Company Taxation CA Sri Lanka Form

What is the Company Taxation CA Sri Lanka

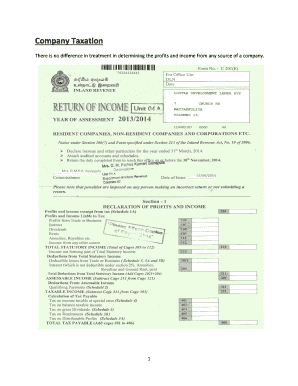

The Company Taxation CA Sri Lanka form is a crucial document that businesses in Sri Lanka must complete to comply with local tax regulations. This form serves as a declaration of the company's income, expenses, and tax liabilities. It is essential for ensuring that the business meets its tax obligations and avoids penalties. Understanding the details of this form is vital for any company operating in Sri Lanka, as it directly impacts financial reporting and tax planning.

Steps to complete the Company Taxation CA Sri Lanka

Completing the Company Taxation CA Sri Lanka form involves several key steps. First, gather all necessary financial documents, including income statements, balance sheets, and records of expenses. Next, accurately fill out the form, ensuring that all figures reflect the company's financial situation for the relevant tax year. After completing the form, review it for accuracy and compliance with local tax laws. Finally, submit the form by the specified deadline to avoid any potential penalties.

Legal use of the Company Taxation CA Sri Lanka

The legal use of the Company Taxation CA Sri Lanka form is governed by the tax laws of Sri Lanka. To be considered valid, the form must be completed accurately and submitted on time. Non-compliance with these regulations can result in severe penalties, including fines and legal action. Additionally, the form must be signed by an authorized representative of the company to ensure its legitimacy. Understanding these legal requirements is essential for maintaining compliance and protecting the business's interests.

Required Documents

To successfully complete the Company Taxation CA Sri Lanka form, several documents are required. These typically include:

- Financial statements, including income statements and balance sheets

- Records of all business expenses and income sources

- Previous tax returns, if applicable

- Any additional documentation requested by the tax authorities

Having these documents ready will facilitate the accurate completion of the form and help ensure compliance with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Company Taxation CA Sri Lanka form are critical to avoid penalties. Typically, companies must submit their tax returns by a specific date, which may vary based on the financial year-end. It is essential to stay informed about these deadlines, as late submissions can result in fines or interest charges on unpaid taxes. Businesses should also be aware of any extensions that may be available under specific circumstances.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Company Taxation CA Sri Lanka form can lead to significant penalties. These may include:

- Fines for late submission or inaccuracies

- Interest on unpaid taxes

- Legal action for severe violations

Understanding these penalties emphasizes the importance of timely and accurate tax reporting for businesses operating in Sri Lanka.

Quick guide on how to complete company taxation ca sri lanka

Complete [SKS] seamlessly on any device

Digital document management has become widely embraced by organizations and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to adapt and electronically sign [SKS] easily

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Mark important sections of the documents or conceal sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal value as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you would prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow satisfies your document management needs with just a few clicks from any device of your choosing. Update and eSign [SKS] and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Company Taxation CA Sri Lanka

Create this form in 5 minutes!

How to create an eSignature for the company taxation ca sri lanka

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Company Taxation CA Sri Lanka?

Company Taxation CA Sri Lanka refers to the taxation policies and regulations that govern businesses operating in Sri Lanka. Understanding these regulations is crucial for compliance and effective financial management. Businesses must stay updated on tax obligations to avoid penalties and ensure smooth operations.

-

How can airSlate SignNow assist with Company Taxation CA Sri Lanka?

airSlate SignNow streamlines the document management process required for Company Taxation CA Sri Lanka. It allows businesses to send, eSign, and manage important documents securely and efficiently. This simplifies the filing and compliance process, enabling easier management of tax-related paperwork.

-

What features does airSlate SignNow offer for managing taxation documents?

airSlate SignNow offers features such as customizable templates, bulk sending, and automated reminders that enhance the document management process for Company Taxation CA Sri Lanka. These features ensure that all necessary documents are accessible, timely, and compliant with local regulations. With an intuitive interface, managing taxation documents becomes straightforward.

-

Is airSlate SignNow cost-effective for small businesses dealing with Company Taxation CA Sri Lanka?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing Company Taxation CA Sri Lanka. With competitive pricing and various plans, businesses can choose an option that fits their budget without sacrificing essential features. This affordability allows small companies to focus on compliance without financial strain.

-

What integrations does airSlate SignNow support for Company Taxation CA Sri Lanka?

airSlate SignNow supports a variety of integrations with popular accounting and financial software that are pivotal for Company Taxation CA Sri Lanka. This enables seamless data transfer and enhances productivity by centralizing document management and tax processes. Integrations help ensure that your financial records are accurate and up-to-date.

-

How secure is airSlate SignNow for handling sensitive taxation documents?

Security is a priority for airSlate SignNow when it comes to handling sensitive documents related to Company Taxation CA Sri Lanka. The platform utilizes advanced encryption and secure servers to protect your data from unauthorized access. This commitment to security ensures that businesses can manage their taxation documents with confidence.

-

Can airSlate SignNow help with tax compliance deadlines for Company Taxation CA Sri Lanka?

Absolutely! airSlate SignNow includes features such as automated reminders to help businesses keep track of important compliance deadlines for Company Taxation CA Sri Lanka. This proactive approach minimizes the risk of missed deadlines, ensuring that all taxation requirements are met on time.

Get more for Company Taxation CA Sri Lanka

Find out other Company Taxation CA Sri Lanka

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors