FORM ST 5 Rev 1 Georgia Department of Revenue Etax Dor Ga

Understanding the Georgia Sales Tax Exempt Form (ST-5)

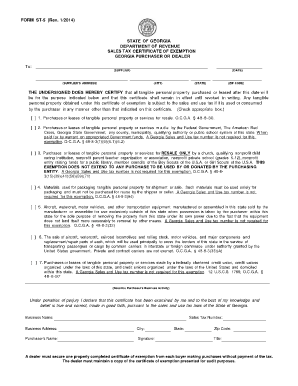

The Georgia Sales Tax Exempt Form, commonly referred to as the ST-5, is a crucial document for businesses and individuals seeking exemption from sales tax on certain purchases. This form is primarily used by organizations that qualify for tax-exempt status under Georgia law, including non-profit organizations, governmental entities, and certain educational institutions. By submitting the ST-5, eligible entities can avoid paying sales tax on purchases directly related to their exempt purposes.

Steps to Complete the Georgia Sales Tax Exempt Form (ST-5)

Completing the Georgia Sales Tax Exempt Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the name and address of the purchaser, the type of exempt organization, and the reason for the exemption. Next, accurately fill out the form, ensuring that all fields are completed. It is essential to sign and date the form to validate it. Finally, provide the completed form to the seller to facilitate tax-exempt purchases.

Eligibility Criteria for the Georgia Sales Tax Exempt Form (ST-5)

To qualify for the Georgia Sales Tax Exempt Form, applicants must meet specific eligibility criteria. Generally, organizations must be recognized as tax-exempt under federal or state law. Common examples include charitable organizations, educational institutions, and government entities. Additionally, the purchases made must be directly related to the exempt purpose of the organization. It is important to review the Georgia Department of Revenue guidelines to confirm eligibility before applying.

Legal Use of the Georgia Sales Tax Exempt Form (ST-5)

The legal use of the Georgia Sales Tax Exempt Form is governed by state tax laws. When properly completed and presented, the ST-5 serves as a valid document to claim exemption from sales tax. It is crucial for users to understand that misuse of the form, such as using it for non-qualifying purchases, can lead to penalties. Organizations must ensure compliance with all applicable laws and regulations to maintain their tax-exempt status.

Obtaining the Georgia Sales Tax Exempt Form (ST-5)

The Georgia Sales Tax Exempt Form can be obtained directly from the Georgia Department of Revenue's website or through authorized tax professionals. It is available in a printable format, allowing users to complete it manually. Additionally, some organizations may provide the form upon request, ensuring that eligible purchasers have easy access to this essential document.

Examples of Using the Georgia Sales Tax Exempt Form (ST-5)

There are various scenarios in which the Georgia Sales Tax Exempt Form can be utilized. For instance, a non-profit organization purchasing supplies for a community event can present the ST-5 to avoid sales tax on those items. Similarly, a government agency acquiring equipment for public use may also use the form to claim exemption. These examples illustrate the practical applications of the ST-5 in facilitating tax-exempt transactions.

Quick guide on how to complete form st 5 rev 1 georgia department of revenue etax dor ga

Prepare FORM ST 5 Rev 1 Georgia Department Of Revenue Etax Dor Ga effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an excellent eco-conscious substitute for conventional printed and signed documents, as you can locate the necessary form and securely archive it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Handle FORM ST 5 Rev 1 Georgia Department Of Revenue Etax Dor Ga on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign FORM ST 5 Rev 1 Georgia Department Of Revenue Etax Dor Ga effortlessly

- Obtain FORM ST 5 Rev 1 Georgia Department Of Revenue Etax Dor Ga and click on Get Form to commence.

- Make use of the tools we provide to complete your form.

- Highlight signNow sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal significance as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your modifications.

- Select how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and eSign FORM ST 5 Rev 1 Georgia Department Of Revenue Etax Dor Ga and ensure exceptional communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 5 rev 1 georgia department of revenue etax dor ga

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a GA tax exempt form?

A GA tax exempt form is a document that allows eligible organizations in Georgia to make purchases without paying sales tax. This form is essential for non-profits, government agencies, and other exempt entities. Using the GA tax exempt form helps these organizations save money on necessary purchases.

-

How can airSlate SignNow help with the GA tax exempt form process?

airSlate SignNow streamlines the process of filling out and signing your GA tax exempt form. With our easy-to-use platform, you can quickly create, edit, and send this form securely. This eliminates the need for paper submissions and helps ensure your documents are processed efficiently.

-

Is there a cost associated with using airSlate SignNow for the GA tax exempt form?

airSlate SignNow offers a cost-effective solution for managing the GA tax exempt form. Our pricing plans are competitive and tailored to meet the needs of businesses of all sizes. You can choose a plan that best fits your requirements without breaking the bank.

-

What features does airSlate SignNow provide for managing tax exempt forms?

airSlate SignNow provides essential features such as electronic signatures, template creation, and document sharing for managing your GA tax exempt form. You can track document status and store forms securely in the cloud. These features enhance productivity and simplify compliance with tax regulations.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax management software. This allows for efficient management of the GA tax exempt form and ensures that you can easily access and utilize your documents within your existing workflows. Integrations help minimize data entry and streamline processes.

-

How do I securely send a GA tax exempt form using airSlate SignNow?

To securely send your GA tax exempt form using airSlate SignNow, simply upload your completed document to the platform and enter the recipient's email. Our encrypted system ensures that your sensitive information is protected while delivering the form timely. You will also receive notifications upon signing.

-

What are the benefits of using airSlate SignNow for tax exempt forms?

Using airSlate SignNow for your GA tax exempt form offers several benefits, including increased efficiency, time savings, and reduced paper usage. The platform's user-friendly interface ensures that all users can manage forms effortlessly. Additionally, we provide secure storage and ease of access for all your essential documents.

Get more for FORM ST 5 Rev 1 Georgia Department Of Revenue Etax Dor Ga

- Alabama married form

- Codicil to will form for amending your will will changes or amendments alabama

- Legal last will and testament form for divorced person not remarried with adult and minor children alabama

- Mutual wills package with last wills and testaments for married couple with adult children alabama form

- Mutual wills package with last wills and testaments for married couple with no children alabama form

- Mutual wills package with last wills and testaments for married couple with minor children alabama form

- Legal last will and testament form for married person with adult and minor children from prior marriage alabama

- Legal last will and testament form for married person with adult and minor children alabama

Find out other FORM ST 5 Rev 1 Georgia Department Of Revenue Etax Dor Ga

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation