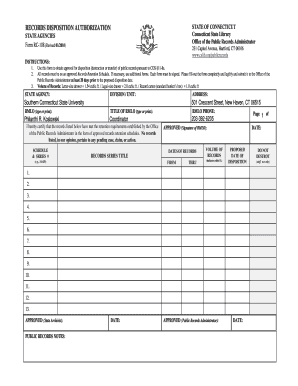

Ct Records Retention Schedule Form

What is the Ct Records Retention Schedule

The Ct Records Retention Schedule outlines the required timeframes for retaining various types of records within Connecticut. This schedule is essential for ensuring compliance with state laws and regulations regarding record-keeping. It specifies categories of records, such as financial documents, personnel files, and legal correspondence, along with the duration for which each type must be retained. Understanding this schedule helps organizations manage their records effectively, reducing the risk of legal issues and ensuring that important information is preserved as needed.

How to Use the Ct Records Retention Schedule

Using the Ct Records Retention Schedule involves several key steps. First, identify the types of records your organization maintains and match them with the appropriate categories listed in the schedule. Next, determine the retention period for each record type, which indicates how long you must keep each document before it can be disposed of. It is also important to regularly review your records management practices to ensure compliance with the schedule. This proactive approach helps organizations avoid potential penalties for non-compliance and ensures that records are accessible when needed.

Key Elements of the Ct Records Retention Schedule

Several key elements are vital to understanding the Ct Records Retention Schedule. These include:

- Record Categories: Different types of records are categorized based on their nature and importance.

- Retention Periods: Each category specifies how long records must be retained, which can vary from a few years to indefinitely.

- Disposal Guidelines: Instructions on how to properly dispose of records once the retention period has expired, ensuring confidentiality and compliance.

- Legal References: Citations of relevant laws and regulations that govern record retention, providing a legal framework for compliance.

Steps to Complete the Ct Records Retention Schedule

Completing the Ct Records Retention Schedule involves a systematic approach. Start by gathering all existing records and categorizing them according to the schedule. Next, assign retention periods based on the guidelines provided. Ensure that all staff members understand their responsibilities regarding record maintenance and disposal. Regular audits of records should be conducted to verify compliance with the established retention periods. Document any changes or updates to the schedule to maintain an accurate record of your organization’s compliance efforts.

Legal Use of the Ct Records Retention Schedule

The Ct Records Retention Schedule serves a legal purpose by ensuring that organizations comply with state regulations regarding record retention. Proper adherence to the schedule can protect businesses from legal liabilities related to improper record disposal or retention. It is crucial for organizations to familiarize themselves with the legal implications of record retention and to implement policies that align with the schedule to avoid potential penalties and ensure that records are available for audits or legal inquiries.

Examples of Using the Ct Records Retention Schedule

Practical examples of using the Ct Records Retention Schedule can enhance understanding. For instance, a business may categorize employee personnel files under a specific section of the schedule, which may require retention for seven years after an employee leaves the company. Similarly, financial records, such as tax documents, might need to be retained for a period of three years. By following these examples, organizations can effectively manage their records in compliance with state requirements.

Quick guide on how to complete ct records retention schedule

Prepare Ct Records Retention Schedule seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Ct Records Retention Schedule on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to edit and eSign Ct Records Retention Schedule effortlessly

- Obtain Ct Records Retention Schedule and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from a device of your choice. Edit and eSign Ct Records Retention Schedule and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct records retention schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a retention schedule template?

A retention schedule template is a document that outlines how long different types of records should be kept before being disposed of. This template helps organizations manage their data effectively, ensuring compliance with legal requirements while optimizing storage resources.

-

How can airSlate SignNow help with my retention schedule template?

With airSlate SignNow, you can easily create, modify, and share your retention schedule template with team members. Our platform's eSignature functionality ensures that all stakeholders can sign off on the document promptly, facilitating a smooth approval process for your data management policies.

-

Is there a cost associated with using airSlate SignNow for my retention schedule template?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for creating your retention schedule template. You can choose a plan that provides the right features and capabilities for your organization without breaking the budget.

-

What features are included in the retention schedule template with airSlate SignNow?

Our retention schedule template includes essential features such as customizable templates, document storage, automated reminders for record retention, and secure electronic signatures. These features streamline the management of your retention schedule and enhance compliance with regulatory standards.

-

Can I customize the retention schedule template to meet my organization’s needs?

Absolutely! The retention schedule template in airSlate SignNow is fully customizable. You can modify retention periods, add specific data categories, and tailor it to align with your organization’s policies and regulatory requirements.

-

Does airSlate SignNow offer integrations for the retention schedule template?

Yes, airSlate SignNow seamlessly integrates with popular business applications, enhancing the functionality of your retention schedule template. This allows for better data management and coordination across various platforms, making it easier to track and retain important documents.

-

What benefits can I expect by using a retention schedule template in airSlate SignNow?

Using a retention schedule template in airSlate SignNow offers numerous benefits, including improved compliance, reduced storage costs, and enhanced productivity. It provides a structured approach to managing records, ensuring your organization adheres to legal obligations while freeing up valuable resources.

Get more for Ct Records Retention Schedule

Find out other Ct Records Retention Schedule

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile