Check Payment Bounced Form

What is the check payment bounced?

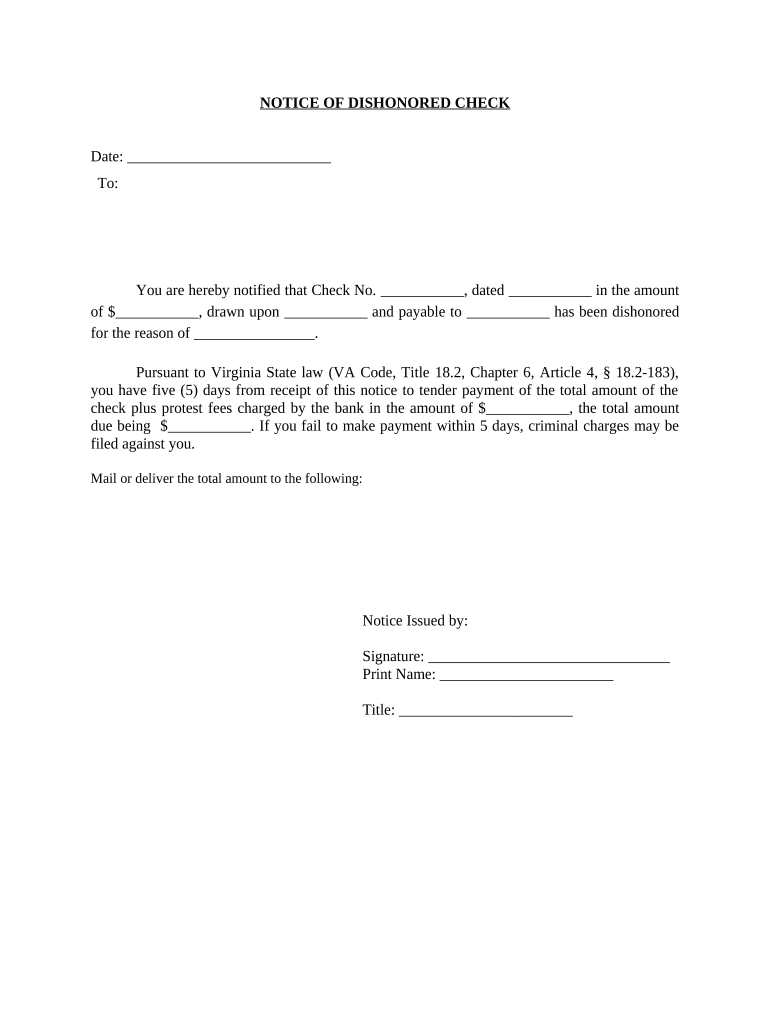

A check payment bounced occurs when a bank refuses to honor a check due to insufficient funds or other issues with the account. This situation can lead to various complications for both the issuer and the recipient of the check. When a check is returned, it is typically marked as "bounced" or "returned," and the issuer may face fees from their bank, as well as potential legal repercussions if the payment was for a debt or obligation. Understanding the implications of a bounced check is essential for managing finances effectively.

How to use the check payment bounced form

The check payment bounced form is a document used to officially report and request action regarding a bounced check. To use this form effectively, follow these steps:

- Gather necessary information, including the check number, date, amount, and the reason for the bounce.

- Complete the form with accurate details about the transaction and the parties involved.

- Include any relevant documentation, such as bank statements or correspondence regarding the bounced check.

- Submit the form to the appropriate financial institution or legal authority as required.

Steps to complete the check payment bounced form

Completing the check payment bounced form involves several key steps to ensure accuracy and compliance:

- Start by clearly identifying the check in question, including its number and date.

- Provide your contact information and that of the check recipient.

- Detail the reason for the bounce, such as insufficient funds or a closed account.

- Sign and date the form to validate your submission.

- Keep a copy of the completed form for your records.

Legal use of the check payment bounced form

The legal use of the check payment bounced form is crucial for protecting your rights and ensuring compliance with financial regulations. When properly filled out and submitted, this form serves as a formal record of the bounced check, which can be important in disputes or legal proceedings. It is essential to adhere to state-specific laws regarding bounced checks, as these can vary significantly. Legal advice may be beneficial if you encounter complications related to a bounced check.

Key elements of the check payment bounced form

Several key elements must be included in the check payment bounced form to ensure its effectiveness:

- Check Details: Include the check number, date, and amount.

- Issuer Information: Provide your name, address, and contact details.

- Recipient Information: Include the name and address of the person or entity to whom the check was issued.

- Reason for Bounce: Clearly state why the check was not honored.

- Signature: Your signature is necessary to validate the form.

Examples of using the check payment bounced form

There are various scenarios in which the check payment bounced form may be utilized. For instance:

- A business may use the form to report a bounced payment from a client for services rendered.

- An individual might submit the form to a landlord after a rent check is returned due to insufficient funds.

- Organizations can file the form to document bounced donations or payments received.

Quick guide on how to complete check payment bounced

Easily Prepare Check Payment Bounced on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage Check Payment Bounced on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Check Payment Bounced with Ease

- Find Check Payment Bounced and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Check Payment Bounced and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How can I check stopped payment on my eSigned documents?

To check stopped payment on your eSigned documents, you can log into your airSlate SignNow account and review the transaction history. This feature allows you to monitor all signed documents and any associated payment statuses. If a check was stopped, it would be reflected in your account records.

-

What features does airSlate SignNow offer for managing stopped payments?

airSlate SignNow provides comprehensive features for managing finance-related documents, including the ability to track payment statuses. You can easily verify if a check stopped payment has occurred and take necessary actions. Additionally, the platform allows instant notifications and tracking for better management.

-

Is there a fee associated with checking a stopped payment?

There are no additional fees for checking a stopped payment through airSlate SignNow. The service is integrated into your existing subscription, ensuring that you can access all necessary information without hidden costs. This transparency is part of our commitment to providing a cost-effective solution.

-

How does airSlate SignNow integrate with payment systems for stopped checks?

airSlate SignNow seamlessly integrates with various payment systems, enabling users to manage their documents and payments efficiently. When a check stopped payment occurs, integration with your financial platform can help streamline the process of updating or replacing payments. This simplifies your workflow and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for eSigning documents related to stopped payments?

Using airSlate SignNow to eSign documents related to stopped payments offers several benefits, including enhanced security and efficiency. The eSigning process ensures that all documents are legally binding and easily accessible. This creates a more streamlined experience for managing your financial transactions.

-

Can I automate reminders for checks that may need a stopped payment?

Yes, airSlate SignNow allows you to automate reminders for any checks that may need a stopped payment. You can set up notifications based on your document status, ensuring you never miss an important update. This automation feature enhances your financial management efficiency.

-

What customer support options are available for issues related to stopped payments?

airSlate SignNow offers various customer support options to assist with any issues related to stopped payments. You can access our online help center, submit a support request, or use the live chat feature for immediate assistance. Our team is dedicated to ensuring your experience is seamless and hassle-free.

Get more for Check Payment Bounced

Find out other Check Payment Bounced

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now