Small Business Rate Relief Application Bformb Ealing

Understanding the Small Business Rate Relief Application

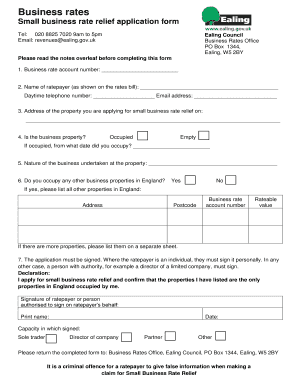

The Small Business Rate Relief application is designed to assist small businesses in reducing their business rates. This relief is particularly beneficial for those operating in areas where business rates can be a significant financial burden. The application process typically requires businesses to demonstrate their eligibility based on specific criteria, such as the size of the business and the nature of its operations. Understanding the requirements and the purpose of this application can help business owners make informed decisions regarding their financial obligations.

Steps to Complete the Small Business Rate Relief Application

Completing the Small Business Rate Relief application involves several key steps:

- Gather necessary documentation, including proof of business size and financial statements.

- Access the application form, which can usually be found on local government websites or through business support organizations.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the application for any errors or omissions before submission.

- Submit the application by the specified method, whether online, by mail, or in person.

Eligibility Criteria for Small Business Rate Relief

To qualify for Small Business Rate Relief, businesses must meet specific eligibility criteria. Generally, these criteria include:

- The business must occupy only one property with a rateable value below a certain threshold.

- The property must be used for non-domestic purposes.

- Businesses that receive other forms of relief may not qualify.

It is essential for business owners to review these criteria carefully to determine their eligibility before applying.

Required Documents for the Application

When applying for Small Business Rate Relief, businesses typically need to provide several documents to support their application. These may include:

- Proof of business registration, such as a business license or incorporation documents.

- Financial statements that demonstrate the business's revenue and expenses.

- Details of any other properties owned or occupied by the business.

Having these documents ready can streamline the application process and improve the chances of approval.

Form Submission Methods

Businesses can submit their Small Business Rate Relief application through various methods, including:

- Online submission via the local government’s website.

- Mailing the completed application form to the relevant local authority.

- In-person submission at designated government offices.

Choosing the right submission method can depend on the business's urgency and convenience.

Application Process and Approval Time

The application process for Small Business Rate Relief can vary by locality, but generally follows these steps:

- Submission of the application form and required documents.

- Review by the local council to verify eligibility.

- Notification of approval or denial, typically within a few weeks.

Understanding the timeline for approval can help businesses plan their finances accordingly.

Quick guide on how to complete small business rate relief application bformb ealing

Effortlessly Prepare Small Business Rate Relief Application Bformb Ealing on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Handle Small Business Rate Relief Application Bformb Ealing on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Streamlined Process to Modify and eSign Small Business Rate Relief Application Bformb Ealing with Ease

- Locate Small Business Rate Relief Application Bformb Ealing and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or mask sensitive information using features offered by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to preserve your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require generating new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Modify and eSign Small Business Rate Relief Application Bformb Ealing to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the small business rate relief application bformb ealing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is small business rate relief?

Small business rate relief is a government initiative designed to support small businesses by reducing their business rates. It can signNowly lower the costs associated with operating a small business, allowing you to allocate more resources to growth and development. If you qualify, this relief can make a considerable difference in your overall expenses.

-

How does airSlate SignNow support small businesses seeking rate relief?

AirSlate SignNow provides an easy-to-use, cost-effective solution that helps small businesses streamline their document management. With features like eSigning and seamless document sharing, we allow businesses to save time and reduce operational costs. This efficiency can complement the savings from small business rate relief, maximizing your budget.

-

What features does airSlate SignNow offer that benefit small businesses?

AirSlate SignNow offers a range of features including document eSigning, templates, and automated workflows that are particularly beneficial for small businesses. These features help enhance productivity, minimize paperwork, and improve customer satisfaction. Utilizing these tools along with small business rate relief can lead to greater efficiency and savings.

-

Is there a free trial available for small businesses using airSlate SignNow?

Yes, airSlate SignNow offers a free trial for small businesses to explore its features without any commitment. This trial allows you to assess how our solution can help you save time and money, especially when you're trying to take advantage of small business rate relief. Start your trial today to discover the benefits.

-

Can airSlate SignNow integrate with other tools my small business uses?

Absolutely! AirSlate SignNow integrates seamlessly with various tools and platforms that small businesses commonly use, such as CRMs and project management software. Integrating these tools can enhance your business operations, making it easier to manage tasks without affecting the small business rate relief you might be receiving.

-

What are the pricing plans for airSlate SignNow and how can they support small businesses?

AirSlate SignNow offers competitive pricing plans designed with small businesses in mind. These plans are structured to deliver value while considering cost-saving measures like small business rate relief. By choosing the right plan, small businesses can optimize their operations while minimizing overhead costs.

-

How can airSlate SignNow simplify the document signing process for small businesses?

AirSlate SignNow simplifies the document signing process with its intuitive interface, allowing small businesses to send and eSign documents quickly and securely. This ease of use aligns with the goals of small businesses to operate efficiently while also benefiting from any small business rate relief available. Streamlining this process can free up time for more strategic initiatives.

Get more for Small Business Rate Relief Application Bformb Ealing

- Justia workers response to complaint new mexico workers form

- Control number nm 029 78 form

- Article 13 table of contents rldstatenmus form

- Unmarried as joint tenants with the right of survivorship and not as tenants in common form

- Materialmans request individual form

- As grantors do hereby grant and warrant unto form

- Control number nm 032 78 form

- Control number nm 035 78 form

Find out other Small Business Rate Relief Application Bformb Ealing

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy