Related Party Declaration Form

What is the related party declaration form

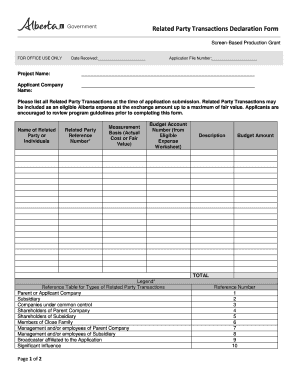

The related party declaration form is a crucial document used to disclose transactions and relationships between parties that have a close connection, such as family members or business partners. This form ensures transparency in financial dealings, helping organizations comply with regulations and maintain ethical standards. It typically requires detailed information about the nature of the relationship, the transactions involved, and the financial implications for all parties. Proper completion of this form is essential for accurate reporting and accountability in business practices.

How to use the related party declaration form

Using the related party declaration form involves several key steps. First, gather all necessary information about the related parties, including names, addresses, and the nature of the relationship. Next, provide details about any transactions that have taken place, such as sales, loans, or services rendered. It is important to be thorough and accurate, as this information will be reviewed for compliance and transparency. After filling out the form, ensure that all parties sign it to validate the disclosures made. This form can be submitted electronically or in paper format, depending on the organization's requirements.

Steps to complete the related party declaration form

Completing the related party declaration form requires careful attention to detail. Follow these steps for a successful submission:

- Gather Information: Collect names, addresses, and relevant details about all related parties.

- Detail Transactions: List all transactions, including dates, amounts, and the nature of each transaction.

- Review Relationships: Clearly define the nature of the relationship between the parties involved.

- Sign the Form: Ensure all parties sign and date the form to confirm the accuracy of the information provided.

- Submit the Form: Follow your organization’s guidelines for submitting the form, whether online or via mail.

Legal use of the related party declaration form

The legal use of the related party declaration form is essential for compliance with various regulations. In the United States, businesses are required to disclose related party transactions to prevent conflicts of interest and ensure fair reporting. This form serves as a legal document that can be referenced in audits or legal proceedings, providing evidence of transparency and ethical conduct. Failure to accurately complete and submit this form can result in legal penalties and damage to the organization’s reputation.

Key elements of the related party declaration form

Key elements of the related party declaration form include:

- Identification of Parties: Names and addresses of all related parties involved.

- Nature of Relationship: Description of how the parties are related, such as familial ties or business partnerships.

- Transaction Details: Comprehensive information about transactions, including amounts, dates, and purposes.

- Signatures: Required signatures from all parties to validate the information provided.

- Date of Declaration: The date on which the declaration is completed and signed.

Disclosure requirements

Disclosure requirements for the related party declaration form are established to promote transparency and accountability. Organizations must disclose all related party transactions that exceed a certain threshold, as defined by regulatory bodies. This includes not only direct transactions but also indirect relationships that may influence financial decisions. Accurate disclosures help prevent conflicts of interest and ensure that stakeholders are informed about potential biases in financial reporting. Organizations should regularly review their disclosure practices to remain compliant with evolving regulations.

Quick guide on how to complete related party declaration form

Complete Related Party Declaration Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Related Party Declaration Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Related Party Declaration Form with minimal effort

- Find Related Party Declaration Form and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Mark important sections of the documents or redact sensitive content using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign feature, which takes moments and has the same legal authority as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and eSign Related Party Declaration Form while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the related party declaration form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a related party declaration form?

A related party declaration form is a document used to disclose relationships and transactions between an entity and its related parties. This form helps ensure transparency and compliance with regulations by identifying potential conflicts of interest. Using airSlate SignNow, you can easily create, send, and eSign related party declaration forms.

-

How can I create a related party declaration form using airSlate SignNow?

Creating a related party declaration form with airSlate SignNow is straightforward. You can start with a customizable template or create one from scratch using our user-friendly interface. Once designed, you can instantly send it out for signatures, ensuring a seamless workflow.

-

What are the benefits of using airSlate SignNow for related party declaration forms?

Using airSlate SignNow for related party declaration forms offers numerous benefits, including fast document turnaround, improved security with eSignature compliance, and the ability to track document status in real-time. Additionally, our platform reduces paperwork and manual errors, saving you time and enhancing efficiency.

-

Is there a cost associated with using airSlate SignNow for related party declaration forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget while accessing unlimited signing and document management features for related party declaration forms. A free trial option is also available for you to explore our services.

-

Can I integrate airSlate SignNow with other software for related party declaration forms?

Absolutely! airSlate SignNow integrates seamlessly with various business applications such as CRM systems, document management tools, and cloud storage solutions. This integration allows you to automate workflows and keep your related party declaration forms organized across platforms.

-

What security features does airSlate SignNow offer for related party declaration forms?

airSlate SignNow prioritizes security with features like SSL encryption, two-factor authentication, and audit trails for all signed documents, including related party declaration forms. These measures ensure that your sensitive information remains protected and complies with industry regulations.

-

How do I send a related party declaration form for eSignature?

To send a related party declaration form for eSignature using airSlate SignNow, simply upload your document, add the necessary signers, and click 'send.' The recipients will receive an email notification to review and sign the form digitally, all within a few clicks.

Get more for Related Party Declaration Form

- Because of winn dixie worksheets pdf form

- Design job request form gordon

- Amendment to purchase agreement form

- Trimind form

- Format for project profile cum claim form for claiming 50

- Financial responsibility agreement template form

- Approval form 1b 18905857

- Phone california highway patrol state of california chp ca form

Find out other Related Party Declaration Form

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online