W Ra Form

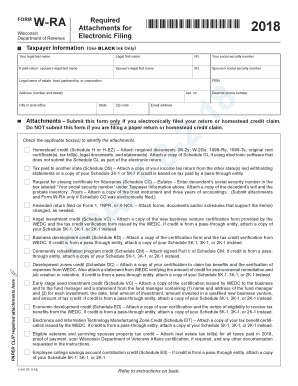

What is the W-RA?

The W-RA, or Wisconsin Form W-RA, is a tax form used by individuals and businesses in Wisconsin to report certain financial information. This form is particularly relevant for those who need to claim a refund of Wisconsin income tax withheld from their wages or other income. Understanding the purpose and requirements of the W-RA is essential for accurate tax reporting and compliance.

How to use the W-RA

Using the W-RA involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including W-2 forms and any other income statements. Next, fill out the W-RA by providing your personal information, including your name, address, and Social Security number. Be sure to include details about the income for which you are claiming a refund. After completing the form, review it for accuracy before submission.

Steps to complete the W-RA

Completing the W-RA involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather necessary documents, such as W-2s and 1099s.

- Provide your personal information, including name, address, and Social Security number.

- Detail the income for which you are seeking a refund.

- Review the form for any errors or omissions.

- Submit the completed form either online or by mail, as per your preference.

Legal use of the W-RA

The legal use of the W-RA is governed by Wisconsin state tax laws. To ensure that your submission is compliant, it is important to adhere to the guidelines set forth by the Wisconsin Department of Revenue. This includes providing accurate information and submitting the form within the designated time frame. Failure to comply with these regulations may result in penalties or delays in processing your refund.

Key elements of the W-RA

Key elements of the W-RA include personal identification information, income details, and the specific amounts of tax withheld. The form also requires signatures to validate the information provided. It is important to ensure that all sections are completed accurately to avoid issues with the Wisconsin Department of Revenue during processing.

Filing Deadlines / Important Dates

Filing deadlines for the W-RA are critical for ensuring timely processing of your tax refund. Typically, the form must be submitted by April 15 of the year following the tax year in question. However, it is advisable to check for any changes in deadlines or extensions that may apply to your specific situation. Staying informed about these dates helps prevent penalties and ensures that you receive your refund promptly.

Form Submission Methods (Online / Mail / In-Person)

The W-RA can be submitted through various methods, providing flexibility for users. You can file the form online via the Wisconsin Department of Revenue's website, which offers a streamlined process. Alternatively, you may choose to mail the completed form to the appropriate address or submit it in person at designated state offices. Each method has its own processing times, so consider your needs when selecting a submission method.

Quick guide on how to complete w ra

Complete W Ra seamlessly on any device

Online document management has gained traction among enterprises and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage W Ra on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign W Ra with ease

- Obtain W Ra and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from the device of your choice. Modify and eSign W Ra and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w ra

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it utilize w ra?

airSlate SignNow is a versatile e-signature platform that allows businesses to send and eSign documents seamlessly. With its user-friendly interface, companies can easily manage their workflows and streamline transactions, saving time and reducing errors. Utilizing w ra, SignNow enhances document security and compliance.

-

How much does airSlate SignNow cost?

AirSlate SignNow offers flexible pricing plans tailored to various business needs, starting at an affordable rate. Choosing a plan depends on the number of users and features required. Investing in airSlate SignNow with its focus on w ra can lead to signNow cost savings in document management.

-

What features does airSlate SignNow offer?

airSlate SignNow provides an extensive range of features including e-signatures, templates, document management, and mobile access. Its advanced functionalities, such as the integration of w ra, ensure that users can efficiently track document status and collaborate with team members remotely. These features make it an all-in-one solution for businesses.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow seamlessly integrates with popular applications like Salesforce, Google Drive, and Microsoft Office. These integrations allow businesses to utilize w ra alongside existing tools, ensuring a cohesive workflow and maximum efficiency. The ability to connect multiple platforms enhances the overall user experience.

-

What are the benefits of using airSlate SignNow for document management?

Using airSlate SignNow for document management offers numerous benefits, including improved efficiency, reduced turnaround times, and enhanced security. The incorporation of w ra in its processes ensures that documents are handled with the utmost care, minimizing risks associated with traditional methods. This leads to better productivity and streamlined operations.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises. Its cost-effective pricing and scalable features make it an ideal choice for startups or smaller organizations looking to implement w ra into their operations without a signNow financial burden.

-

What security measures are in place with airSlate SignNow?

airSlate SignNow prioritizes security with multiple layers of protection, including data encryption and secure access protocols. The platform's commitment to w ra ensures compliance with industry standards and regulations, protecting sensitive information throughout the document signing process. This peace of mind is crucial for businesses dealing with confidential data.

Get more for W Ra

- Florida southern district bankruptcy guide and forms package for chapters 7 or 13 florida

- Bill of sale with warranty by individual seller florida form

- Bill of sale with warranty for corporate seller florida form

- Florida bill sale form

- Bill of sale without warranty by corporate seller florida form

- Florida marriage 497303245 form

- Correction statement and agreement florida form

- Florida closing 497303248 form

Find out other W Ra

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form