Employer Withholding Forms and City of Big Rapids Ci Big Rapids Mi

What is the Employer Withholding Forms and City of Big Rapids CI Big Rapids MI

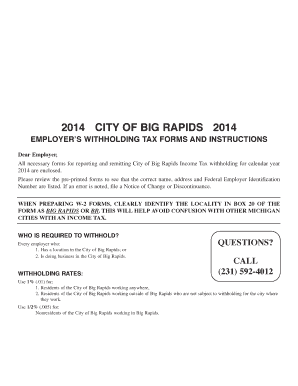

The Employer Withholding Forms are essential documents that employers in Big Rapids, Michigan, must use to report and withhold income taxes from employee wages. These forms ensure compliance with federal and state tax regulations, allowing employers to accurately calculate the amount of tax to withhold based on employee earnings. The forms also provide necessary information to the City of Big Rapids, ensuring that local tax obligations are met. Understanding these forms is crucial for both employers and employees to maintain compliance and avoid potential penalties.

Steps to Complete the Employer Withholding Forms and City of Big Rapids CI Big Rapids MI

Completing the Employer Withholding Forms involves several key steps:

- Gather necessary employee information, including Social Security numbers and tax filing status.

- Determine the appropriate withholding allowances using the IRS guidelines.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors before submission.

- Submit the completed form to the appropriate tax authorities, either online or via mail.

Following these steps helps ensure that the forms are completed correctly, reducing the risk of errors and potential audits.

Legal Use of the Employer Withholding Forms and City of Big Rapids CI Big Rapids MI

The legal use of the Employer Withholding Forms is governed by federal and state tax laws. These forms must be filled out accurately to reflect the correct withholding amounts. Employers are required to maintain records of these forms for a specified period, as they may be subject to review by tax authorities. Compliance with regulations such as the IRS guidelines and state-specific laws is essential to avoid penalties and ensure that employees' tax obligations are met.

Key Elements of the Employer Withholding Forms and City of Big Rapids CI Big Rapids MI

Key elements of the Employer Withholding Forms include:

- Employee Information: Name, address, and Social Security number.

- Filing Status: Single, married, or head of household.

- Withholding Allowances: Number of allowances claimed by the employee.

- Additional Withholding: Any extra amount the employee wishes to withhold.

These elements are crucial for accurately calculating the tax withheld from employee wages and ensuring compliance with tax laws.

IRS Guidelines for Employer Withholding Forms

The IRS provides specific guidelines for completing Employer Withholding Forms. Employers must refer to the IRS Publication 15 (Circular E) for detailed instructions on how to fill out these forms correctly. This publication outlines the requirements for withholding, depositing, and reporting federal income tax, Social Security, and Medicare taxes. Adhering to these guidelines helps employers avoid common mistakes and ensures proper compliance with federal tax laws.

Filing Deadlines and Important Dates

Filing deadlines for the Employer Withholding Forms are critical for compliance. Employers must submit these forms by the specified due dates to avoid penalties. Typically, forms must be filed by January 31 for the previous tax year. Additionally, employers should be aware of quarterly deadlines for remitting withheld taxes to the IRS and state authorities. Keeping track of these deadlines is essential for maintaining good standing with tax agencies.

Quick guide on how to complete employer withholding forms and city of big rapids ci big rapids mi

Complete Employer Withholding Forms And City Of Big Rapids Ci Big rapids Mi effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Employer Withholding Forms And City Of Big Rapids Ci Big rapids Mi on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Employer Withholding Forms And City Of Big Rapids Ci Big rapids Mi effortlessly

- Obtain Employer Withholding Forms And City Of Big Rapids Ci Big rapids Mi and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then select the Done button to save your changes.

- Choose how you would like to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Employer Withholding Forms And City Of Big Rapids Ci Big rapids Mi to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employer withholding forms and city of big rapids ci big rapids mi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to miela locality name?

airSlate SignNow is a robust eSignature platform that empowers businesses, including those in the miela locality name, to streamline their document signing processes. It offers a user-friendly interface that makes sending and signing documents easy. By integrating advanced features, airSlate SignNow enables local businesses to improve their efficiency while ensuring compliance with legal standards.

-

What are the key features of airSlate SignNow for users in miela locality name?

The key features of airSlate SignNow include customizable templates, automation workflows, and secure eSignature capabilities. For customers in the miela locality name, these features help facilitate easy document management, reduce turnaround times, and improve overall productivity. With a focus on user experience, airSlate SignNow is designed to meet the specific needs of diverse businesses.

-

How much does airSlate SignNow cost for businesses in miela locality name?

airSlate SignNow offers flexible pricing plans to accommodate various business sizes in the miela locality name. Pricing generally depends on the features selected and the number of users required. This ensures that businesses can find a cost-effective solution that fits their budget without compromising on essential features.

-

Are there any integrations available with airSlate SignNow for miela locality name users?

Yes, airSlate SignNow integrates with a wide range of applications and tools commonly used by businesses in the miela locality name. This includes popular platforms like Google Drive, Salesforce, and authentication services. These integrations allow users to streamline their workflows, enhance collaboration, and ensure a seamless experience across different software.

-

What are the benefits of using airSlate SignNow for local businesses in miela locality name?

Businesses in the miela locality name stand to benefit signNowly from using airSlate SignNow. The platform not only enhances operational efficiency through quick document turnaround, but also helps in reducing paper usage, contributing to a more environmentally friendly approach. Additionally, it ensures secure and legally binding signatures, boosting customer trust.

-

Is airSlate SignNow secure for users in miela locality name?

Absolutely! airSlate SignNow prioritizes security, employing industry-standard encryption protocols to protect your documents and signature data. For users in the miela locality name, this means peace of mind when sending sensitive documents. The platform also complies with legal and regulatory standards, ensuring that your business remains protected.

-

How can I get started with airSlate SignNow in miela locality name?

Getting started with airSlate SignNow is easy for businesses in the miela locality name. Simply visit our website to sign up for a free trial or choose a pricing plan that suits your needs. Once registered, you can quickly begin uploading documents and sending them for signature, greatly enhancing your efficiency from day one.

Get more for Employer Withholding Forms And City Of Big Rapids Ci Big rapids Mi

- Transcript request francis howell school district form

- Assistive technology evaluation guide for students with ncatp ncatp form

- Environmental questionnaire form prairieland edc

- Kcb bank loan application form pdf

- Leap applicationleap application qxd qxd city and county of denver denvergov form

- Child support delaware direct deposit form

- Algebra2trig1 mixed factoring practice form

- Ecobank loan application form

Find out other Employer Withholding Forms And City Of Big Rapids Ci Big rapids Mi

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form