enabling you to manage your zakat form and other documents without breaking the bank.

-

What features does airSlate SignNow provide for handling zakat forms?

airSlate SignNow provides features such as customizable templates, electronic signatures, cloud storage, and real-time tracking for your zakat form. These features allow for enhanced document management and efficiency.

-

Can I integrate airSlate SignNow with other software to manage my zakat form?

Absolutely! airSlate SignNow offers integrations with various tools and software, making it easy to manage your zakat form alongside your existing systems. This ensures a seamless workflow and better data management.

-

How secure is my zakat form when using airSlate SignNow?

Security is a top priority for airSlate SignNow. Your zakat form will be protected with advanced encryption and compliance with industry standards, ensuring that your sensitive information remains confidential and safe.

-

Can I access my zakat form on mobile devices?

Yes, airSlate SignNow is mobile-friendly, allowing you to access, sign, and manage your zakat form on any device. This flexibility ensures that you can handle your documentation anytime, anywhere.

Get more for zakat form

Find out other zakat and sadaqa trust fund

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template