ATF F 3311 4 Atf Form

What is the ATF F 3311 Tax Form?

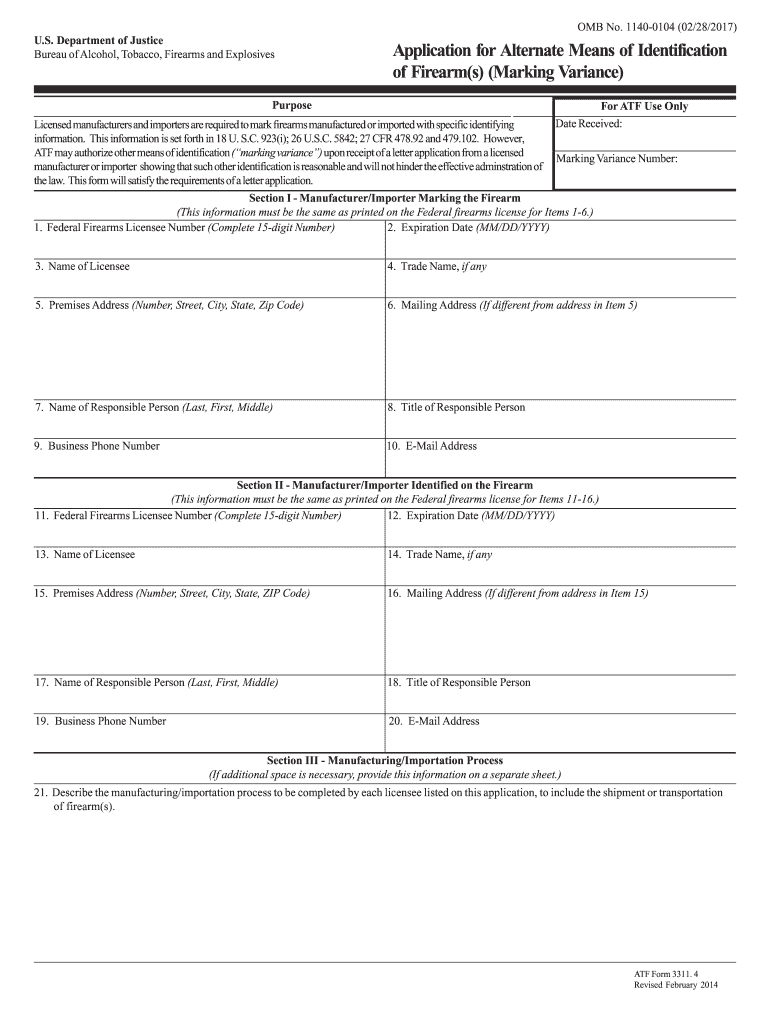

The ATF F 3311 tax form is a crucial document used for reporting certain transactions involving firearms and explosives. This form is primarily required by the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) and is essential for compliance with federal regulations. It helps track the movement and ownership of regulated items, ensuring that all transactions adhere to legal standards. Understanding the purpose of this form is vital for individuals and businesses involved in the firearms industry.

Steps to Complete the ATF F 3311 Tax Form

Filling out the ATF F 3311 tax form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary information: Collect all relevant details, including your personal information, the type of transaction, and specifics about the items involved.

- Fill out the form: Enter the required information clearly and accurately. Ensure that all fields are completed to avoid delays.

- Review your entries: Double-check all information for accuracy before submission. Mistakes can lead to compliance issues.

- Submit the form: Follow the appropriate submission method, whether online, by mail, or in person, as specified by the ATF.

Legal Use of the ATF F 3311 Tax Form

The legal use of the ATF F 3311 tax form is governed by federal regulations that dictate how firearms and explosives should be reported. Proper use of this form ensures compliance with the law, protecting individuals and businesses from potential legal repercussions. It is essential to understand the legal implications of submitting this form, as inaccuracies or omissions can lead to penalties or investigations.

Who Issues the ATF F 3311 Tax Form?

The ATF F 3311 tax form is issued by the Bureau of Alcohol, Tobacco, Firearms and Explosives, a federal agency under the Department of Justice. This agency is responsible for enforcing laws related to firearms and explosives, including the regulation of their sale, distribution, and ownership. Understanding the issuing authority helps users recognize the importance of compliance with the requirements associated with this form.

Required Documents for the ATF F 3311 Tax Form

When completing the ATF F 3311 tax form, certain documents may be required to support your submission. These typically include:

- Proof of identity: A government-issued ID may be necessary to verify your identity.

- Transaction records: Documentation related to the specific transaction being reported, such as invoices or receipts.

- Additional permits: Any relevant permits or licenses that pertain to the ownership or transfer of firearms or explosives.

Penalties for Non-Compliance with the ATF F 3311 Tax Form

Failure to comply with the requirements associated with the ATF F 3311 tax form can result in significant penalties. These may include fines, revocation of licenses, or even criminal charges, depending on the severity of the violation. It is crucial for individuals and businesses to understand these potential consequences and ensure that all submissions are accurate and timely to avoid legal issues.

Quick guide on how to complete atf f 33114 atf

Effortlessly Prepare ATF F 3311 4 Atf on Any Device

The management of documents online has gained popularity among both companies and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed materials, enabling you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Manage ATF F 3311 4 Atf across any platform with the airSlate SignNow applications for Android or iOS and enhance any document-related workflow today.

How to Edit and eSign ATF F 3311 4 Atf with Ease

- Find ATF F 3311 4 Atf and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Decide how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign ATF F 3311 4 Atf and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

At what point does the ATF consider an AR-15 lower receiver a long gun when filling out the form 4473?

The law and ATF are quite clear on how a fire arm type is to be recorded on the form 4473.Section B line 16, handgun, long gun, other.Section D question 27 type of fire arm.Question 16. Type of Firearm(s):Quoting from the instructions for Form 4473"Other" refers to frames, receivers and other firearms that are neither handguns nor long guns (rifles or shotguns), such as firearms having a pistol grip that expel a shotgun shell, or National Firearms Act (NFA) firearms, including silencers. If a frame or receiver can only be made into a long gun (rifle or shotgun), it is still a frame or receiver not a handgun or long gun. However, frames and receivers are still "firearms" by definition, and subject to the same GCA limitations as any other firearms. See Section 921(a)(3)(B). Section 922(b)(1) makes it unlawful for a licensee to sell any firearm other than a shotgun or rifle to any person under the age of 21. Since a frame or receiver for a firearm, to include one that can only be made into a long gun, is a "firearm other than a shotgun or rifle," it cannot be transferred to anyone under the age of 21, nor can these firearms be transferred to anyone who is not a resident of the State where the transfer is to take place. Also, note that multiple sales forms are not required for frames or receivers of any firearms, or pistol grip shotguns, since they are not "pistols or revolvers" under Section 923(g)(3)(A)(Question 27) Question 24-28. Firearm(s) Description:These blocks must be completed with the firearm(s) information. Firearms manufactured after 1968 by Federal firearms licensees should all be marked with a serial number. Should you acquire a firearm that is legally not marked with a serial number (i.e. pre-1968); you may answer question 26 with "NSN" (No Serial Number), "N/A" or "None." If more than four firearms are involved in a transaction, the information required by Section D, questions 24-28, must be provided for the additional firearms on a separate sheet of paper, which must be attached to this ATF Form 4473.Types of firearms include, but are not limited to: pistol, revolver, rifle, shotgun, receiver, frame and other firearms that are neither handguns nor long guns (rifles or shotguns), such as firearms having a pistol grip that expel a shotgun shell (pistol grip firearm) or NFA firearms (machinegun, silencer, short-barreled shotgun, short-barreled rifle, destructive device or "any other weapon").End quote.To enter false information on the form 4473 would be committing a Federal felony. Therefore a stripped receiver must be marked as a receiver. If it is a stripped receiver regardless of manufactures markings, it must be recorded as a “receiver” on the form 4473.To answer the question posted. The ATF would consider an AR 15 receiver a long gun when the receiver is assembled as a long gun when it is transferred. Again a receiver only, is to be recorded as a receiver.

-

If the Vice President of a company buys a firearm for himself under their name and fills out the ATF (4473) form themselves and has one of their area managers/supervisors go over the form, is it illegal?

Let's make sure that I'm not an expert on this, but I think it is according to the ATF website (Page on atf.gov) Question 3.

-

How did the FBI fail to catch the Texas Church killer's Dishonorable Discharge as it is a required question (11 g.) on the ATF form 4473 used for transferring a firearm?

It actually wasn’t a DD, it was a “Bad Conduct Discharge”, which is similar but legally differentiable from a Dishonorable Discharge. BCDs do not make the recipient a prohibited person, unless the crime was a case of domestic violence, which is a permanent disqualifier per the Lautenberg Amendment.However, it’s become known that the Air Force failed to report this conviction to the FBI for inclusion in NICS. NICS, unlike more thorough Federal background checks (such as the one required by the State of Texas for a CHL, which caught the conviction and denied him a carry license), does not proactively go out and find this information; various criminal justice agencies are required to interface with the NICS system, uploading records that substantiate a person’s status as a “prohibited person”. In the absence of any such record within the database, the default assumption is that the purchaser is a fine upstanding citizen who should indeed be sold a firearm of their choosing. Obviously that’s not always the case; both false “proceeds” due to missing information, and false “denys” due to incorrect or outdated information, are notable if not extremely common.

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How do I fill up the ITR 4 form?

Guidance to File ITR 4Below are mentioned few common guidelines to consider while filing your ITR 4 form:If any schedule is not relevant/applicable to you, just strike it out and write —NA— across itIf any item/particular is not applicable/relevant to you, just write NA against itIndicate nil figures by writing “Nil” across it.Kindly, put a “-” sign prior to any negative figure.All figures shall be rounded off to the nearest one rupee except figures for total income/loss and tax payable. Those shall be rounded off to the nearest multiple of ten.If you are an Employer individual, then you must mark Government if you are a Central/State Government employee. You should tick PSU if you are working in a public sector company of the Central/State Government.Sequence to fill ITR 4 formThe easiest way to fill out your ITR-4 Form is to follow this order:Part AAll the schedulesPart BVerificationModes to file ITR 4 FormYou can submit your ITR-4 Form either online or offline. It is compulsory to file ITR in India electronically (either through Mode 3 or Mode 4) for the following assesses:Those whose earning exceeds Rs. 5 lakhs per yearThose possessing any assets outside the boundary of India (including financial interest in any entity) or signing authority in any account outside India.Those claiming relief under Section 90/90A/91 to whom Schedule FSI and Schedule TR applyOffline:By furnishing a return in a tangible l paper formBy furnishing a bar-coded returnThe Income Tax Department will issue you an acknowledgment as a form of response/reply at the time of submission of your tangible paper return.Online/Electronically:By furnishing the return electronically using digital signature certificate.By sending the data electronically and then submitting the confirmation of the return in Return Form ITR-VIf you submit your ITR-4 Form by electronic means under digital signature, the acknowledgment/response will be sent to your registered email id. You can even download it manually from the official income tax website. For this, you are first required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing.Keep in mind that ITR-4 is an annexure-less form. It means you don’t have to attach any documents when you send it.TaxRaahi is your income tax return filing online companion. Get complete assistance and tax saving tips from experts.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

Create this form in 5 minutes!

How to create an eSignature for the atf f 33114 atf

How to make an electronic signature for your Atf F 33114 Atf in the online mode

How to make an electronic signature for the Atf F 33114 Atf in Chrome

How to make an eSignature for putting it on the Atf F 33114 Atf in Gmail

How to create an eSignature for the Atf F 33114 Atf from your smart phone

How to generate an eSignature for the Atf F 33114 Atf on iOS

How to make an eSignature for the Atf F 33114 Atf on Android devices

People also ask

-

What is the 3311 tax form?

The 3311 tax form is a specific IRS document used for reporting various tax-related information. Understanding this form is essential for businesses that need to comply with tax regulations while utilizing services like airSlate SignNow for document management.

-

How can airSlate SignNow help with the 3311 tax form?

airSlate SignNow simplifies the process of signing and sending the 3311 tax form electronically. With features like secure eSignature capture and easy document sharing, businesses can quickly manage their tax documentation without the hassle of paper forms.

-

Is there a cost associated with using airSlate SignNow for the 3311 tax form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. These plans are cost-effective, ensuring that you can manage your 3311 tax forms efficiently without breaking the bank.

-

What features does airSlate SignNow offer for managing the 3311 tax form?

airSlate SignNow provides features such as customizable templates, automated reminders, and secure cloud storage, all of which facilitate the management of the 3311 tax form. These tools help streamline the eSigning process, making it easier for businesses to operate.

-

Can I integrate airSlate SignNow with other software for the 3311 tax form?

Absolutely! airSlate SignNow supports integrations with a variety of software, which can enhance your workflow when dealing with the 3311 tax form. These integrations help centralize your document processes, making it easier to manage tax reporting.

-

What are the benefits of using airSlate SignNow for the 3311 tax form?

Using airSlate SignNow for the 3311 tax form offers numerous benefits, including increased efficiency, reduced processing time, and enhanced document security. By leveraging this tool, businesses can ensure that their tax documentation is handled effectively and securely.

-

Is airSlate SignNow user-friendly for completing the 3311 tax form?

Yes, airSlate SignNow is designed with user experience in mind, making it simple to complete the 3311 tax form. The intuitive interface allows users to easily navigate the platform, ensuring a smooth signing and submission process.

Get more for ATF F 3311 4 Atf

- Football agent mandate sample form

- Electrical experience verification form

- Proof of financial responsibility form

- Family reunion itinerary template form

- Cross border permit namibia form

- Fort bend county justice of the peace courts form

- Judge gary d janssen fort bend county form

- Fillable online to fill in and save this pdf use adobe form

Find out other ATF F 3311 4 Atf

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template