WH 192 Oregongov Oregon Form

What is the WH 192 Oregongov Oregon

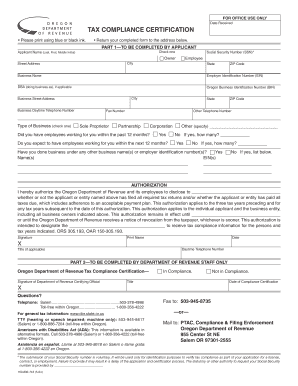

The WH 192 Oregongov Oregon form is a specific document used for reporting and managing various employment-related information within the state of Oregon. This form is primarily utilized by employers to ensure compliance with state regulations regarding wage and hour laws. It serves as an important tool for documenting employee details, including hours worked and wages paid, which are essential for accurate payroll processing and adherence to labor laws.

How to use the WH 192 Oregongov Oregon

Using the WH 192 Oregongov Oregon form involves several steps that ensure accurate completion and submission. First, gather all necessary employee information, including names, addresses, and Social Security numbers. Next, accurately record the hours worked and wages for each employee. Once the form is filled out, it can be submitted electronically through the appropriate state portal or printed and mailed to the designated office. It is crucial to keep a copy of the completed form for your records.

Steps to complete the WH 192 Oregongov Oregon

Completing the WH 192 Oregongov Oregon form requires careful attention to detail. Follow these steps:

- Collect all relevant employee data, including identification details and employment dates.

- Document the total hours worked by each employee for the reporting period.

- Calculate the total wages earned, ensuring compliance with minimum wage laws.

- Review the form for accuracy, checking for any missing information.

- Submit the form electronically or via mail, depending on your preference and the requirements set by the state.

Legal use of the WH 192 Oregongov Oregon

The legal use of the WH 192 Oregongov Oregon form is critical for employers in maintaining compliance with state labor laws. This form must be filled out accurately to reflect the true nature of employment relationships. Misrepresentation or failure to submit the form can lead to legal repercussions, including fines or penalties. Therefore, it is essential to understand the legal implications of the information provided and ensure that it is complete and truthful.

State-specific rules for the WH 192 Oregongov Oregon

Oregon has specific regulations governing the use of the WH 192 Oregongov Oregon form. Employers must adhere to state labor laws, which include guidelines on minimum wage, overtime pay, and record-keeping requirements. Additionally, any updates to state labor laws may affect how the form is completed and submitted. It is important for employers to stay informed about these regulations to ensure compliance and avoid potential legal issues.

Form Submission Methods (Online / Mail / In-Person)

The WH 192 Oregongov Oregon form can be submitted through various methods, providing flexibility for employers. The preferred method is electronic submission via the state’s online portal, which allows for immediate processing. Alternatively, employers may choose to print the form and submit it by mail, ensuring it is sent to the correct office. In some cases, in-person submission may also be an option, particularly for those seeking assistance or clarification on the form.

Quick guide on how to complete wh 192 oregongov oregon

Complete WH 192 Oregongov Oregon effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely retain it online. airSlate SignNow provides all the tools you require to create, adjust, and electronically sign your documents swiftly without delays. Handle WH 192 Oregongov Oregon on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign WH 192 Oregongov Oregon with ease

- Locate WH 192 Oregongov Oregon and then click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign WH 192 Oregongov Oregon and guarantee outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wh 192 oregongov oregon

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is WH 192 Oregongov Oregon and how can airSlate SignNow help?

WH 192 Oregongov Oregon is a document specifically related to payroll and employment tax filings in Oregon. With airSlate SignNow, businesses can efficiently manage the eSigning process for WH 192 Oregongov Oregon, ensuring compliance and accuracy on all required documents.

-

How much does airSlate SignNow cost for handling WH 192 Oregongov Oregon?

airSlate SignNow offers competitive pricing tailored for businesses that need to manage WH 192 Oregongov Oregon documents. Our flexible plans allow you to choose based on your volume of documents and features needed, ensuring you get the best value for your eSigning needs.

-

What features does airSlate SignNow provide for WH 192 Oregongov Oregon documentation?

airSlate SignNow provides a range of features for handling WH 192 Oregongov Oregon documents, including customizable templates, secure eSigning, and document tracking. These tools streamline your workflow, making it easier to collect signatures and manage compliance.

-

Is airSlate SignNow secure for sending WH 192 Oregongov Oregon documents?

Yes, airSlate SignNow employs top-tier security measures, including encryption and secure cloud storage, to protect your WH 192 Oregongov Oregon documents. You can trust our platform to securely manage sensitive information while ensuring compliance with regulations.

-

Can airSlate SignNow integrate with other software for managing WH 192 Oregongov Oregon?

Absolutely! airSlate SignNow provides integrations with various business software tools, making it easy to incorporate WH 192 Oregongov Oregon document management into your existing workflows. This connectivity enhances productivity and simplifies the signing process.

-

What are the benefits of using airSlate SignNow for WH 192 Oregongov Oregon?

Using airSlate SignNow for WH 192 Oregongov Oregon offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced compliance. Our user-friendly platform empowers businesses to simplify the eSigning process and focus on their core activities.

-

How can I get started with airSlate SignNow for WH 192 Oregongov Oregon?

Getting started with airSlate SignNow for WH 192 Oregongov Oregon is easy! Simply sign up for a free trial on our website, explore the features available for document management, and begin creating and sending your WH 192 Oregongov Oregon documents for eSigning.

Get more for WH 192 Oregongov Oregon

- 162b mediation clauses form

- 163b arbitration clauses form

- Your get out of arbitration and into the labour court for free form

- Shoot out clauses in partnerships and close corporations form

- 424b3 1 a16 99042424b3htm 424b3 filed pursuant to rule form

- 182 indemnification provisions form

- Principle xiv2 law applicable to international contracts form

- 26 exit mechanism issues list form

Find out other WH 192 Oregongov Oregon

- Download Electronic signature PDF Free

- Download Electronic signature Word Free

- How To Download Electronic signature Document

- Download Electronic signature Document Now

- Download Electronic signature Document Free

- Download Electronic signature PPT Free

- Download Electronic signature Form Free

- Download Electronic signature Document Fast

- Download Electronic signature Document Android

- Can I Download Electronic signature PPT

- Download Electronic signature Document iOS

- How To Fill Electronic signature Form

- Create Electronic signature PDF Computer

- How To Create Electronic signature PDF

- Create Electronic signature PDF Free

- How Can I Create Electronic signature PDF

- Fill Electronic signature Presentation Myself

- Create Electronic signature Word Online

- How To Create Electronic signature Word

- How Do I Create Electronic signature Word