Indiana Form 103 Short

What is the Indiana Form 103 Short

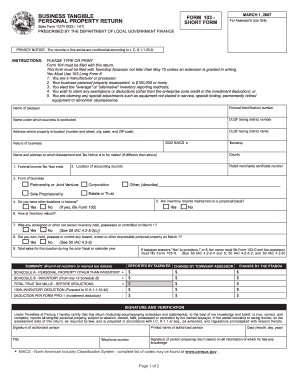

The Indiana Form 103 Short is a property tax form used in Indiana to report property ownership and assess property taxes. This form is specifically designed for individuals and entities that own property in the state and need to provide information regarding their property for tax assessment purposes. It simplifies the reporting process for certain property owners, making it easier to comply with state tax regulations.

How to use the Indiana Form 103 Short

Using the Indiana Form 103 Short involves several steps to ensure accurate reporting of property information. First, gather all necessary details about the property, including its location, type, and any exemptions that may apply. Next, fill out the form with the required information, ensuring that all fields are completed accurately. After completing the form, review it for any errors before submitting it to the appropriate local tax authority. This process can also be completed electronically, providing a more efficient way to manage property tax reporting.

Steps to complete the Indiana Form 103 Short

Completing the Indiana Form 103 Short involves a systematic approach:

- Gather property information, including address and ownership details.

- Identify any applicable exemptions that may reduce the tax burden.

- Fill in the form with accurate and complete information.

- Review the form for accuracy, checking for any missing information.

- Submit the completed form to the local tax authority by the designated deadline.

Legal use of the Indiana Form 103 Short

The legal use of the Indiana Form 103 Short is crucial for ensuring compliance with state tax laws. This form must be completed accurately to avoid penalties or issues with property tax assessments. Electronic submissions of the form are recognized as legally binding, provided they adhere to the necessary regulations and guidelines set forth by Indiana law. Utilizing a trusted eSignature platform can enhance the legal validity of the form by ensuring secure and compliant submission.

Key elements of the Indiana Form 103 Short

Key elements of the Indiana Form 103 Short include:

- Property identification information, such as the parcel number and address.

- Owner details, including names and contact information.

- Assessment information, including the type of property and any exemptions claimed.

- Signature of the property owner or authorized representative.

Form Submission Methods

The Indiana Form 103 Short can be submitted through various methods to accommodate different preferences. Property owners can choose to file the form electronically, which is often faster and more efficient. Alternatively, the form can be printed and mailed to the appropriate local tax authority. In some cases, in-person submissions may also be accepted, allowing for direct interaction with tax officials. Each method has its own advantages, and property owners should select the one that best fits their needs.

Quick guide on how to complete indiana form 103 short

Easily prepare Indiana Form 103 Short on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without hassles. Manage Indiana Form 103 Short on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to adjust and electronically sign Indiana Form 103 Short effortlessly

- Obtain Indiana Form 103 Short and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize important parts of the documents or redact confidential information using the tools provided specifically for this purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choosing. Adjust and electronically sign Indiana Form 103 Short and ensure excellent communication throughout any phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana form 103 short

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 103 short and how can airSlate SignNow help with it?

Form 103 short is a specific document used for various financial and legal applications. With airSlate SignNow, you can easily create, send, and eSign form 103 short, streamlining the process and ensuring compliance with industry standards.

-

Are there any costs associated with using airSlate SignNow for form 103 short?

airSlate SignNow offers competitive pricing plans that cater to different business needs. You can start with our free trial and explore the features for form 103 short without any initial cost, ensuring a cost-effective solution for your document signing needs.

-

What features does airSlate SignNow provide for managing form 103 short?

Our platform includes essential features like customizable templates, automated workflows, and secure cloud storage for form 103 short. This allows you to manage documents efficiently and keep all your agreements organized and accessible.

-

How does airSlate SignNow ensure the security of form 103 short?

Security is a top priority at airSlate SignNow. We use advanced encryption and compliance measures to protect your form 103 short and other documents, ensuring that your sensitive information remains confidential and secure.

-

Can I integrate airSlate SignNow with other applications for form 103 short?

Yes, airSlate SignNow offers numerous integrations with popular applications like Google Drive, Dropbox, and CRM systems. This seamless integration enhances your workflow for form 103 short and ensures that all your tools work together efficiently.

-

Is it difficult to eSign form 103 short using airSlate SignNow?

Not at all! airSlate SignNow provides a user-friendly interface that makes eSigning form 103 short quick and simple. With just a few clicks, you can sign documents digitally whether you're in the office or on the go.

-

What are the benefits of using airSlate SignNow for my form 103 short needs?

Using airSlate SignNow for form 103 short can greatly enhance your productivity by reducing paperwork and turnaround time. The platform simplifies the signing process, ensuring you can focus on your core business activities.

Get more for Indiana Form 103 Short

- Be my revocation of will form

- With the terms of the will and laws of the state of new jersey in reference to the procedures and form

- New jersey legal form titles us legal forms power of

- Health care provider disagreement form request for

- Application to workers compensation judgepdf fpdf docx form

- Control number nm004 d form

- Period of 10 days then the holder hereof may at its option declare the whole sum then form

- 30 printable bill of sale for watercraft forms and templates

Find out other Indiana Form 103 Short

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free