Colorado State Sales and Use Tax Exemption for Low Emitting Colorado Form

Understanding the Colorado State Sales and Use Tax Exemption for Low Emitting Vehicles

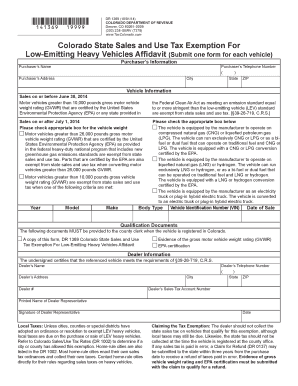

The Colorado State Sales and Use Tax Exemption for Low Emitting Vehicles is designed to encourage the purchase of environmentally friendly vehicles. This exemption allows qualifying individuals and businesses to avoid paying state sales tax on eligible low-emission vehicles. To qualify, the vehicle must meet specific emissions standards set by the state, which are intended to reduce air pollution and promote sustainability.

Eligibility Criteria for the Colorado Tax Exemption Form

To be eligible for the Colorado tax exemption, the vehicle must be classified as a low-emission vehicle according to state regulations. This includes electric vehicles, hybrid vehicles, and certain models that meet stringent emissions criteria. Additionally, the applicant must provide proof of residency in Colorado and ownership of the vehicle. It is essential to ensure that all documentation is accurate and complete to avoid delays in the approval process.

Steps to Complete the Colorado Tax Exemption Form

Completing the Colorado tax exemption form involves several key steps:

- Gather necessary documentation, including proof of vehicle eligibility and residency.

- Fill out the Colorado tax exemption form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with any supporting documents to the appropriate state agency.

Following these steps carefully can help streamline the process and ensure timely approval.

Legal Use of the Colorado Tax Exemption Certificate

The Colorado tax exemption certificate is legally binding when completed and submitted according to state regulations. It is crucial for applicants to understand that misuse of the exemption can lead to penalties, including fines or revocation of the exemption. Ensuring compliance with all requirements and maintaining accurate records of the exemption can help avoid legal issues.

Examples of Using the Colorado Tax Exemption Form

Individuals and businesses can utilize the Colorado tax exemption form in various scenarios. For instance, a resident purchasing a new electric vehicle can apply for the exemption to reduce the overall cost. Similarly, businesses that invest in low-emission vehicles for their fleets can also benefit from this exemption, making it a valuable financial incentive for environmentally conscious choices.

Required Documents for the Colorado Tax Exemption Form

When applying for the Colorado tax exemption, applicants must submit several key documents:

- Proof of vehicle eligibility, such as the vehicle identification number (VIN) and emissions certification.

- Proof of residency in Colorado, which may include a utility bill or lease agreement.

- Completed Colorado tax exemption form.

Having these documents ready can facilitate a smoother application process and help ensure compliance with state requirements.

Quick guide on how to complete colorado state sales and use tax exemption for low emitting colorado

Prepare Colorado State Sales And Use Tax Exemption For Low Emitting Colorado effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents promptly without any holdups. Manage Colorado State Sales And Use Tax Exemption For Low Emitting Colorado on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and eSign Colorado State Sales And Use Tax Exemption For Low Emitting Colorado with ease

- Find Colorado State Sales And Use Tax Exemption For Low Emitting Colorado and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive data with tools designed by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or missing documents, the hassle of searching for forms, or mistakes that necessitate reprinting document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Colorado State Sales And Use Tax Exemption For Low Emitting Colorado and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colorado state sales and use tax exemption for low emitting colorado

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to colorado state tax?

airSlate SignNow is an eSignature solution that allows businesses to easily send and sign documents online. By utilizing this platform, you can simplify the documentation process related to colorado state tax, ensuring that your tax forms are completed quickly and securely.

-

How does airSlate SignNow help with filing colorado state tax documents?

Using airSlate SignNow, you can efficiently manage and sign the necessary documents for filing colorado state tax. The platform enables you to streamline document workflows, making it easier to gather signatures and submit your tax paperwork on time, ultimately reducing the risk of errors.

-

What features does airSlate SignNow offer for managing colorado state tax forms?

airSlate SignNow offers a variety of features perfect for handling colorado state tax forms. These include customizable templates, automated reminders for important deadlines, and seamless collaboration options, ensuring that your team can work together effectively to meet tax obligations.

-

Is airSlate SignNow cost-effective for small businesses dealing with colorado state tax?

Yes, airSlate SignNow provides a cost-effective solution for small businesses managing their colorado state tax requirements. With flexible pricing plans, you can choose an option that fits your budget while still gaining access to essential tools necessary for efficient tax management.

-

Can airSlate SignNow integrate with other software used for managing colorado state tax?

Absolutely! airSlate SignNow can seamlessly integrate with various business applications, enabling you to manage your colorado state tax processes more effectively. This integration helps you avoid manual data entry and keeps all your tax documentation organized across different platforms.

-

What are the benefits of using airSlate SignNow for colorado state tax documentation?

By using airSlate SignNow for your colorado state tax documentation, you benefit from enhanced security features, faster processing times, and improved compliance with state regulations. The platform also simplifies the signing process, making it easier to collect necessary signatures and maintain accurate records.

-

How secure is airSlate SignNow when handling colorado state tax confidential information?

airSlate SignNow prioritizes security, ensuring that all information related to colorado state tax is protected. The platform employs advanced encryption methods and follows industry standards to safeguard your sensitive data, giving you peace of mind while processing tax documents.

Get more for Colorado State Sales And Use Tax Exemption For Low Emitting Colorado

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497301484 form

- Dc business form

- Agreement shareholders 497301486 form

- District of columbia directors form

- Corporate records maintenance package for existing corporations district of columbia form

- District of columbia limited liability company llc formation package district of columbia

- Limited liability company llc operating agreement district of columbia form

- Dc llc form

Find out other Colorado State Sales And Use Tax Exemption For Low Emitting Colorado

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online