Founder Stock Agreement Form

What is the founder stock agreement?

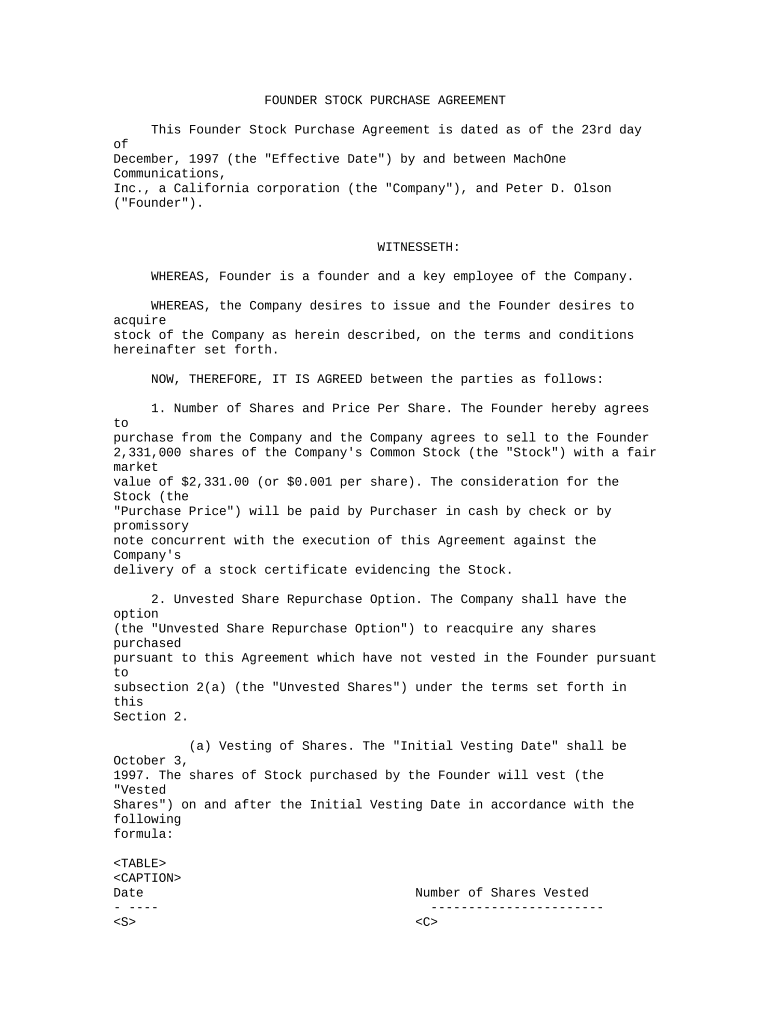

The founder stock agreement is a legal document that outlines the terms under which founders of a company receive shares. This agreement typically includes details about the number of shares allocated, vesting schedules, and the rights and obligations of the founders. It serves to protect the interests of both the founders and the company, ensuring clarity and reducing potential disputes in the future. The founder stock agreement is essential for establishing ownership and equity distribution among the founding members.

Key elements of the founder stock agreement

A comprehensive founder stock agreement includes several critical components:

- Share allocation: Specifies the number of shares each founder receives.

- Vesting schedule: Outlines when founders earn their shares over time, often to encourage commitment to the company.

- Rights and obligations: Details the responsibilities of each founder and their rights regarding decision-making and profit distribution.

- Transfer restrictions: Sets conditions under which shares can be sold or transferred to ensure control remains within the founding team.

- Termination clauses: Defines the consequences if a founder leaves the company or fails to meet their obligations.

Steps to complete the founder stock agreement

Completing a founder stock agreement involves several steps to ensure all parties understand and agree to the terms:

- Draft the agreement: Begin by outlining the key elements, including share allocation and vesting schedules.

- Review with all founders: Discuss the draft with all founders to ensure clarity and agreement on the terms.

- Consult legal counsel: It is advisable to have a lawyer review the agreement to ensure compliance with applicable laws and regulations.

- Sign the agreement: Once all parties agree, each founder should sign the document, ideally in the presence of a witness or notary.

- Store securely: Keep a copy of the signed agreement in a secure location for future reference.

Legal use of the founder stock agreement

The founder stock agreement is legally binding when executed properly. To ensure its legality, it must comply with relevant state and federal laws. This includes adherence to securities regulations, which govern how shares can be issued and transferred. Additionally, the agreement should be clear and unambiguous to avoid potential legal disputes. Using a reliable digital solution for signing, such as eSigning platforms, can enhance the security and legitimacy of the document.

How to obtain the founder stock agreement

Obtaining a founder stock agreement can be done through several avenues:

- Legal templates: Many legal websites offer templates that can be customized to fit the specific needs of the founders.

- Consulting a lawyer: Engaging a legal professional can provide tailored advice and ensure that the agreement meets all legal requirements.

- Online resources: Various online platforms provide resources and guidance on drafting founder stock agreements.

Examples of using the founder stock agreement

Founder stock agreements are commonly used in startup environments, where founders need to establish clear ownership structures. For instance, in a tech startup, the agreement might specify that each founder receives a certain percentage of shares based on their contributions and roles. Another example could involve a startup that requires a vesting schedule to ensure that founders remain committed to the company for a set period before fully owning their shares. These agreements help prevent misunderstandings and protect the interests of all parties involved.

Quick guide on how to complete founder stock agreement

Finish Founder Stock Agreement effortlessly on any gadget

Web-based document organization has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the resources necessary to generate, alter, and eSign your documents swiftly without hold-ups. Manage Founder Stock Agreement on any device with the airSlate SignNow Android or iOS applications and enhance any document-centered procedure today.

The optimal method to change and eSign Founder Stock Agreement seamlessly

- Find Founder Stock Agreement and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to secure your modifications.

- Choose how you wish to send your form, via email, SMS, or shared link, or download it to your PC.

Eliminate the worry of lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Founder Stock Agreement and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is founder stock?

Founder stock refers to the shares of equity that are allocated to the founders of a company. This type of stock is crucial for startup founders as it establishes ownership and can signNowly influence future funding and valuation. Understanding founder stock is essential for entrepreneurs looking to build a solid financial foundation.

-

How does founder stock differ from other types of stock?

Founder stock typically comes with fewer restrictions and is usually issued at a lower price compared to other types of stock, such as preferred stock. This allows founders to maintain greater control over their company during its early stages. Additionally, it often includes more favorable vesting conditions to support long-term commitment.

-

What role does founder stock play in business negotiations?

Founder stock is an essential topic during business negotiations, as it can signNowly impact ownership percentages and equity distribution. Investors often pay close attention to how much founder stock is retained when assessing a startup's potential. Having a clear understanding of founder stock can empower founders in negotiation scenarios with potential investors.

-

How can airSlate SignNow help with founder stock agreements?

airSlate SignNow streamlines the process of creating and signing founder stock agreements through its user-friendly platform. Businesses can easily draft, send, and eSign necessary documents, ensuring compliance and reducing paperwork headaches. This level of efficiency makes managing founder stock agreements straightforward for startups.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans tailored to different business needs, including options that are ideal for startups managing founder stock transactions. Whether you're looking for basic functionalities or robust features for extensive document management, there's a plan to suit your requirements. Review the plans to find one that fits your budget.

-

Can airSlate SignNow integrate with other tools to manage founder stock?

Yes, airSlate SignNow integrates seamlessly with various business tools, including CRMs and financial platforms, to help manage founder stock effectively. These integrations allow for better tracking and organization of stock allocation documents. Streamlining your workflow can save time and improve accuracy when dealing with founder stock issues.

-

What benefits does airSlate SignNow provide for startups issuing founder stock?

Using airSlate SignNow signNowly benefits startups by simplifying the documentation process related to founder stock. It enhances collaboration among founders and advisors, ensuring that all stakeholders have access to updated agreements. The secure and legally binding eSignature feature also ensures compliance and builds trust in the issuance process.

Get more for Founder Stock Agreement

- Pre shipping instruction form 445723831

- Personal reference form governors state university govst

- Letter of affiliation to company form

- Ged application form

- Utah 4h record book form

- Lesson plan for peer pressure form

- Using all capital letters in the ielts listening and reading form

- Muscogee creek nation education form

Find out other Founder Stock Agreement

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed