ATT 104 Georgia Department of Revenue Etax Dor Ga Form

What is the ATT 104 Georgia Department of Revenue Etax Dor Ga

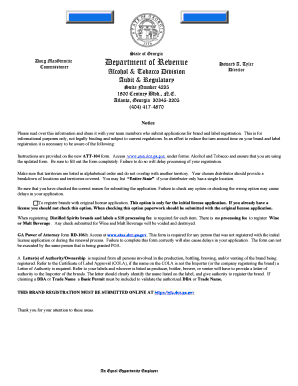

The ATT 104 Georgia Department of Revenue Etax Dor Ga form is a crucial document used for electronic tax filing in the state of Georgia. This form is specifically designed for taxpayers to report various tax obligations electronically, streamlining the process for both individuals and businesses. It serves as an official declaration of income and tax liability, ensuring compliance with state tax laws. Understanding the purpose and requirements of this form is essential for accurate and timely filing.

Steps to complete the ATT 104 Georgia Department of Revenue Etax Dor Ga

Completing the ATT 104 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, access the online platform where the form is hosted. Fill in the required fields with accurate information, ensuring all entries align with the gathered documents. Review the completed form for any errors or omissions before submitting it electronically. Finally, retain a copy of the submitted form for your records, as it serves as proof of your filing.

Legal use of the ATT 104 Georgia Department of Revenue Etax Dor Ga

The ATT 104 form is legally recognized as a valid method for submitting tax information to the Georgia Department of Revenue. To ensure its legal standing, it must be completed accurately and submitted within the designated filing deadlines. The form complies with the Electronic Signatures in Global and National Commerce Act (ESIGN), which affirms the legality of electronic signatures. This compliance guarantees that the form, once submitted, holds the same weight as a traditional paper document in legal contexts.

Filing Deadlines / Important Dates

Filing deadlines for the ATT 104 form are crucial for taxpayers to adhere to in order to avoid penalties. Typically, the deadline aligns with the federal tax filing date, which is April 15 for most individuals. However, specific deadlines may vary based on the taxpayer's situation, such as extensions or special circumstances. It is important to stay informed about any changes to these dates by regularly checking updates from the Georgia Department of Revenue.

Required Documents

To successfully complete the ATT 104 form, certain documents must be prepared in advance. These include W-2 forms, 1099 forms, and any other relevant income documentation. Additionally, taxpayers should have records of deductions and credits they plan to claim. Ensuring that all required documents are organized and accessible will facilitate a smoother filing process and help prevent errors.

Form Submission Methods (Online / Mail / In-Person)

The ATT 104 form can be submitted through various methods, providing flexibility for taxpayers. The most efficient way is to file electronically through the Georgia Department of Revenue's online portal. This method allows for immediate processing and confirmation. Alternatively, taxpayers may choose to mail the completed form or submit it in person at designated locations. Each method has specific instructions and timelines that should be followed to ensure compliance.

Who Issues the Form

The ATT 104 form is issued by the Georgia Department of Revenue, the state agency responsible for tax collection and regulation. This department oversees the administration of tax laws and ensures that all forms are updated to reflect current regulations. Taxpayers can rely on the department for guidance on how to complete the form and for any inquiries related to their tax obligations.

Quick guide on how to complete att 104 georgia department of revenue etax dor ga

Prepare ATT 104 Georgia Department Of Revenue Etax Dor Ga effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage ATT 104 Georgia Department Of Revenue Etax Dor Ga on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest way to modify and eSign ATT 104 Georgia Department Of Revenue Etax Dor Ga effortlessly

- Obtain ATT 104 Georgia Department Of Revenue Etax Dor Ga and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign ATT 104 Georgia Department Of Revenue Etax Dor Ga and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the att 104 georgia department of revenue etax dor ga

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ogc dor georgia gov and how does it relate to eSigning?

The ogc dor georgia gov refers to the official site for the Georgia Department of Revenue's Office of General Counsel. It provides essential information and resources that can be seamlessly integrated with eSigning platforms like airSlate SignNow, enabling businesses to handle legal documents efficiently.

-

How does airSlate SignNow integrate with ogc dor georgia gov services?

airSlate SignNow allows for easy integration with ogc dor georgia gov services, enabling users to securely send and eSign documents related to state compliance and revenue matters. This integration helps streamline processes, ensuring that businesses remain compliant with Georgia state laws.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to fit different business needs. While specific pricing details can be found on our website, we ensure that our plans provide cost-effective solutions for managing document workflows, including those related to ogc dor georgia gov requirements.

-

What features does airSlate SignNow offer for users in Georgia?

airSlate SignNow features include customizable templates, team collaboration tools, and advanced security options specifically designed to meet the needs of users involved with ogc dor georgia gov processes. These features simplify document management while ensuring compliance with local regulations.

-

What are the benefits of using airSlate SignNow for ogc dor georgia gov-related documents?

Using airSlate SignNow for ogc dor georgia gov-related documents provides numerous benefits, including increased efficiency in document handling, reduced turnaround times, and enhanced security. Our platform ensures that all documents remain compliant with Georgia's legal standards.

-

Can I use airSlate SignNow on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing users to access ogc dor georgia gov related documents anytime and anywhere. The mobile capabilities make it convenient for busy professionals to manage and sign documents on the go.

-

What type of customer support does airSlate SignNow provide?

airSlate SignNow offers robust customer support, including live chat, email assistance, and comprehensive knowledge base resources tailored for users dealing with ogc dor georgia gov documents. Our support team is committed to helping you resolve any issues quickly and efficiently.

Get more for ATT 104 Georgia Department Of Revenue Etax Dor Ga

- Colorado financial affidavit form

- Finding and order concerning payment of fees colorado form

- Authorization payment form

- Court appointed form

- Colorado income tax form

- Instructions filing court form

- Notice of appeal and designation of record criminal colorado form

- Motion to determine factual innocence colorado form

Find out other ATT 104 Georgia Department Of Revenue Etax Dor Ga

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF