Loan Agreement Form

What is the Loan Agreement?

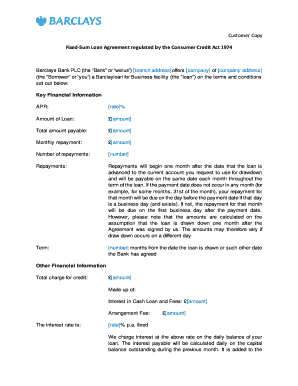

A loan agreement is a legally binding document that outlines the terms and conditions under which a lender provides funds to a borrower. This agreement specifies the amount of the loan, the interest rate, repayment schedule, and any penalties for missed payments. Understanding the components of a loan agreement is essential for both parties to ensure clarity and compliance with the terms set forth.

Key Elements of the Loan Agreement

Several critical elements make up a loan agreement. These include:

- Loan Amount: The total sum of money being borrowed.

- Interest Rate: The percentage charged on the loan amount, which can be fixed or variable.

- Repayment Schedule: Detailed timeline outlining when payments are due and the amount of each payment.

- Default Terms: Conditions under which the borrower may be considered in default and the repercussions that follow.

- Collateral: Any assets pledged by the borrower to secure the loan.

Steps to Complete the Loan Agreement

Completing a loan agreement involves several steps to ensure that all necessary information is accurately captured:

- Gather required information about the borrower and lender.

- Clearly outline the loan amount and interest rate.

- Define the repayment schedule, including due dates and amounts.

- Include any terms regarding penalties for late payments or defaults.

- Have both parties review the agreement thoroughly before signing.

Legal Use of the Loan Agreement

For a loan agreement to be legally binding, it must comply with relevant laws and regulations. This includes ensuring that the agreement is signed by both parties and that all terms are clear and enforceable. Additionally, the agreement must adhere to federal and state laws governing lending practices, which may vary across jurisdictions.

Application Process & Approval Time

The application process for a loan scheme typically involves submitting a formal request along with necessary documentation. This may include proof of income, credit history, and identification. After submission, the lender will review the application, which can take anywhere from a few days to several weeks, depending on the lender's policies and the complexity of the application.

Required Documents

When applying for a loan scheme, several documents are generally required to facilitate the approval process:

- Identification: Government-issued ID or driver's license.

- Proof of Income: Pay stubs, tax returns, or bank statements.

- Credit Report: A report detailing the borrower's credit history.

- Loan Purpose: Documentation explaining how the loan funds will be used.

Quick guide on how to complete loan agreement 421882908

Complete Loan Agreement seamlessly on any device

Online document management has gained popularity with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without complications. Manage Loan Agreement on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

The easiest way to edit and eSign Loan Agreement effortlessly

- Find Loan Agreement and click Get Form to begin.

- Utilize the tools we offer to fill in your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or disorganized files, tedious form searches, or errors that require new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you prefer. Edit and eSign Loan Agreement and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan agreement 421882908

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a pay agreement and how does it work with airSlate SignNow?

A pay agreement is a legally binding document that outlines the terms of a payment arrangement between parties. With airSlate SignNow, users can easily create, send, and eSign pay agreements securely online, ensuring all parties understand their payment obligations.

-

How much does it cost to use airSlate SignNow for creating pay agreements?

The cost of using airSlate SignNow for pay agreements depends on the selected pricing plan. We offer various plans tailored for individuals and businesses, allowing flexibility to choose one that fits your budget. Explore our pricing page for detailed information on each plan's features and benefits.

-

What features does airSlate SignNow offer for managing pay agreements?

airSlate SignNow provides a range of features for managing pay agreements, including customizable templates, automated reminders, and real-time tracking of document status. These tools streamline the entire process, making it efficient and user-friendly for both sender and recipient.

-

Can I integrate airSlate SignNow with other applications for my pay agreements?

Yes, airSlate SignNow offers integrations with various applications like Google Drive, Dropbox, and CRM systems. This allows you to manage your pay agreements seamlessly alongside other tools you use, enhancing overall efficiency in your workflows.

-

Is it secure to send pay agreements using airSlate SignNow?

Absolutely! airSlate SignNow employs industry-standard encryption and compliance measures to ensure the security of your pay agreements. Your sensitive information is protected throughout the signing process, giving you peace of mind when sending and receiving documents.

-

How can I track the status of my pay agreements in airSlate SignNow?

You can easily track the status of your pay agreements in airSlate SignNow through the user dashboard. It provides real-time updates on whether the document has been viewed, signed, or requires action from recipients, streamlining your document management process.

-

Are there any benefits to using airSlate SignNow for pay agreements compared to traditional methods?

Using airSlate SignNow for pay agreements has numerous benefits, including signNow time savings and enhanced efficiency. Unlike traditional methods, electronic signatures eliminate the need for printing, scanning, and mailing documents, allowing for swift execution of agreements.

Get more for Loan Agreement

- Order appointing form

- Form 7 10

- Person in need of supervision forms pinsnycourtsgov

- Persons in need of supervision new york state unified court form

- Faqs new york state unified court form

- New york state court acts family court fct 633ny form

- Fillable online form 7 17 fax email print pdffiller

- Person in need of supervision form

Find out other Loan Agreement

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself